CTCP Thương mại Dịch vụ Tràng Thi (T12) has released an environmental impact assessment report for the Quang Huc urban project in Phu Tho province.

According to the report published in January 2024, the detailed construction plan for the Quang Huc urban area, with a scale of approximately 37.36 hectares, was approved by the Phu Tho Provincial People’s Committee in June 2022. This plan is part of the 1/2000 zoning plan for the Tam Nong eco-tourism, resort, and golf area, approved by the Phu Tho Provincial People’s Committee according to Decision 2987/QD-UBND on November 13, 2020.

The investor of the Quang Huc urban area is Trang Thi Trading and Services Joint Stock Company, with Truong Thanh Development and Services Joint Stock Company as the consulting unit. Both companies are headquartered in Hanoi.

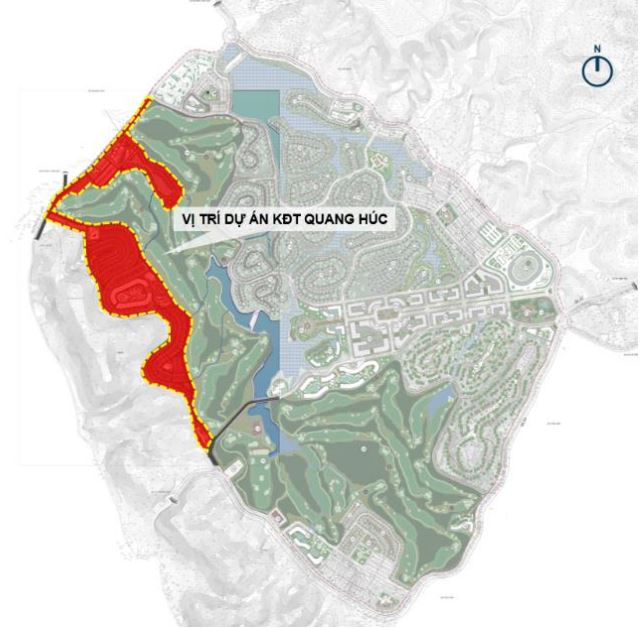

According to Trang Thi’s report, the project is bordered by DT.315C road and existing residential areas to the northwest; forest land to the southwest; forest land and existing residential areas to the northeast; and forest land to the southeast. The current land use consists mainly of existing residential land (1.67 hectares), agricultural land (35.13 hectares, including 0.84 hectares of water surface, 21.42 hectares of production forests, 4.14 hectares of protection forests, 1.22 hectares of annual crops, and 7.51 hectares of rice cultivation), non-agricultural land (0.4 hectares for transportation), and unused land (0.16 hectares).

The project allocates land by functional group, including 10.5 hectares for villa residential land (with a maximum height of 3 floors), 2.3 hectares for resettlement residential land (with a maximum height of 5 floors), and over 2.5 hectares for commercial and service land. The project can accommodate approximately 2,468 people.

Location of the Quang Huc project. Source: Trang Thi

|

Over 1 billion VND is allocated to compensate for over 21 hectares of non-planted forest.

The Quang Huc project was approved by the Phu Tho Provincial People’s Committee in April 2021. The total investment capital is estimated at 2,308 billion VND, including 74.4 billion VND for compensation, site clearance, and resettlement support, and 2,233 billion VND for construction. The maximum implementation period is 60 months from the date of signing the project implementation contract. The project has a 50-year operation period for commercial and service land and an indefinite period for residential land.

In September 2021, the provincial People’s Committee approved Trang Thi as the project’s investor. The company’s contributed capital must reach 346 billion VND, with 1,962 billion VND raised from other sources. The estimated land use fee to be paid is over 102 billion VND.

In August 2022, Trang Thi submitted a proposal to the authorities to pay for reforestation in lieu of the forest area converted for other purposes. According to a survey and assessment of the current forest status, the total area proposed for conversion of forest land for other purposes is over 21.4 hectares. Due to the inability to organize reforestation, the company plans to pay for reforestation with an area and value of nearly 1.1 billion VND (equivalent to 51.2 million VND per hectare of reforestation) to the forest protection and development fund of Phu Tho province. In September 2022, the provincial People’s Committee approved Trang Thi’s proposal for reforestation payment.

Architectural rendering of the Quang Huc project. Source: Trang Thi

|

Transfer of villa and residential land in the project for 3.3 trillion VND

Regarding the Quang Huc project, in October 2023, Trang Thi’s General Meeting of Shareholders approved a partial transfer of the project. The transfer includes (1) the project area within the planned villa residential land (from BT.01 to BT.17) and (2) the project area within the planned residential land (BT.18 to BT.30). The estimated transfer prices are 1.7 trillion VND for part 1 and 1.6 trillion VND for part 2, including the entire project development rights for the transferred land, the land use value, and all costs associated with the land.

The receiving party of the transfer has not been publicly disclosed by the company.

Trang Thi started as Ngũ Kim Company, established in 1955 and later renamed as Kim Khi – Hoa Chat Company. In August 1988, the company acquired the assets and labor of two dissolved units, Industry and Trade Company for Technology Products Hanoi and General Business Company Hanoi, and changed its name to Kim Khi – Dien May Hanoi.

In 1993, the company changed its name to Trang Thi Trading and Services Joint Stock Company. In 2003, Thanh Tri Trading Joint Stock Company merged into Trang Thi, followed by Dong Anh Trading and Total Business Joint Stock Company in 2004. In 2010, the company became Trang Thi Trading and Services Limited Liability Company (Trang Thi LLC). In 2015, the company underwent equitization and successfully conducted an IPO of over 3.1 million shares at an average price of 82,000 VND per share. In October 2015, the company completed the transfer of state capital to a joint-stock company. In 2017, the company started trading on the UPCoM market with the ticker symbol T12.

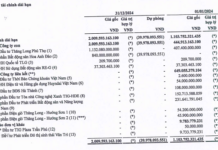

Trang Thi is currently a member of T&T Corporation, chaired by Do Quang Hien, with main business activities in metal and electrical household appliances, food, and real estate development. Its charter capital is 540 billion VND. Trang Thi’s affiliated companies include Nghia Do Trading and Services Joint Stock Company, in which T12 holds 20%; Xuan Thuy Trading and Services Joint Stock Company, with a capital of 55.6 billion VND, in which T12 holds 30%; and Thai Son – Long An Joint Stock Company, with a capital of 1,500 billion VND, in which T12 holds 30%.

Vu Trong Tuan, a member of the Board of Directors and General Director of Trang Thi, formerly worked at T&T Corporation and is currently also the Chairman of the Board of Directors of TIC Hanoi Trading and Investment Joint Stock Company and the General Director of affiliated entities including T&T Consumer Goods Trading Company Limited, T&T Retail Company Limited, and T&T High-Tech Medicine Corporation. Tuan personally holds nearly 13.3 million shares, equivalent to 24.61% of Trang Thi’s charter capital. In addition, he represents ownership of 10.8 million shares, equivalent to 20% of Trang Thi’s charter capital on behalf of T&T Corporation.

Do Vinh Quang is currently the Chairman (non-executive) of Trang Thi. Quang is the second son of Do Quang Hien.

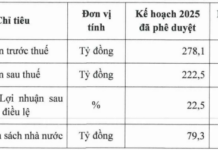

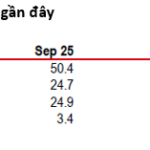

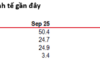

| Trang Thi’s financial performance |

Thu Minh