| Business performance of GIL from 2003 to present |

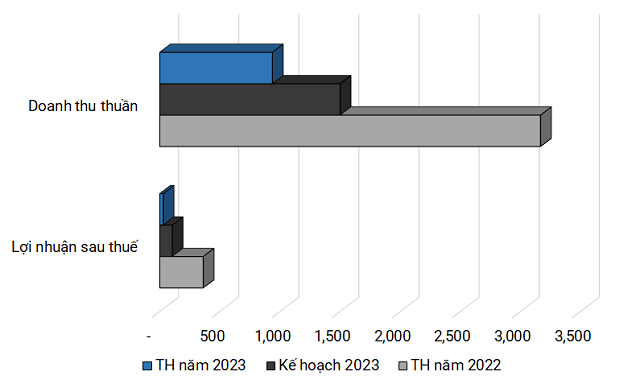

Compared to the same period in 2022, all aspects in the fourth quarter of 2023 of Gilimex Trading and Exporting Joint Stock Company (Gilimex, HOSE: GIL) have declined except for a sudden increase in net profit.

Revenue narrowed by 12%, only reaching over 230 billion VND but the cost of goods sold did not decrease proportionally, contributing to a 33% decrease in gross profit. Not to mention the decrease of 67% in financial activities such as interest income, loan income, or exchange rate difference which no longer provides a significant support for GIL’s profits as in the previous period.

In the difficult context, the number of employees was reduced from 1,818 at the beginning of the year to only 968, equivalent to a 50% reduction in 2023. However, instead of decreasing, the management staff costs of GIL have increased 3 times compared to the fourth quarter of 2022, reaching 22 billion VND, directly pushing the enterprise’s management expenses up to 30%.

However, there are two positive points that have helped GIL achieve a strong increase in profit. Firstly, in addition to the decrease in interest expenses, the reserve for financial investments of GIL also decreased to over 2 billion VND compared to 13 billion VND in the same period, and the exchange rate difference loss decreased significantly from nearly 53 billion VND to 4.6 billion VND.

Secondly, there was an increase of over 100 billion VND in other income, the main reason leading to the company’s extraordinary profit. GIL stated that this income was achieved thanks to the restructuring of its business operations during the period.

Source: VietstockFinance

|

It can be said that this achievement is a miracle because as of the end of the third quarter of 2023, GIL still had a net loss of over 63 billion VND. However, somehow, the company still made a profit of 27.6 billion VND in 2023 despite the unfavorable situation. 2023 became the year with the lowest profit for GIL since 2007.

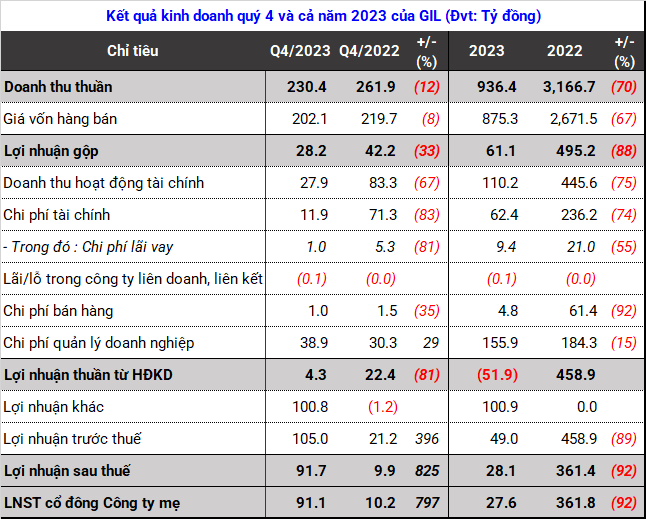

After the COVID-19 pandemic, GIL’s business activities became even more difficult when there was a dispute over a purchase contract with the major partner Amazon. The leadership had anticipated the difficulties, so they set modest revenue and profit targets for 2023, but in the end, they only achieved 62% and 27% of the goals.

|

Performance against the 2023 plan of GIL (Unit: billion VND)

Source: VietstockFinance

|

In terms of finance, in the past year, GIL has significantly reduced its time deposits in banks, with only 200 billion VND left compared to nearly 1,000 billion VND at the beginning of the year.

This money was withdrawn to reduce bank borrowings, leaving only about 120 billion VND, a decrease of 82%, and to pay off short-term suppliers, a decrease of 30%.

The difficulty in business also led to a sharp decrease in GIL’s borrowing and repayment activities compared to the same period. Specifically, the borrowing proceeds in the period were only 271 billion VND, a decrease of 88%; the principal repayment of the borrowings decreased by 70%, leaving only 789 billion VND.

Tu Kinh