|

Business performance of VNZ in Q4 and the whole year of 2023

Source: VietstockFinance

|

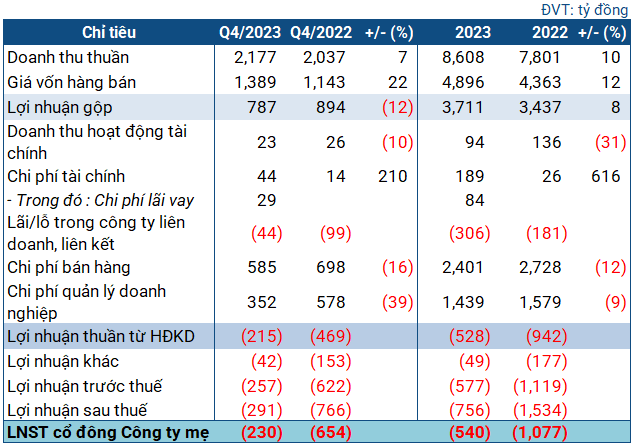

In Q4, VNZ achieved nearly 1.2 trillion VND in revenue, a 7% increase compared to the same period. The cost of goods sold increased significantly by 22% to nearly 1.4 trillion VND. After deductions, the gross profit was 787 billion VND, a 12% decrease from the same period last year.

The positive point for VNZ in this quarter is that it has significantly reduced sales and business management expenses, but these are still two major indicators. The company also reduced other losses by 42 billion VND (compared to a loss of 152 billion VND in the same period last year due to asset impairment costs).

The well-managed cost helped improve the Q4 results of VNZ significantly. By the end of the year, the company’s net loss was 230 billion VND, only about one-third of the loss in the same period last year (654 billion VND).

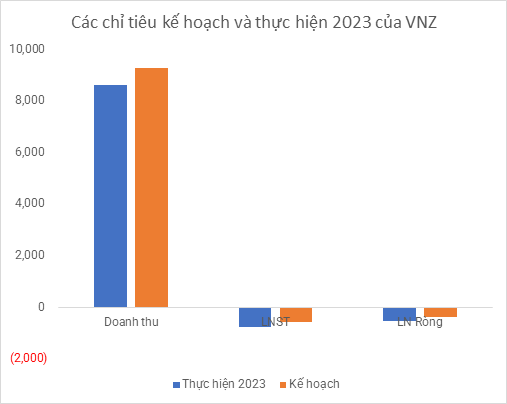

For the whole year, VNZ had over 8.6 trillion VND in revenue, a 10% increase compared to the previous year. The company still had a net loss of 540 billion VND (compared to a loss of 1,077 billion VND in the same period last year). Overall, the Q4 loss caused VNZ‘s net loss target of 378 billion VND to fail, but it also showed a significant improvement compared to what was done in the previous year.

Source: VietstockFinance

|

As of the end of 2023, VNZ‘s total assets reached over 9.7 trillion VND, a 9% increase from the beginning of the year. Cash and deposits increased by 29% to nearly 4 trillion VND. Short-term receivables from customers decreased slightly to 544 billion VND. Construction in progress was recorded at 214 billion VND, five times higher than at the beginning of the year, due to the completion of the VNG Data Center project.

Long-term financial investments decreased by 17% to 1.2 trillion VND, with provision for losses increasing significantly to 70 billion VND (2.4 billion VND at the beginning of the year), as a provision for investments in other units.

According to the Q4 separate financial statements, VNZ‘s long-term investment value increased by 36% to over 4.8 trillion VND. In particular, the ownership ratio in Zion (the unit owning ZaloPay) increased from 69.98% to 72.654%, corresponding to an investment value of nearly 3.4 trillion VND. However, a provision for losses of nearly 3.3 trillion VND was set aside (2.7 trillion VND at the beginning of the year). The company did not disclose detailed information about this provision from Q4/2022, but according to the Q3/2022 financial statements, at least 2.27 trillion VND was allocated to Zion JSC (the unit owning ZaloPay).

Among the affiliated units, except for Dayone, which had a profit (about 8 billion VND), the other investment areas were still incurring losses. The unit with the heaviest loss is Tiki Global, with accumulated losses of over 510 billion VND, equal to the recognized investment value at the beginning of the year.

On the balance sheet side, short-term liabilities were recorded at nearly 4 trillion VND, a 43% increase compared to the beginning of the year. In particular, short-term borrowings increased significantly to more than 865 billion VND (only 44 billion VND at the beginning of the year), which were short-term loans from commercial banks to serve the Data Center and software production project. Long-term borrowings increased by 55% to 618 billion VND, which were also bank loans.

Surprisingly, the withdrawal of IPO documents in the US

Still remember in the middle of 2023, VNZ caught attention when following VinFast, it submitted IPO documents in the US, aiming to list on the Nasdaq Global Select Market with the trading code “VNG”.

However, by September 2023, VNG had postponed its IPO plan until the investors are ready to receive it. The latest development, VNG Limited announced to the US Securities and Exchange Commission (SEC) on January 22, 2024 regarding the decision not to IPO at this time and plans to return in the future.

This statement also did not provide a specific timeline for the resumption of the IPO process or the reasons for the aforementioned withdrawal. VNG also declined to comment on this issue.

According to information from Tech in Asia in early October 2023, VNG CEO Lê Hồng Minh had internal discussions about the reasons why the company postponed its listing plan in the US. Specifically, Lê Hồng Minh believed that investors were still not ready for IPOs by Asian technology companies.

“I want VNG to carry out the IPO from a strong position and have the best price increase opportunity after listing. Despite the macroeconomic challenges in 2023, all business activities of VNG are developing well and the company sees great opportunities in its global and AI efforts”, Lê Hồng Minh shared.

Lê Hồng Minh also said that the company’s leadership had met with more than 120 global investors over the past year to share its story. However, most investors are still standing by and observing. “I am confident that we will be able to return to the market in the near future”, Lê Hồng Minh affirmed.