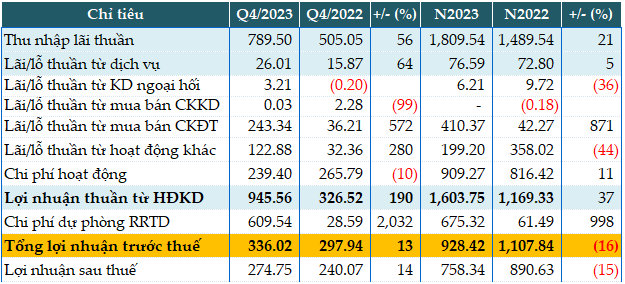

Overall in 2023, VietABank’s net interest income increased by 21% compared to the previous year, reaching nearly VND 1,810 billion.

External income sources decreased significantly, although they did not contribute much to the bank’s income. Foreign exchange earnings decreased by 36% (VND 6 billion), and other operating income decreased by 44% (VND 199 billion).

The only bright spot in VietABank’s business picture came from a profit of over VND 410 billion from securities trading activities, compared to just over VND 42 billion in the previous year.

Last year, VietABank increased its operating expenses by 11% to VND 909 billion due to increased expenses from service management activities. In addition, the bank allocated over VND 675 billion for credit risk provisions (compared to VND 61 billion the previous year), resulting in pre-tax profit of over VND 928 billion, a 16% decrease.

Compared to the planned pre-tax profit of VND 1,275 billion in 2023, VietABank only achieved 73% of the target.

|

Q4 and full-year 2023 business results of VAB. Unit: Billion VND

Source: VietstockFinance

|

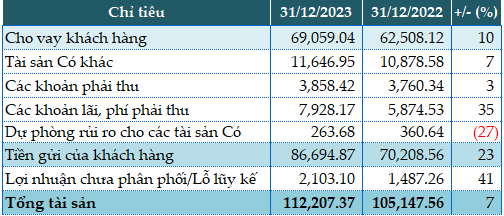

As of the end of 2023, the bank’s total assets increased by 7% compared to the beginning of the year, reaching VND 112,207 billion. Cash decreased by 20% (VND 361 billion), deposits at the State Bank increased by 56% (VND 2,149 billion), an additional VND 3,250 billion in loans to other credit institutions that were not recorded at the beginning of the year, and customer loans increased by 10% (VND 69,059 billion)…

In terms of capital sources, customer deposits increased by 23% (VND 86,694 billion), no longer recording government and State Bank debts, which were recorded at VND 3,621 billion at the beginning of the year. Loans from other credit institutions amounted to just over VND 19 billion, compared to nearly VND 1,070 billion at the beginning of the year.

|

Some financial indicators of VAB as of 31/12/2023. Unit: Billion VND

Source: VietstockFinance

|

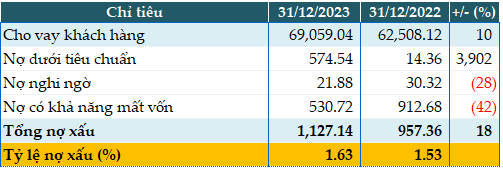

VietABank’s non-performing loans as of 31/12/2023 amounted to VND 1,127 billion, an 18% increase compared to the beginning of the year. Notably, substandard loans increased 40 times, surging to VND 574 billion compared to the initial VND 14 billion. As a result, the ratio of non-performing loans to outstanding loans increased from 1.53% at the beginning of the year to 1.63%.

|

Quality of VAB’s loans as of 31/12/2023. Unit: Billion VND

Source: VietstockFinance

|