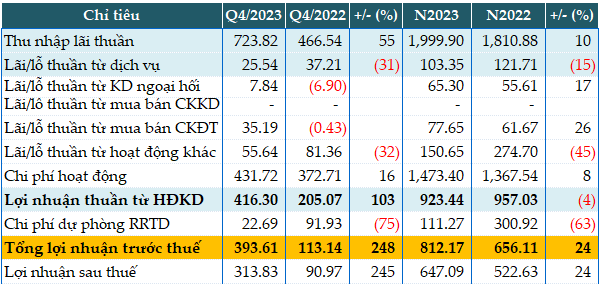

In Q4, net interest income increased by 55% compared to the same period, reaching nearly VND 724 billion. According to Vietbank’s explanation, the work of bad debt recovery and handling, as well as foreign exchange debt, was vigorously implemented.

Service income decreased by 31% to nearly VND 26 billion, mainly due to a decrease in service income (income from insurance agents, income from account management), while service costs increased (mainly due to digital banking service costs).

Notably, forex trading earned nearly VND 8 billion, while in the same period last year it suffered a loss of nearly VND 7 billion, due to the strong increase in the USD/VND exchange rate in the last months of the year.

Thanks to effectively leveraging opportunities in the government bonds market, which brought profits from securities trading activities, Vietbank made a profit of over VND 35 billion, while in the same period last year it incurred losses.

In Q4, the Bank reduced credit risk provisions by 75%, setting aside only nearly VND 23 billion, due to Vietbank’s control of loans and handling of overdue and bad debts.

As a result, the Bank’s profit before tax reached nearly VND 394 billion, 3.5 times higher than the same period last year.

For the full year 2023, Vietbank also reduced credit risk provisions by 63% compared to the previous year (to VND 111 billion), so the Bank’s profit before tax exceeded VND 812 billion, increasing by 24%. However, Vietbank only achieved 85% of the set goal of VND 960 billion profit before tax for the whole year.

|

Q4 and full year 2023 business results of VBB. Unit: Billion VND

Source: VietstockFinance

|

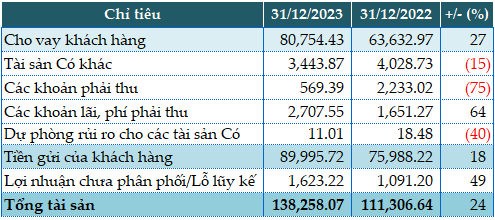

By the end of 2023, total assets recorded over VND 138.258 trillion, a 24% increase compared to the beginning of the year. Among them, deposits at the State Bank of Vietnam increased by 5 times (VND 9.408 trillion), deposits at other credit institutions increased by 53% (VND 26.547 trillion), while customer loans increased by 27% (VND 80.754 trillion).

In the remaining part of the balance sheet, the government and the State Bank of Vietnam only recorded over VND 9 billion in debts, while at the beginning of the year it was VND 12.662 trillion. Deposits at other credit institutions increased by 24% to VND 23.139 trillion. Customer deposits increased by only 17% to VND 89.995 trillion.

|

Some financial indicators of VBB as of 31/12/2023. Unit: Billion VND

Source: VietstockFinance

|

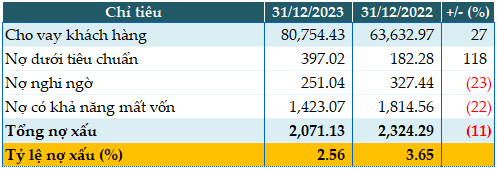

Vietbank’s business picture is brightened by the improved quality of loans, as bad debts as of 31/12/2023 decreased by 11% compared to the beginning of the year, to over VND 2.071 trillion. The bad debt ratio decreased from 3.65% at the beginning of the year to 2.56%.

|

Quality of loans of VBB as of 31/12/2023. Unit: Billion VND

Source: VietstockFinance

|