Showcasing the stone, tile, and SPC flooring products booth by Royal Invest JSC

|

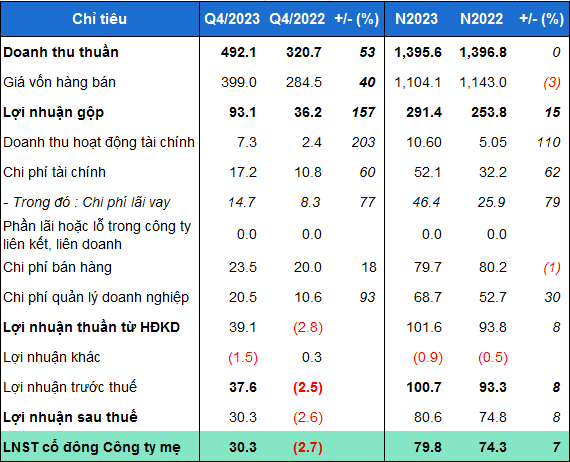

Royal Invest JSC (RYG) announced its Q4/2023 financial statements, with net revenue of 492 billion VND, a 53% increase compared to the same period last year. The cost of goods sold increased at a slower rate, resulting in a gross profit of 93 billion VND, a 157% increase; the gross profit margin was expanded from 11% to 19%.

In this quarter, the financial income increased to 7 billion VND, more than triple the same period last year, but the financial expenses reached 17 billion VND, a 60% increase. Additionally, both sales and management expenses increased by 18% and 93% respectively compared to the same period.

However, with the profitability from core business operations, RYG reported a net profit of 30 billion VND, compared to a loss of 3 billion VND in the previous year.

|

RYG’s Q4 and 2023 business results

(Unit: Billion VND)

Source: RYG, compiled by the author

|

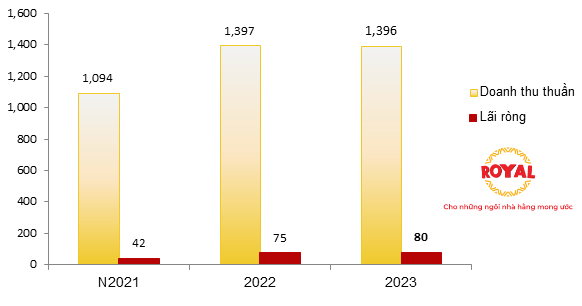

Thanks to the exceptional Q4 profit, Royal Invest JSC’s net profit for the whole year of 2023 reached 80 billion VND, a 7% increase compared to 2022, while net revenue remained at nearly 1,400 billion VND. These are the highest figures in the past 3 years, since the company started disclosing information in 2021.

The sale of finished products (tiles) continues to be the main revenue driver for RYG in 2023, accounting for 66% of total revenue and 91% of gross profit; the gross profit margin for this segment improved from 20% to 29%.

In 2023, RYG set a target of achieving a net revenue of 1,400 billion VND and a post-tax profit of 85 billion VND. With the above results, the company achieved 94% of the profit plan, while closely meeting the revenue target.

|

RYG’s business performance in the period 2021-2023

(Unit: Billion VND)

Source: RYG, compiled by the author

|

Increased borrowings

On the balance sheet, as of December 31, 2023, Royal Invest JSC’s total assets reached 1,665 billion VND, an increase of nearly 500 billion VND compared to the beginning of the year. Among them, cash and bank deposits accounted for 40 billion VND, a 43% decrease and only 2% of total assets.

Contrarily, short-term receivables from customers doubled since the beginning of the year, reaching 504 billion VND. The value of inventories increased by nearly 30% to 389 billion VND, accounting for 2/3 of the total, mainly in finished products.

On the liability side, Royal Invest JSC’s payable reached 952 billion VND, an increase of 260 billion VND compared to the beginning of the year. Short-term financial liabilities amounted to 581 billion VND, a 37% increase and accounting for 61% of total liabilities.

The largest borrowings came from Vietcombank with 154 billion VND; BIDV with 144 billion VND… In 2023, the interest on the company’s borrowings increased to 52 billion VND.

At the end of 2023, undistributed post-tax profits for RYG increased to 197 billion VND. Previously, from 2021-2022, the company did not pay dividends to shareholders. In 2023, RYG plans to distribute dividends to shareholders at a rate of 10%.

|

After a successful IPO at the end of October 2023, Royal Invest JSC finalized the shareholder list to prepare for listing on HOSE. Recently, Vietnam Securities Depository Center (VSDC) issued a registration certificate and securities code for Royal Invest JSC with the code RYG. The number of RYG shares registered for listing is 45 million units, equivalent to a registered value of 450 billion VND. Starting from November 20, 2023, VSDC will accept deposits for the registered number of shares. Royal Invest plans to go public on HOSE with the code RYG, at a price of 15,000 VND/share |