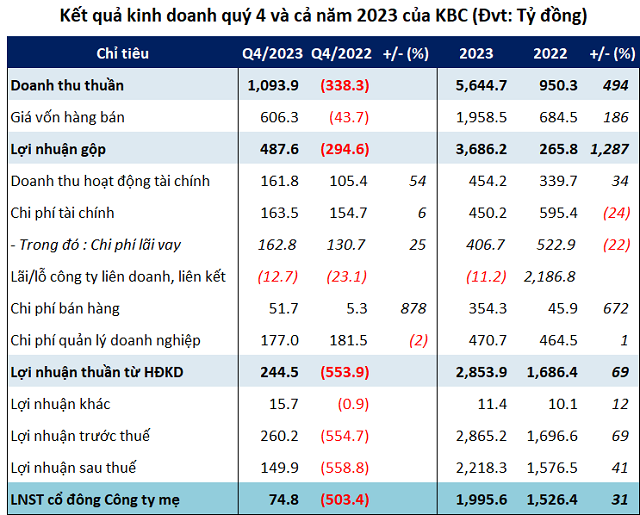

The real estate company Kinh Bac Urban Development Corporation (HOSE: KBC) has recently released its consolidated financial statement for the fourth quarter of 2023. The company reported a net revenue of nearly 1,094 billion VND, a decrease of 338 billion VND compared to the same period last year. In addition, its financial operation revenue also increased by 54% to nearly 162 billion VND.

Source: VietstockFinance

|

Thanks to the increase in revenue, the total expenses for this quarter reached 392 billion VND, a 15% increase. The majority of the expenses were financial costs, which amounted to over 163 billion VND (a 25% increase), and business management expenses of 177 billion VND (a 2% decrease).

In the end, Kinh Bac Urban Development Corporation achieved a net profit of nearly 75 billion VND, compared to a loss of 503 billion VND in the same period last year.

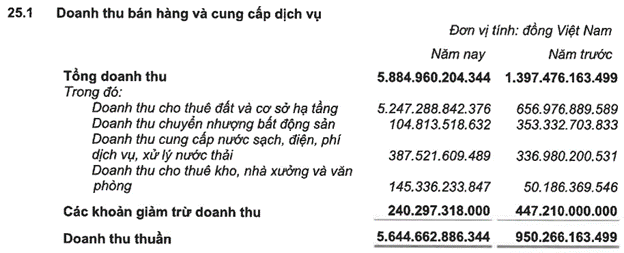

For the whole year of 2023, KBC recorded a net revenue of nearly 5,645 billion VND, a six-fold increase compared to 2022. The leasing of land and industrial infrastructure accounted for 93% of the revenue, with a significant increase to over 5,247 billion VND, eight times higher than the same period last year.

Source: KBC

|

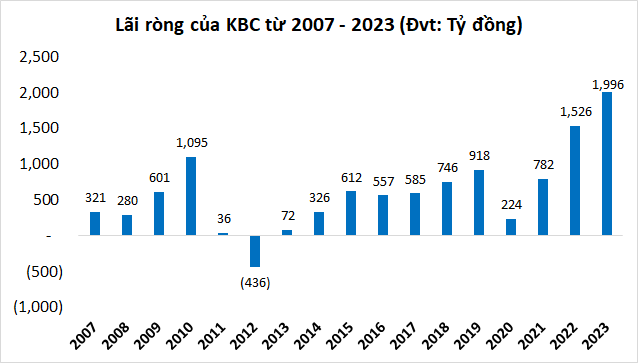

As a result, Kinh Bac Urban Development Corporation reported a net profit of nearly 1,996 billion VND for 2023, a 31% increase compared to 2022. The company achieved 68% of its total revenue target and 55% of its after-tax profit target for the year.

However, this is still the highest profit level the company has achieved since its listing on the stock exchange in 2007 (listed on HNX in December 2007 and transferred to HOSE in 2009).

Source: VietstockFinance

|

Total debts decreased by 52%.

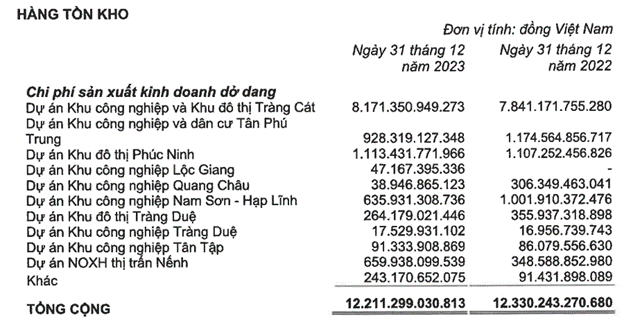

As of the end of 2023, Kinh Bac Urban Development Corporation’s total assets reached over 33,420 billion VND, a 4% decrease compared to the beginning of the year. The majority of assets are short-term assets, totaling over 25,291 billion VND, accounting for 76% of the total assets. Among them, inventory accounted for nearly 37% of the total assets, with notable projects such as the Trang Cat Industrial Zone and Urban Area (over 8,171 billion VND), Phuc Ninh Urban Area (over 1,113 billion VND), Tan Phu Trung Industrial and Residential Area (over 928 billion VND), etc.

Source: KBC

|

KBC’s cash balance decreased to 786 billion VND. In terms of securities investment, KBC currently has a short-term investment in Hoa Sen Hotel Company Limited with nearly 1,855 billion VND.

On the liability side, KBC has a total of 13,226 billion VND in upcoming payments, a 22% decrease compared to the beginning of the year. The total financial debts, both short-term and long-term, amount to over 3,659 billion VND, a 52% decrease compared to the beginning of the year, accounting for 28% of the total debt and 11% of the company’s capital.

By Thanh Tu