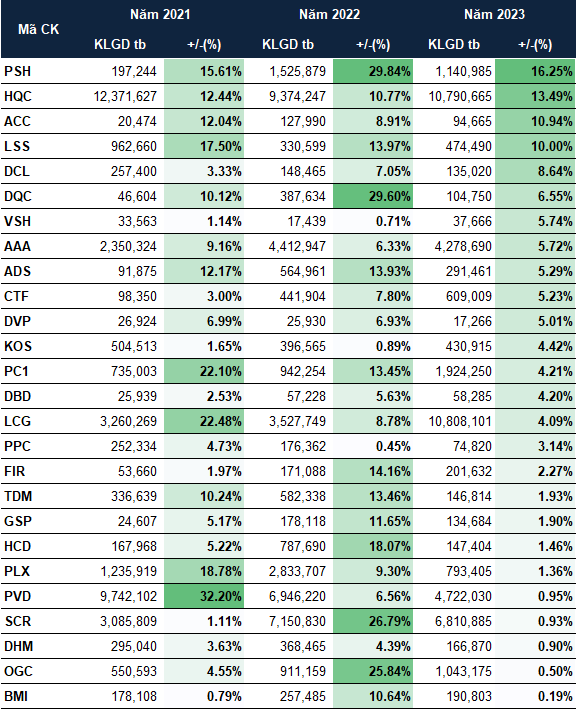

According to VietstockFinance statistics, in phase 3 of February for 3 consecutive years 2021-2023, HOSE exchange recorded 26 stocks consistently increasing while only 4 stocks consistently decreasing.

The majority of stocks that usually increase during this period are medium and small-cap ones, except for the big players in the petroleum industry like PLX. Some notable stocks include PSH, HQC, SCR, OGC,…

Meanwhile, 3 out of the 4 stocks that usually decrease are familiar to investors such as NVL, HAG, and CTD. The remaining stock is CDC.

|

Stocks on HOSE exchange increasing throughout February 2021-2023

Source: VietstockFinance

|

|

Stocks on HOSE exchange decreasing throughout February 2021-2023

Source: VietstockFinance

|

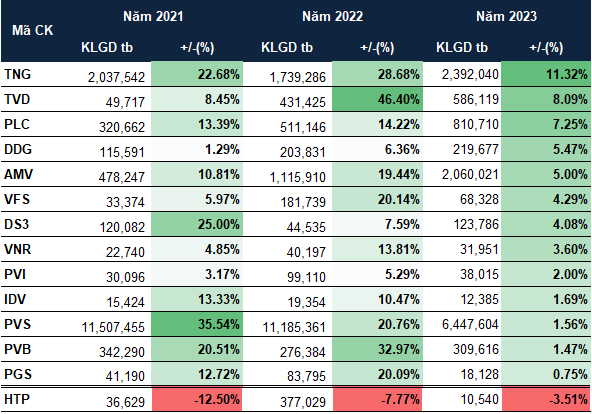

On HNX exchange, the number of stocks that usually increase also dominates compared to the ones that usually decrease. While there is only one decreasing stock which is HTP, there are up to 13 stocks that usually increase.

The increasing list includes the appearance of many stocks starting with “P” such as PLC, PVS, PVB, and PGS, alongside two insurance stocks VNR and PVI.

|

Stocks on HNX exchange increasing/decreasing throughout February 2021-2023

Source: VietstockFinance

|

Not only does the majority of stocks usually increase, VN-Index also demonstrates positive signs in February. Data from the past decade (2014-2023) shows that VN-Index only goes down in February of 3 years (2016, 2020, and 2022), while it continuously increases, with the lowest increase being 1.75% in 2023.

Source: VietstockFinance

|

|

Regarding the stock market in 2024, PGS.TS. Nguyen Huu Huan – Lecturer at University of Economics Ho Chi Minh City (UEH) believes that if investors are willing to take risks, they can continue to choose the stock market as an investment channel this year. However, investors should only allocate 20-30% of their capital to venture into the stock market. Currently, it is difficult to make money by “surfing” in this market, and only long-term investments should be considered, evaluating stocks with good fundamental value for high return on investment, as the income of large corporations recovers. Regarding industries, Mr. Huan believes that in the short term, investors are expecting stocks from industries that will immediately benefit when the economy recovers such as: retail, construction materials, real estate,… |

Ha Le