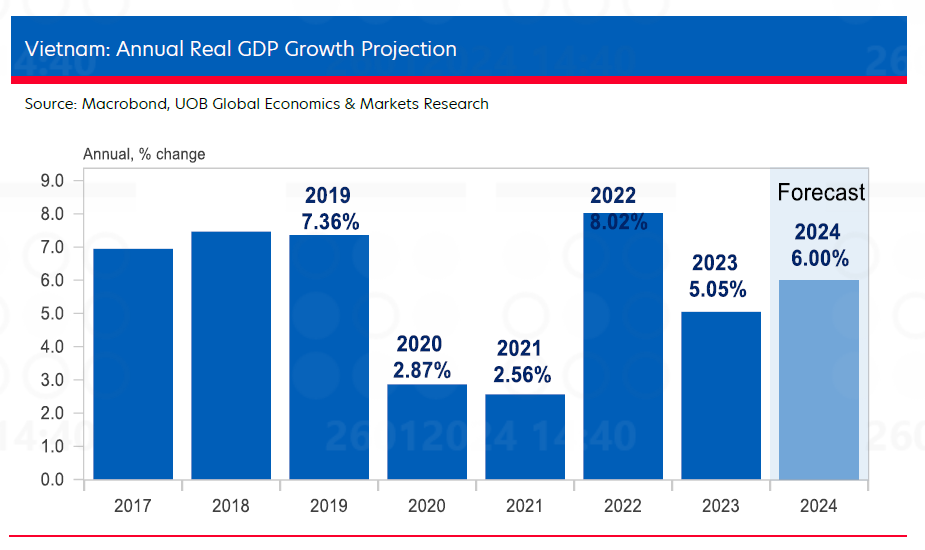

A research group has revised Vietnam’s growth forecast to 5.05% in 2023, due to the pressure from weakened external demand and a high base effect from the previous year. The group also warns of many challenges and disadvantages in 2024 due to the uncertainties and risks arising from ongoing military conflicts elsewhere in the world, political disputes between major powers, and high interest rates.

UOB highlights the conflict in the Red Sea region, which accounts for 12% of global trade with 17,000 ships passing through each year, has forced global shipping companies to reroute around the Cape of Good Hope, thus extending the journey and causing delays in transportation, resulting in higher shipping costs and disruptions in the supply chain.

The research group suggests that this will harm not only consumers and end-users, but also exporters, manufacturers, and supply chains worldwide, including Vietnam. This is because orders will be affected by delays and higher costs, which will in turn affect production activities.

Another factor that UOB believes needs to be considered is the implementation of the Global Minimum Tax (GMT) in Vietnam on multinational enterprises (MNEs), effective from January 1, 2024.

The researchers emphasize that the key issue is that different tax incentives, such as preferential tax rates, exemptions, and other advantages for MNEs, have helped reduce the corporate tax rate to 20%. With the current changes, foreign investors, especially MNEs, will need to consider higher tax costs in their future business plans. It is important to implement measures to offset the GMT, such as reducing costs and improving labor productivity, to maintain Vietnam’s competitiveness as an investment destination.

However, at present, Vietnam’s prospects are reinforced by the recovery in semiconductor demand, stable growth in China and the region, as well as the significant shift in supply chains that benefits Vietnam and other ASEAN countries.

The SBV will maintain the recapitalization interest rate at 4.5% as currently.

UOB acknowledges that the State Bank of Vietnam (SBV) responded swiftly in early 2023 to the economic downturn and challenges with consecutive rapid interest rate cuts.

The latest policy rate cut took place in June 2023, with the recapitalization interest rate being cut by a total of 150 basis points to 4.5%. However, with the pace of economic activity recovering and better prospects in 2024, the possibility of further interest rate cuts has diminished.

“Therefore, we believe that the SBV will maintain the recapitalization interest rate at the current level of 4.5%“, UOB forecasts.

Instead of continuing to lower interest rates, as it will be constrained by lower limits, the government has shifted focus to non-interest rate measures to support the economy. One of these is to increase the emphasis on delivering credit to borrowers (i.e., quantitative easing measures).

Another indicator is the recent amendment of the Credit Organizations Law, which will take effect on July 1, 2024.

“The amended law provides a framework for special loans from the SBV, including interest-free loans and non-collateralized loans, which can be targeted at specific policy objectives to support critical sectors and implement emergency liquidity operations when necessary, such as mass withdrawals at banks. This reflects the government’s commitment and means of supporting critical sectors and responding to emergency situations“, UOB analyzes.

In 2023, bank credit grew by 13.5% compared to the same period, slightly lower than the target range of 14-15% set for the year, as regulatory bodies required banks to simplify lending procedures and improve businesses’ access to bank loans. By 2024, the SBV aims to promote credit growth to around 15% with flexible adjustments based on the economic developments during the year.