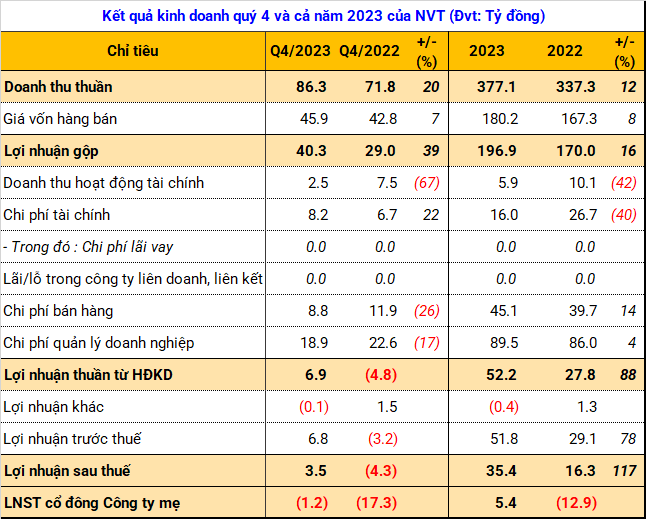

Tourism Real Estate Joint Stock Company Ninh Van Bay (HOSE: NVT) announced that, thanks to intensified promotion activities and events introducing resort areas to customers and a strong increase in tourist numbers, it achieved a revenue of VND 86 billion ($3.7 million) in the fourth quarter, an increase of 20%.

During the period, NVT expanded its gross profit margin from 40% to 46%. Furthermore, various expenses were significantly reduced, such as a 26% decrease in sales expenses and a 17% decrease in business management expenses. On the other hand, NVT faced challenges from loan interest burdens and reduced income from financial operations.

Ending the fourth quarter of 2023, the company recorded a net loss of VND 1.2 billion ($52,000), which can be seen as a positive sign for the company’s shareholders.

Source: VietstockFinance

|

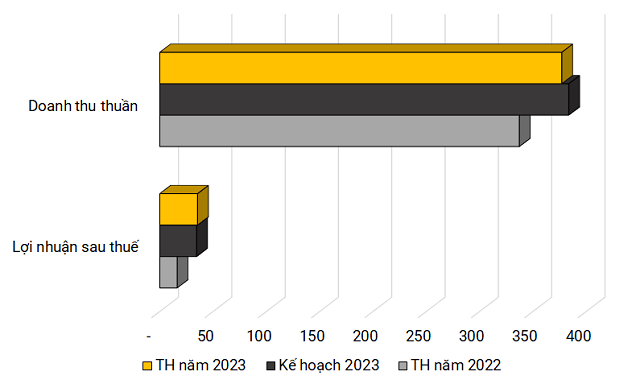

NVT concluded the whole year of 2023 with a profit of VND 5.4 billion ($231,000), which is much better compared to the net loss of VND 13 billion ($557,000) in 2022. Additionally, it successfully met its previously set after-tax profit target. Looking back at the year, NVT‘s shareholders and investors gradually felt the “light at the end of the tunnel” of the tourism and resort real estate market.

|

Actual results compared to the 2023 plan of NVT (Unit: billion VND)

Source: VietstockFinance

|

The accounting balance sheet of NVT at the end of 2023 did not have significant fluctuations. Except for an additional VND 10 billion ($429,000) in basic construction costs for an ecotourism project owned by a subsidiary within the Group.

During the past year, NVT divested all of its 4.58% capital contribution in Tan Phu Tourism Joint Stock Company for the original price of VND 18.3 billion ($785,000). This divestment was fully reserved by the company for many years.

NVT officially withdraws from Emeralda Ninh Binh Resort after more than a decade

The company’s bond debt has also decreased by VND 24 billion ($1 million) and currently stands at VND 190 billion ($8.1 million). This bond lot, with a total value of VND 216 billion ($9.3 million), is held by the Military Commercial Joint Stock Bank (HOSE: MBB). It is expected to mature in 2031 and is secured by the entire capital contribution of two subsidiaries, Dahuong Investment Tourism Limited Liability Company and Hong Hai Tourism Joint Stock Company.

| Net profit results of NVT from 2007 |

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)