|

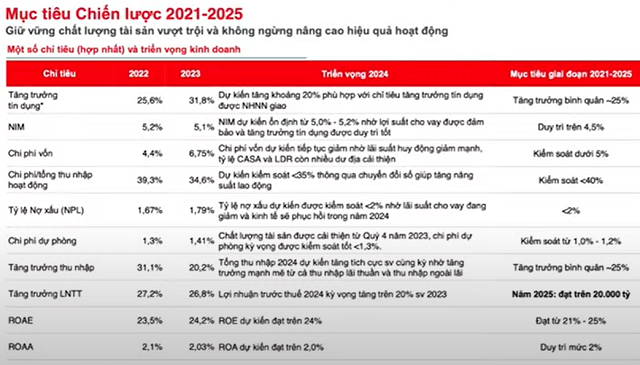

Pre-tax profit in 2024 to grow at least 20%, aiming for 20,000 billion in 2025.

Mr. Hoang Thanh Tung – Investor Relations Director of HDBank shared that in 2023, HDBank achieved credit growth of 31.8% and in 2024, HDBank aims for a credit growth of 20% in line with the target set by the State Bank of Vietnam (SBV).

NIM (Net Interest Margin) is expected to be around 5.0-5.2% amid decreasing deposit interest rates, helping the bank control funding costs and have a large room to improve capital efficiency.

CASA ratio in 2024 is expected to reach a minimum of 16%, up from 11% in 2023. This will have a very positive impact on the bank’s funding costs in 2024.

Cost-to-income ratio is expected to be controlled below 35% through digital transformation, which helps increase labor productivity, streamline internal processes, and achieve reasonable cost levels.

NPL (Non-performing Loan) ratio and provisioning cost in 2024 are expected to be better controlled due to improved economic conditions. Most forecasts from experts indicate that the economy this year will be better than last year, thereby increasing the income of individuals and businesses. The interest rate environment has also cooled down quickly, helping control customers’ debt repayment ability, and the overall NPL ratio in the industry is expected to improve further in the future.

Overall, total income and pre-tax profit are expected to improve. Specifically, pre-tax profit is guaranteed to increase by at least 20% compared to the 13,000 billion VND in 2023. As a result, profitable indicators such as ROE and ROA are expected to reach over 24% and 2% respectively this year.

For the long-term goal of the period 2021-2025, HDBank aims for an average annual credit growth of 25%. By 2025, the pre-tax profit target is expected to exceed 20,000 billion VND.

Screenshot image

|

10% vacancy waiting for suitable strategic partners.

Answering shareholders’ question about the plan to open a representative office in South Korea as well as strategic shareholders, Mr. Hoang Thanh Tung said that HDBank’s Board of Directors has just issued a resolution approving the establishment of a representative office in Seoul, South Korea. This is part of HDBank’s strategy to expand cooperation with international financial institutions, corporations, and global enterprises.

South Korea is an important market for Vietnam in terms of investment and trade. In 2023, South Korea was also among the top three countries with the most FDI investment in Vietnam.

In terms of two-way trade, South Korea is also an important market. The number of Vietnamese people living and working in South Korea is high, and there are also many Korean businesses present in Vietnam. The number of Korean FDI customers is also increasing.

These are the factors that make HDBank see the increasing two-way demand. Vietnamese businesses have a need to strengthen trade with Korean enterprises, and Korean businesses are also looking for investment opportunities in Vietnam.

With the interest of Korean investors contributing capital to HDBank not only from South Korea but also from Europe and America. However, the selection of partners to increase capital and attract strategic shareholders is part of the bank’s plan, helping to enhance financial capacity, meet growth needs, and ensure capital adequacy ratios. Issuing shares to foreign investors must comply with the Law.

The regulations limiting the ownership ratio of shareholders in the Law on Credit Institutions (amended) that have just been passed do not affect foreign investors but only apply to domestic organizations. HDBank already has a available foreign ownership limit of 10% for this plan and can be implemented when the market conditions are favorable and a suitable partner is found.