The market liquidity has increased compared to the previous trading session, with the trading volume of VN-Index reaching over 1 billion shares, equivalent to a value of over 21 trillion VND; HNX-Index reached nearly 96 million shares, equivalent to a value of over 1.8 trillion VND.

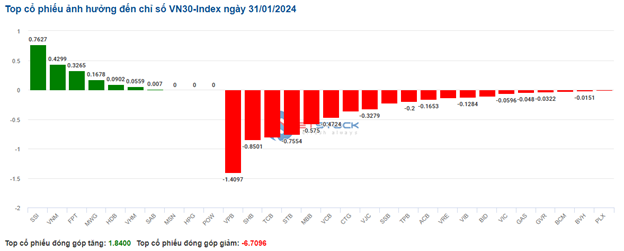

Continuing the decline of the morning session, VN-Index opened the afternoon session in the red. Near the end of the session, selling pressure dominated, causing the index to sharply decrease and close near the lowest level of the day. In terms of impact, VCB, BID, and CTG were the most negatively affected stocks, taking away more than 5.2 points from the index. On the contrary, FTS, NVL, and VCI were the most positively affected stocks of VN-Index.

|

Top stocks affecting VN-Index In terms of points |

HNX-Index also had a similar trend, with the index being negatively affected by stocks such as DDG (-3.64%), DTD (-3.6%), VC3 (-3.56%), DXP (-3.05%),…

|

Source: VietstockFinance

|

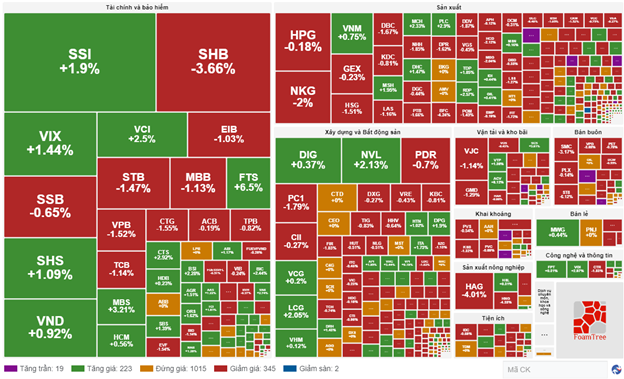

The agriculture – forestry – fishery sector had the largest decrease in the market with -3.31%, mainly due to stocks such as HAG (-5.02%) and HNG (-6.88%). Following that were the banking and plastics – chemicals manufacturing sectors with decreases of 1.94% and 1.53% respectively. On the contrary, the rubber product sector had the strongest recovery with 0.83%, mainly due to stocks such as DRC (+0.47%), CSM (+2.33%), and SRC (+0.18%).

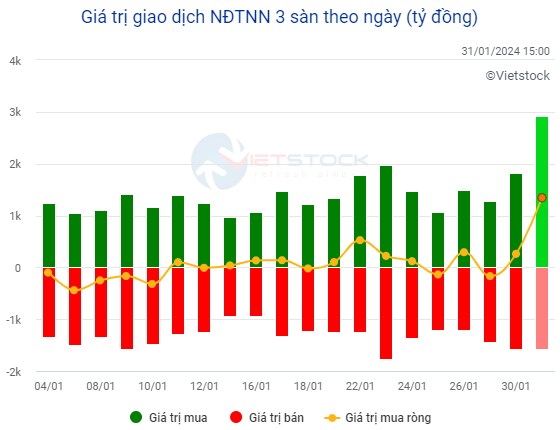

In terms of foreign trading, this group continued to net buy over 1.3 trillion VND on HOSE. In which the net buying value of matched orders was nearly 69 billion VND, focused on stocks such as SSI (193.43 billion), HPG (113.23 billion), AAA (94.92 billion), and VIX (79.83 billion). On HNX, foreign investors net sold over 1 billion VND, focusing on stocks such as SHS (22.75 billion), PVS (3.02 billion), and VCS (1.69 billion).

Source: Vietstock Finance

|

Morning session: VN-Index resumes sharp decline

At the end of the morning session, selling pressure increased, causing the main indexes to reverse and decrease. VN-Index decreased sharply by 9.09 points, to 1,170.56 points; HNX-Index decreased by 0.36 points, to 230.31 points. The number of temporarily declining stocks outnumbered the increasing stocks with 224 gainers and 390 decliners.

The trading volume of VN-Index recorded in the morning session reached nearly 561 million units, with a value of over 11.4 trillion VND. HNX-Index recorded a trading volume of nearly 58 million units, with a trading value of over 1.05 trillion VND.

By the end of the morning session, stocks VCB, VPB, and BID were the most negatively affected stocks, taking away more than 3.5 points from the index. On the contrary, stocks VNM, SSI, and FTS were the most positively affected stocks, adding more than 0.5 points to the index.

As of the end of this morning, the securities sector is the top contributor to the index. In which, stocks in this sector mostly recorded good increases, such as SSI with a 1.61% increase, BSI with a 1.71% increase, VCI with a 2.38% increase, MBS with a 3.61% increase, and FTS with a 5.4% increase.

On the contrary, banking stocks continue to have negative developments with a series of stocks in the red such as VCB, BID, CTG, VPB, TCB, MBB, STB, SHB,.. LPB, on the other hand, after a bright red start, has climbed to the reference level.

10:30 AM: Selling pressure dominates

Selling side increased the pressure, causing the main indexes to reverse and decline. As of 10:30 AM, VN-Index decreased by 4.49 points, trading around 1,175 points. HNX-Index slightly increased by 0.27 points, trading around 230 points.

SSI and VNM are the two stocks that had a positive impact on VN30 index with their contributions of 0.76 points and 0.43 points respectively. On the contrary, the banking group including VPB, SHB, STB, and TCB is under strong selling pressure, taking away 1.41 points, 0.85 points, 0.80 points, and 0.76 points from the general index.

Source: Vietstock Finance

|

The red color is dominating the banking and plastics – chemicals manufacturing sectors as most stocks are declining. Specifically, VCB decreased by 0.99%, BID decreased by over 1%, CTG decreased by 1.24%, GVR decreased by 0.87%, and DGC decreased by 0.44%….

Compared to the start of the session, the selling side seemed to have more dominance. The number of declining stocks was 347 stocks (2 floor-declining stocks) and the number of increasing stocks was 242 stocks (19 ceiling-increasing stocks).

9:30 AM: Securities group takes the lead

After the increase in points in yesterday’s session, VN-Index opened this morning session with a positive sentiment. Significant contributions came from the securities industry.

Stocks in the securities industry started strong at the beginning of the session, with FTS increasing by over 3%, followed by MBS and CTS with increases of 2.81% and 2.23% respectively. In addition, other stocks such as SSI, VND, VCI, SHS, HCM, VIX, BSI,… mostly showed positive increases.

The supporting industry group also had a bright start. Stocks such as ACG, DHC, PLC, TLG all maintained their gains.

On the other hand, the agriculture – forestry – fishery group did not have a positive start. Stocks such as HAG decreased from the beginning of the session, while HNG had a significant decrease of 4.17%.

Lý Hỏa