This week, 2 companies announced dividend payouts. Both companies will be paying dividends in cash at a rate of 5-10%.

Bought and Sold

Just after buying 1 million shares, Ms. Doan Hoang Anh – daughter of Mr. Doan Nguyen Duc (Bau Duc), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (stock code: HAG) – is planning to sell 2 million HAG shares.

In 2023, HAG recorded revenue of VND 6,932 billion, an increase of 35.6% compared to the same period.

From February 5th to March 4th, Ms. Doan Hoang Anh will register to sell 2 million HAG shares to reduce her ownership from 11 million shares to 9 million shares (equivalent to 0.97% of charter capital). The reason for the transaction, as stated by Ms. Doan Hoang Anh, is personal financial processing.

Previously, on January 19th, Ms. Doan Hoang Anh bought an additional 1 million HAG shares to increase her ownership to 1.19% of charter capital. In addition, Ms. Doan Thi Nguyen Xuan – sister of Mr. Doan Nguyen Duc – also registered to sell 80,000 shares to reduce her ownership to 73,593 shares. The transaction is expected to be carried out from January 11th to February 9th.

In Q4/2023, HAG recorded revenue of nearly VND 1,898 billion (an increase of nearly 16% compared to the same period). After-tax profit reached nearly VND 1,108 billion (an increase of over 376% compared to the same period last year).

In the disclosure, HAG stated that financial revenue mainly increased due to the recognition of a profit of over VND 240 billion from the liquidation of investments, and financial costs decreased mainly due to a reduction in interest expenses with an amount of nearly VND 1,425 billion.

Explaining the fluctuation in financial costs, HAG stated that it was given an interest exemption by the Vietnam Export Import Commercial Joint Stock Bank.

For the whole year of 2023, HAG recorded revenue of VND 6,932 billion (an increase of 35.6% compared to the same period), and after-tax profit recorded a profit of over VND 1,817 billion (an increase of 61.6% compared to the same period). Despite the large profit in 2023, as of December 31st, 2023, HAG still had accumulated losses of over VND 1,633 billion, equivalent to 17.6% of charter capital.

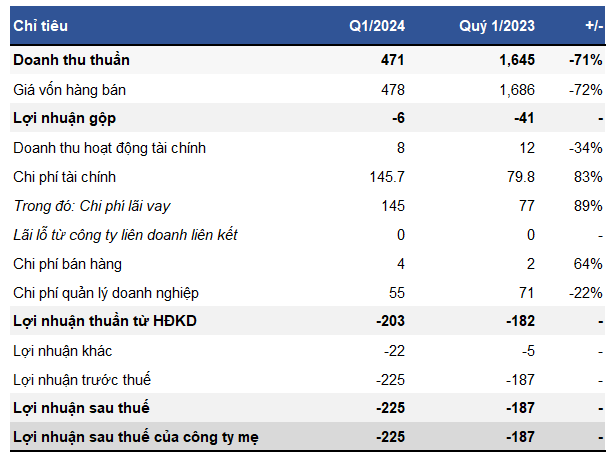

Pomina Steel

Pomina Steel planned to raise over VND 701 billion from strategic shareholders for restructuring but unexpectedly decided to suspend the capital raising plan.

Pomina Steel decided to suspend raising over VND 701 billion.

According to the initial plan, on July 14th, 2023, Pomina Steel approved a private placement plan of 70,175,343 shares to Nansei Steel Company at a price of VND 10,000/share to raise over VND 701 billion to supplement its production and business activities.

Of which, the private placement is divided into two phases. Phase 1 will issue 10,604,038 shares in August 2023, and Phase 2 is expected to issue an additional 59,571,305 shares in September 2024. If the two issuance phases are completed, Nansei Steel Company will become a major shareholder, owning 20.04% of charter capital at Pomina.

However, in September 2023, Pomina Steel requested shareholder consensus to adjust the plan to privately sell 70,175,343 million shares to strategic investor Nansei, with the expected time from August 2023 to the end of 2024 and the number of shares sold in each round to be agreed upon between Pomina Steel and Nansei.

However, after extending the sale period from 2023 to 2024, by the beginning of 2024, Pomina Steel decided to suspend the mentioned capital-raising plan.

CII has raised VND 2,813 billion in bonds.

By the end of the bond issuance period on January 25th, CII announced that it had issued 28,130,689 CII42301 bonds out of a total of 28,401,951 bonds, equivalent to a successful subscription rate of 99.05%. Therefore, CII has raised VND 2,813 billion in bonds.

Vietnam Germicide Joint Stock Company (stock code: VFG) announced a temporary cash dividend of 10% for 2023, meaning shareholders will receive VND 1,000 for each share owned. The last registration date is February 7th. The ex-dividend date is February 6th. The execution date is expected to be March 8th.

Bac Ninh Clean Water Joint Stock Company (stock code: BNW) announced that February 7th will be the last registration date to finalize the list of shareholders to receive a 5% cash dividend. The ex-dividend date is February 6th. The execution date is expected to be March 6th. With 37.5 million shares in circulation, BNW will need VND 19 billion to pay out this dividend.