Ho Chi Minh City Infrastructure Investment Joint Stock Company ( CII ; HoSE: CII) has just announced Q4/2023 financial statements, recording a gross profit from sales of VND 409 billion, up 34.84% compared to Q4/2022. Along with that, financial income brought in VND 576 billion, more than double.

As a result, CII’s net profit in Q4/2023 reached VND 167.3 billion, increasing more than 20 times compared to the same period in 2022 (VND 8.1 billion).

Accumulated until 2023, gross profit from sales reached VND 1,152 billion, decreasing 14.26% compared to the previous year.

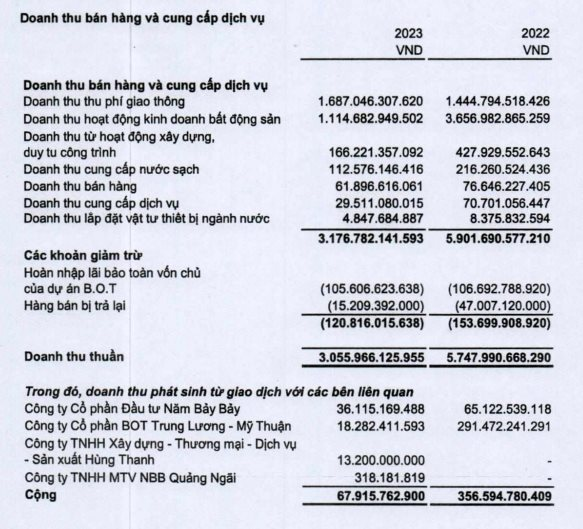

Despite that, net sales revenue – main revenue for CII brought in VND 3,055 billion, decreasing 46.83%. However, the cost of goods sold decreased by 56.77% to VND 1,903 billion, helping the gross profit from sales decrease in a “downward” manner.

CII’s net revenue in 2023 still mainly comes from toll revenue and real estate business activities.

In 2023, financial income brought in VND 1,526 billion, almost flat compared to the previous year. Meanwhile, the loss in joint venture and associated companies was negative VND 17.1 billion, compared to a profit of VND 74.8 billion in 2022; Other profit reported a loss of VND 23.7 billion, compared to a loss of VND 2.6 billion in 2022.

Total costs of CII in 2023 increased sharply compared to the previous year, such as: Financial cost was VND 1,660 billion, up 22.16%; Sales cost was VND 79.9 billion, up 3.98%. Apart from that, enterprise management costs decreased by 0.53% to VND 459.5 billion.

CII’s payable obligations increased sharply to nearly VND 25,000 billion at the end of 2023.

As a result, accumulated until 2023, CII recorded a post-tax net profit of VND 381.4 billion, a decrease of 55.68% compared to the previous year. The post-tax profit of the parent company is VND 187 billion (a decrease of more than 73%), causing the basic earnings per share to decrease from VND 2,648 in 2022 to VND 616 in 2023, corresponding to a decrease of 76.74%.

As of 31/12/2023, the total assets of CII were VND 33,244 billion, up more than 16% compared to the beginning of the year. Among them, short-term assets were VND 6,975 billion, a decrease of 3.92%. Inventory was VND 616 billion, a decrease of 62.45%. The owner’s equity of the enterprise was VND 8,516 billion, an increase of 2.23%.

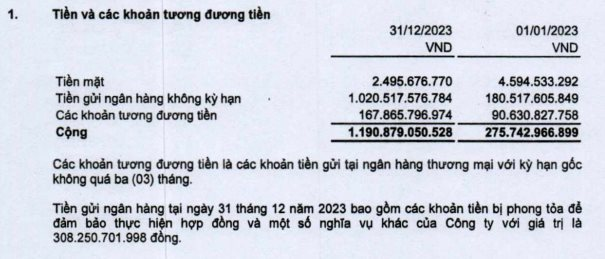

Notably, Cash and cash equivalents as of the end of 2023 were VND 1,190 billion, an increase of more than 4.1 times compared to the beginning of the year (VND 287 billion).

Cash and cash equivalents of CII increased more than 4.1 times compared to the beginning of the year.

On the other side of the balance sheet, the total liabilities of CII as of the end of 2023 were VND 24,728 billion, an increase of more than 22% compared to the beginning of the year, corresponding to nearly VND 4,500 billion. Among them, short-term liabilities were VND 8,191 billion, a decrease of 14.4%. In contrast, long-term liabilities of CII increased by 54.62% to VND 16,536 billion, corresponding to nearly VND 6,000 billion. Total financial debt of CII as of the end of 2023 was VND 18,855 billion, accounting for 76.37% of the total liabilities of the enterprise.

Debt-to-equity ratio increased from 2.43 times at the beginning of the year to 2.9 times at the end of 2023.

Another notable point of CII in 2023 is net cash flow from operating activities from positive VND 973 billion at the beginning of the year to negative VND 1,890 billion at the end of the year. In contrast, net cash flow from investment activities from negative VND 22.3 billion at the beginning of the year turned positive VND 1,119 billion at the end of the year; Net cash flow from financing activities from negative VND 1,364 billion at the beginning of the year turned positive VND 1,686 billion at the end of the year, showing that the company is having to increase borrowing to offset the cash flow shortage.

In the stock market, at the end of February 5, the price of CII shares was VND 18,500 per share, down 0.27% compared to the previous trading session, with the volume of shares traded being more than 5.8 million units.