Strong interest income through no more financial investment provisions

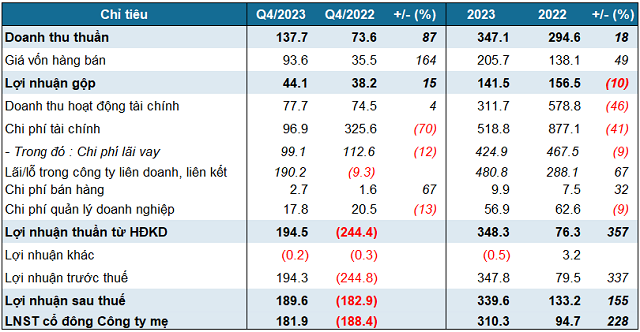

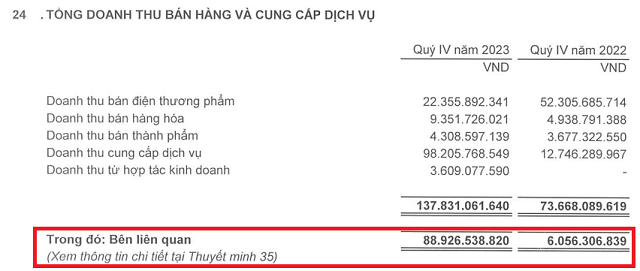

According to the Q4/2023 financial statements, IPA’s net revenue reached VND 138 billion, an increase of 87% compared to the same period last year. This is mainly contributed by the software service revenue for VNDirect Securities, which accounted for nearly VND 81 billion, compared to only VND 3 billion in the same period.

Revenue from related parties also increased to nearly VND 89 billion, up 14.6 times compared to the same period last year, accounting for 64.5% of the total revenue. This on one hand helps the revenue growth, but on the other hand makes IPA more dependent on the company’s “ecosystem”.

Source: IPA consolidated Q4/2023 financial statements

|

Gross profit margin narrowed by 19.8 percentage points to 32%, leading to a gross profit increase of only 15% to reach VND 78 billion.

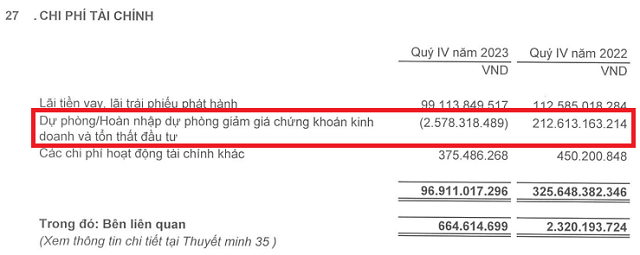

The financial activities, although still a loss of over VND 19 billion, have improved significantly compared to a loss of over VND 251 billion in the same period last year, thanks to a sharp reduction of 70% in financial costs, after no longer having to set aside provisions for business securities devaluation and investment losses like the same period last year.

Source: IPA consolidated Q4/2023 financial statements

|

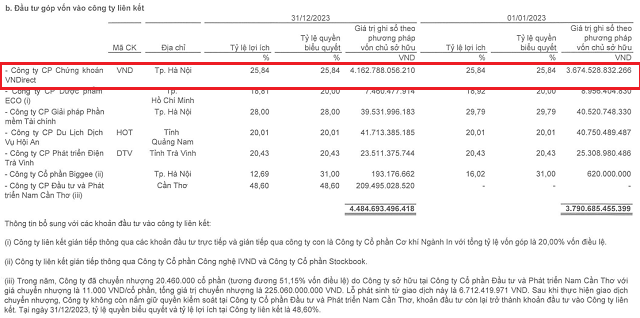

Another positive point is that IPA earned over VND 190 billion from joint venture and associate companies, while it had a loss of over VND 9 billion in the same period last year. The largest investment in joint venture and associate companies of IPA is in VNDirect Securities.

After these fluctuations, IPA achieved a net profit of almost VND 182 billion, almost recovering what was lost in the same period, and also providing significant support to the full year 2023 result with a net profit of over VND 310 billion, an increase of 228% compared to the previous year.

|

IPA’s Q4 business results and cumulative results for 2023

Unit: Billion VND

Source: VietstockFinance

|

As of December 31, 2023, IPA’s total assets reached VND 13,542 billion, remaining relatively unchanged compared to the beginning of the year. The majority of this is financial investments, with a recorded value of nearly VND 5,295 billion, accounting for 60%.

Among these investments, the investment value in joint venture and associate companies is up to VND 4,485 billion, the majority of which is the investment to own 25.84% of the capital in VNDirect Securities.

Source: IPA consolidated Q4/2023 financial statements

|

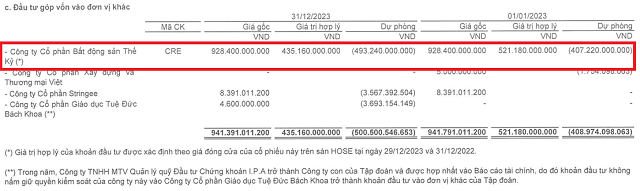

IPA also allocated VND 928.4 billion to invest in Century Land (CRE), but this investment brought “pain” as IPA had to set aside provisions of over VND 493 billion, equivalent to over 53%.

Source: IPA consolidated Q4/2023 financial statements

|

In terms of capital structure, IPA has total borrowings of over VND 4,392 billion, accounting for 50%, mostly through bond issuance in the form of collateral, with interest rates ranging from 9.5% to 10.5%, a term of 3 years, and the issuing agent is VNDirect Securities.