The bond with code BNTCH2433001 is offered for sale to professional organizations with a quantity of 12,000 bonds, a face value of 100 million VND per bond, equivalent to a value of 1.2 trillion VND. The principal will be paid once at maturity, while the interest will be paid quarterly at the end of each period, at a fixed rate of 10.5% per year.

This is a “three nos” bond (no guarantee, non-convertible and non-attached warrants) issued and completed on the same day, January 29, 2024, with a term of 117 months until January 29, 2033. The depository institution is the Vietnam Securities Depository and Clearing Corporation. According to data from the Hanoi Stock Exchange (HNX), this is the only bond lot currently in circulation by the Company.

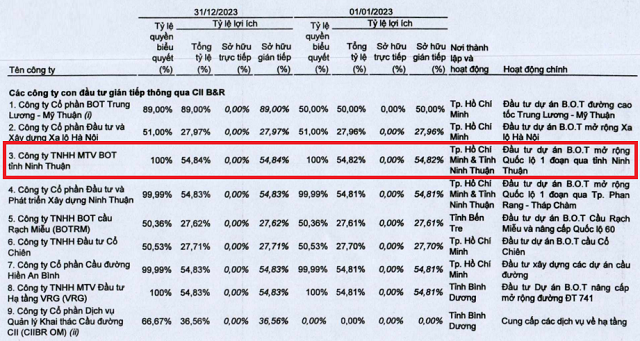

BOT Ninh Thuan’s main activity is investing in the BOT project to expand National Highway 1 through Ninh Thuan province. According to research, BOT Ninh Thuan is a subsidiary company indirectly owned by Ho Chi Minh City Infrastructure Investment Joint Stock Company (HOSE: CII) through CII Bridge and Road Investment Joint Stock Company (CII B&R, HOSE: LGC).

BOT Ninh Thuan was established on July 25, 2014, to implement and manage Phase 2 of the Phan Rang – Thap Cham project, which expands National Highway 1A through Ninh Thuan province. The company’s initial charter capital was 422.16 billion VND. In July 2020, the company increased its capital to 599.06 billion VND and has maintained this level until now. Currently, Mr. Huynh Thai Hoang holds the position of Director cum Legal Representative.

Source: CII consolidated financial statements Q4/2023

|

Regarding the project to expand National Highway 1A through Ninh Thuan province, according to CII’s introduction, this is part of the investment project to expand the QL1A route, the main route of the North-South transportation system. The project has a total extension length of 36.75 km, with short sections ranging from the border between Khanh Hoa and Ninh Thuan provinces, adjacent to the 10.13 km of the Phan Rang – Thap Cham bypass project that CII has invested in. The scale includes 6 lanes, with a road base width of 20.5 m.

The total investment according to estimates is 2.111 trillion VND, with CII B&R as the investor. Currently, the project is operating on a toll collection basis to recover capital according to the estimated schedule from 2017 to 2034. As of the end of 2022, the project has an average toll revenue of 740 million VND per day.

A section of the project to expand National Highway 1A in Ninh Thuan province

|

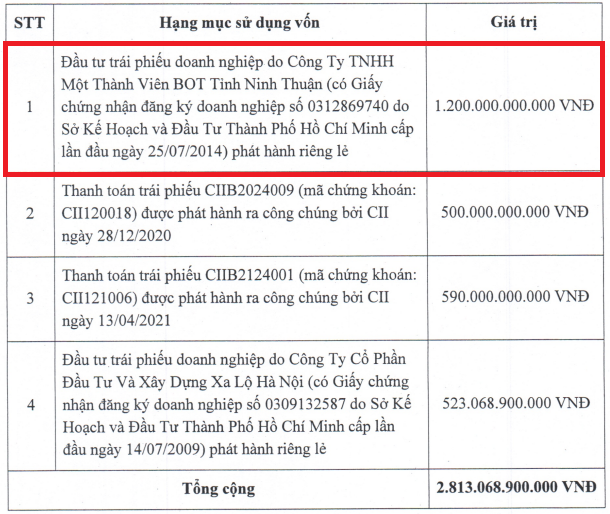

In another related development, the parent company CII announced that it has successfully issued the convertible bond lot CII42301, with a conversion rate of 99.05% on January 25, 2024, raising over 2.813 trillion VND in order to invest in bonds issued by BOT Ninh Thuan (1.2 trillion VND), invest in bonds issued by Hanoi Expressway Company (over 523 billion VND), and the remaining amount is used to pay for the two bond lots CIIB2024009 (500 billion VND) and CIIB2124001 (590 billion VND).

Therefore, the investors who purchased the bond lot issued by BOT Ninh Thuan are also the parent company CII.

|

Capital usage plan from the proceeds of bond lot CII42301

Source: CII

|