Just before the Lunar New Year, the VN-Index received a lot of important macroeconomic information. The macroeconomic indicators for January showed many positive signals, including CPI (Consumer Price Index) increasing by 3.37% compared to the same period last year; the IIP (Industrial Production Index) and import-export index also improved positively.

In particular, foreign direct investment (FDI) continued to flow strongly into Vietnam, with registered FDI capital increasing by 40.2% and implemented FDI capital increasing by 9.6% compared to the same period last year, thereby boosting the upward trend of the real estate stocks in the industrial zone right from the beginning of the week.

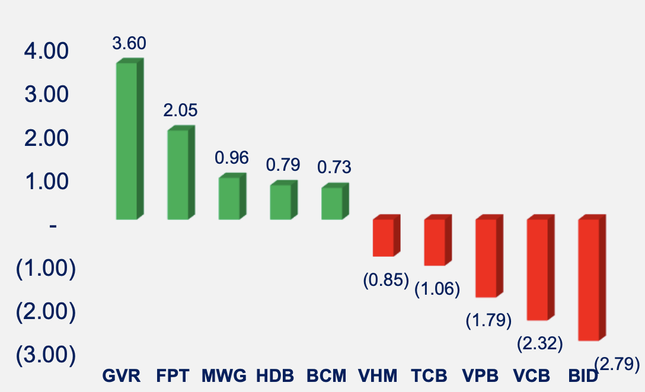

Last week, the market also witnessed capital flowing into the power sector, following the news that the Prime Minister conducted an inspection and requested to accelerate the progress of the 3rd circuit of the 500kV power line project from Quang Trach to Pho Noi. On the contrary, investors took profit from banking stocks.

Over the weekend, the market received information that the Federal Reserve maintained the target federal funds rate for the meeting in January at 5.25-5.5% and assessed that the possibility of a rate cut in March was not high. Although the Fed’s viewpoint was somewhat cautious, the VN-Index returned to recovery after the Purchasing Managers’ Index (PMI) of Vietnam exceeded 50 points for the first time in 5 months and the domestic exchange rate cooled down.

However, the market’s upward momentum could not be sustained during the ETF restructuring session on Friday, with a slight decrease of 0.04%. Influenced by short-term profit-taking sentiment before the Lunar New Year, the VN-INDEX experienced a slight decrease of 0.3% compared to the previous week, closing the week at 1,172.6 points.

Last week, the banking group experienced strong profit-taking.

Experts from VNDirect Securities – Mr. Dinh Quang Hinh – stated that the market had just gone through a week of volatile trading between buyers and sellers as the holiday was approaching. Accordingly, a part of investors had the “early Lunar New Year” mentality and sold to collect money. However, on the other hand, many investors took advantage of the opportunity to “pick up” stocks to prepare for the period after the Lunar New Year. This helped to make trading on the market quite bustling despite the approaching holiday.

“This year, investors should consider taking advantage of the decline sessions before the holiday to accumulate stocks. The recent increase in exchange rates has shown signs of completion, helping to ease psychological pressure on a portion of investors. I believe that domestic investors (especially individual investors) will return to the stock market strongly after the holiday and push stock indexes up,” Mr. Hinh said.

Instead of waiting until after the Lunar New Year to disburse, Mr. Hinh recommended that investors take advantage of the pre-Tet correction sessions to accumulate stocks at discounted prices, prioritizing stocks in industries with supportive fundamental information such as banking, securities, and retail. However, investors should be cautious not to abuse leverage (margin borrowing) before Tet and should use available funds to reduce capital costs.

The analysis team of SHS Securities believed that in the short term, the VN-Index is still on an upward trend, but the process of retesting the support zone has not ended. The market has been moving sideways and short-term investors still have the opportunity to disburse in the coming sessions with the expectation that the VN-Index will approach 1,200 points.

In the medium term, the VN-Index is in a balancing phase to form a new accumulation base, with expectations in the range of 1,150 – 1,250 points. For medium and long-term investors, the market is gradually consolidating and forming a foundation for accumulation, but this process will take time, so it is entirely possible to disburse with the viewpoint of gradually accumulating because the timing of forming a new uptrend will be quite long.

Assessing the short term, the analysis team of SSI Securities believes that technical indicators are still in a neutral zone and show a downward trend. Therefore, the VN-Index can continue to correct within the narrow range of 1,164 – 1,172 points.

Stock market trading holidays during Tet

Ho Chi Minh Stock Exchange (HoSE) and Hanoi Stock Exchange (HNX) have announced the stock market trading holidays for the Lunar New Year of the Year of the Snake 2024. The stock market will temporarily halt trading for 7 days, starting from February 8th (the 29th of Tet) to the end of February 14th (the 5th of Tet). The market holidays are the same as the holidays of officials, civil servants, professionals, and workers.