Sales and management costs increased, causing a decline in fourth-quarter profits

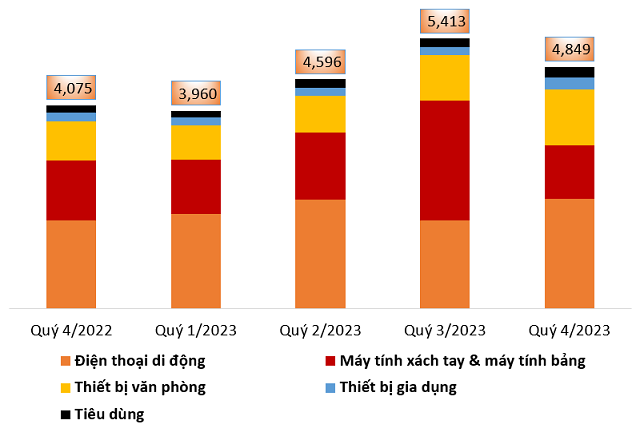

According to the Q4 2023 financial statement, DGW’s net revenue in the final quarter reached VND 4,849 billion, an increase of 19% compared to the same period, thanks to positive growth in the mobile phone and office equipment segments.

Specifically, the mobile phone segment generated VND 2,204 billion, a 24% increase compared to the same period. Q4 is considered the peak season for this segment with the launch of the iPhone 15.

For the office equipment segment, revenue reached VND 1,124 billion, a strong increase of 42%, thanks to the completion of the acquisition of 75% of Achison, thereby consolidating revenue from labor protective equipment products. Furthermore, the year-end period is the peak time for budget disbursement for projects, so this industry benefits when the customers are mainly enterprises, government agencies, the government, and schools.

In addition, two other activities, although not a significant proportion, also saw good growth rates. Household appliances and consumer goods increased by 31% and 57% respectively, reaching VND 234 billion and VND 215 billion.

The only segment with negative growth is laptops and tablets, decreasing by 10% to VND 1,072 billion. DGW explained that this was due to a decrease in demand after the back-to-school season in Q3, along with a difficult economy that limited consumers’ ability to upgrade their devices.

|

Recent net revenue fluctuations of DGW

Unit: Billion VND

Source: VietstockFinance

|

After deducting costs of goods sold, DGW’s gross profit reached VND 521 billion, an 11% increase; gross profit margin slightly decreased by 0.8 percentage points to 10.7%.

The financial activities brought in a profit of VND 38 billion, more positive than the nearly VND 6 billion loss in the same period, thanks to a significant decrease in interest expenses.

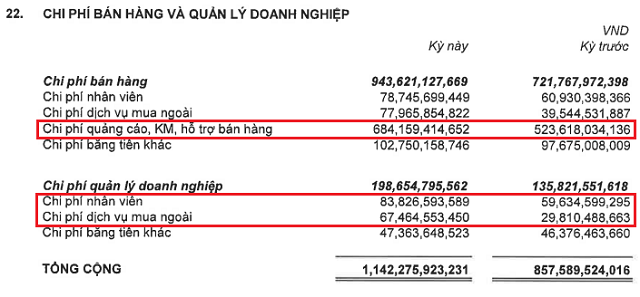

However, DGW couldn’t sustain its profit growth due to the significant pressures from sales and business management costs, both of which increased. Specifically, sales costs increased by 66% to nearly VND 371 billion due to increased costs for advertising, promotions, and customer support. Meanwhile, business management costs increased by 59% to over VND 64 billion due to increased costs for personnel and outsourced services.

Source: Q4 2023 consolidated financial statement of DGW

|

From these unfavorable factors, DGW only achieved a net profit of nearly VND 90 billion in the final quarter, a decrease of 42%. Accumulated for the whole year of 2023, DGW achieved VND 18,818 billion in net revenue and over VND 354 billion in net profit, decreasing by 15% and 48% respectively compared to the previous year.

In 2023, DGW set a post-tax profit target of VND 400 billion. Therefore, the company has achieved more than 90% of its annual plan.

|

Business performance in Q4 and the whole year of 2023 of DGW

Unit: Billion VND

Source: VietstockFinance

|

New asset milestone

As of December 31, 2023, DGW’s total assets reached over VND 7,500 billion, continuing to set a new historical milestone after surpassing the VND 7,000 billion threshold in Q3, with an 18% increase compared to the beginning of the year.

| DGW’s previous year-end assets have never reached VND 7,500 billion |

Among them, inventory was recorded at a value of VND 3,003 billion, although it decreased by 8%, it still accounted for 40%, the highest in the asset structure. Most of it comes from the value of goods including phones, tablets, laptops, etc.

Another item with a high proportion is short-term receivables, recorded at a value of VND 2,221 billion, accounting for 30%. It is worth noting that DGW’s receivables increased by 41%, mainly from receivables from Thế Giới Di Động, FPT Retail, Phong Vũ, and other customers.

Cash and cash equivalents also recorded a strong increase of 75%, reaching VND 1,450 billion, accounting for 19% of total assets.

On the other side of the balance sheet, debts recorded a value of VND 2,327 billion, an increase of 19% compared to the beginning of the year, accounting for 31% of total capital. Most of them are short-term loans from banks such as Vietcombank, HSBC Vietnam, Standard Chartered Vietnam, ANZ Vietnam… mostly unsecured by assets.

Short-term payable to suppliers was at VND 1,557 billion, an increase of 27% and accounting for 21%. It mainly comes from major suppliers such as Asus Global Pte Ltd, Xiaomi H.K Limited, Lenovo (Singapore) Pte Ltd, Acer Incorporated, and other suppliers.

In the stock market, DGW’s stock price reached VND 54,100 per share after the trading session on January 31, 2024, an increase of over 25% over 1 year, with average trading volume of nearly 1.8 million shares per day.

| DGW stock performance over 1 year |