|

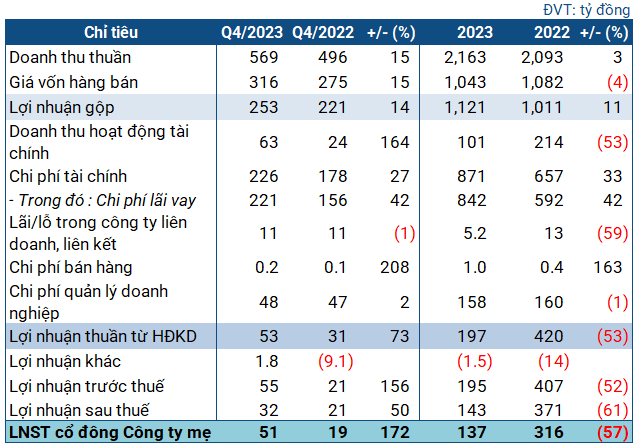

Business results of GEG in Q4 and the whole year 2023

Source: VietstockFinance

|

In Q4, GEG reported revenue of VND 569 billion, an increase of 15% compared to the same period. Gross profit, after deducting cost of goods sold, was VND 253 billion, a 14% increase.

The most notable performance indicator was the strong increase in financial revenue, reaching VND 63 billion, 2.6 times higher than the same period. Financial expenses increased by 27% to VND 226 billion. The company stated that the operation of the Tan Phu Dong 1 Wind Power Plant contributed to the revenue growth in the period, but also pushed up the interest expenses. However, the significant increase in financial revenue was due to additional income from stock transfer.

In addition, the company had other profits of nearly VND 2 billion (compared to a loss of over VND 9 billion in the same period). Overall, GEG achieved a net profit of VND 51 billion, 2.7 times higher than the same period.

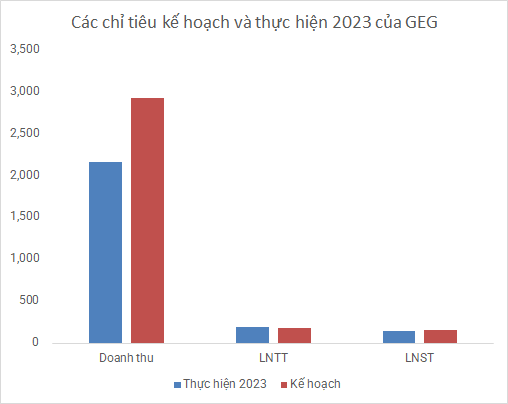

The growth in Q4 helped improve the overall business performance of GEG for the year. By the end of 2023, GEG achieved nearly VND 2.2 trillion in revenue, a 3% increase compared to the previous year. Net profit and gross profit reached VND 143 billion and VND 137 billion, a respective decrease of 61% and 57%. Based on the approved plan of the 2023 Annual General Meeting of Shareholders, the company achieved 74% of the annual revenue target and nearly 93% of the net profit target for the year.

Source: VietstockFinance

|

At the end of Q4, GEG’s total assets were over VND 16.1 trillion, a 6% decrease compared to the beginning of the year. Of which, nearly VND 1.5 trillion was current assets, a 30% decrease. Cash and cash equivalents decreased by 44% to VND 462 billion.

Short-term receivables from customers increased by 32% to nearly VND 474 billion, mostly from the Electricity Trading Company. Inventory decreased by 18% to VND 127 billion.

Construction in progress costs decreased significantly to VND 359 billion (from nearly VND 4.9 trillion at the beginning of the year), mainly due to the operation of the Tan Phu Dong 1 Wind Power Project.

On the liabilities side, short-term debt decreased by 19% to nearly VND 1.7 trillion. Receivables mainly consisted of short-term loans, totaling VND 1.4 trillion, 2.3 times higher than the beginning of the year, including loans from banks and matured bonds (about VND 821 billion). The company still had nearly VND 8.7 trillion in long-term debt, mainly from bank loans serving wind power plant projects.