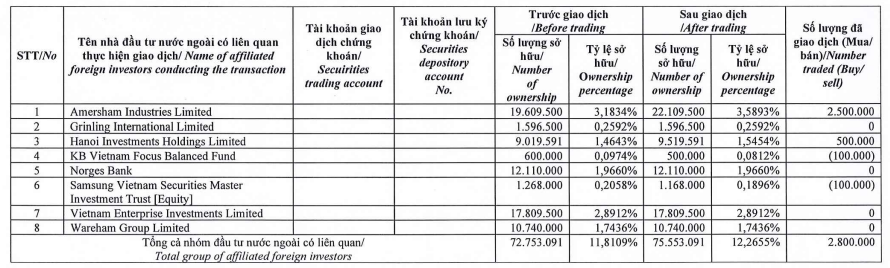

The Dragon Capital fund group reported a net purchase of 2.8 million HSG shares of Hoa Sen Group Joint Stock Company. After this transaction, the foreign fund increased its ownership from 11.81% to 12.27% of the charter capital of HSG, equivalent to 75.55 million shares.

The member funds involved in the transaction are Amersham Industries Limited, which bought 2.5 million shares; Hanoi Investments Holdings Limited, which bought 500,000 shares; KB Vietnam Focus Balanced Fund, which sold 100,000 shares; and Samsung Vietnam Securities Master Investment Trust (Equity), which sold 100,000 HSG shares.

Source: HSG

In just a few days, Dragon Capital has continuously increased its ownership in Hoa Sen Group by accumulating millions of shares. Previously, on January 26, a member fund, Amersham Industries Limited, purchased 3 million HSG shares. This increased the ownership in HSG to nearly 2.7%, bringing the total ownership of the Dragon Capital group to over 11.3%, equivalent to nearly 69.8 million shares.

Earlier, in March 2023, the group officially became a major shareholder in HSG after two member funds purchased 1.1 million shares.

In contrast to the continuous net purchases by foreign funds, internal shareholders of HSG want to reduce their ownership. Specifically, Mr. Tran Ngoc Chu, Deputy Chairman of the Standing Board of Directors, registered to sell 1.5 million HSG shares to reduce ownership from 1,781,147 shares (0.29% of the charter capital) to 281,147 shares (0.046% of the charter capital). The transaction is expected to take place from February 1 to March 1, 2024.

Previously, Mr. Vu Van Thanh, Deputy General Director of HSG, registered to sell 800,000 HSG shares to reduce ownership from 806,202 shares (0.13% of the charter capital) to 6,202 shares (0.001% of the charter capital). The transaction is expected to take place from January 29 to February 27.

In terms of business operations, in the first quarter of the fiscal year 2023-2024 (from October 1 to December 31, 2023), Hoa Sen Group recorded a revenue of VND 9,073 billion, an increase of 15% compared to the same period. After-tax profit reached VND 103 billion, a significant increase compared to the loss of VND 680 billion in the same period.

It can be seen that in the first quarter of the fiscal year 2023-2024, Hoa Sen Group has returned to profitability, mainly due to positive revenue growth, as well as a significant improvement in gross profit margin leading to strong profit growth.

However, in the first quarter of the fiscal year 2023-2024, Hoa Sen Group recorded a negative operating cash flow of VND 672.9 billion compared to VND 1,853.8 billion in the same period. In addition, the investment cash flow recorded a positive VND 13.5 billion and the financial cash flow recorded a positive VND 1,748.1 billion, mainly due to increased borrowings to offset the cash flow deficit.