MWG has conducted the repurchase using its own funds, with the transaction method being the transfer of rights through the Vietnam Securities Depository Center (VSD). Ho Chi Minh City Securities Corporation (HOSE: HCM) has been designated as the agent to carry out the stock repurchase transaction.

The purchase price is determined according to the principles in the ESOP issuance regulations. The transaction is expected to take place in February-March 2024.

This is the first time in 2024 that the retail giant repurchases treasury stock. In 2023, the company had 3 rounds of repurchasing treasury stocks to recover ESOP shares from former employees, totaling over 978.3 thousand shares, exceeding the amount of treasury stocks repurchased in previous years.

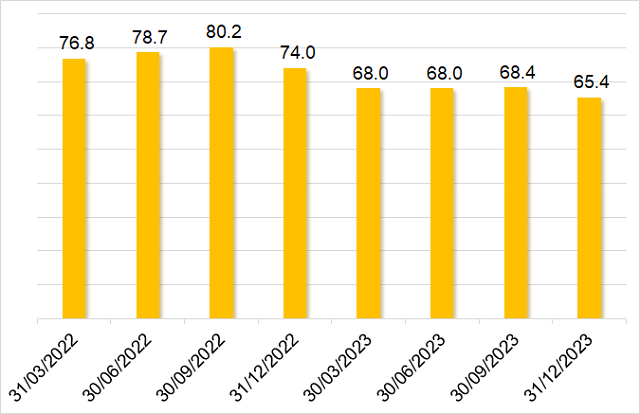

ESOP is not for everyone, but the significant reduction in personnel at MWG in recent times also reflects to some extent the reason why there has been a continuous effort to recover ESOP shares from former employees. As of December 31, 2023, MWG was operating with over 65.4 thousand employees, a decrease of 8.6 thousand compared to the beginning of the year, with a particularly sharp decrease of nearly 3 thousand employees in the fourth quarter, along with the period when MWG closed nearly 200 The Gioi Di Dong and Dien May Xanh stores.

|

The number of MWG employees has recently been decreasing significantly

Unit: Thousand employees

Source: VietstockFinance

|

Scaling down is something that can be “understood” for MWG, especially in the context of unfavorable business conditions and countless difficulties faced by the ICT retail industry. At the end of 2023, MWG only recorded a net profit of 168 billion VND, a decrease of 96% compared to the previous year and marking the lowest level since listing.

Recently, on January 31, MWG’s Board of Directors approved the 2024 business plan to submit to the Annual General Meeting of Shareholders. The plan is expected to be a recovery with net revenue of 125 trillion VND and post-tax profit of 2.4 trillion VND, increasing by 6% and 14 times respectively compared to the performance in 2023.

MWG only recorded a net profit of nearly 168 billion VND in 2023, the lowest since listing

Dragon Capital reduces ownership below 6%, MWG sets target for business recovery in 2024

In the stock market, as of the end of February 5, the MWG stock price reached 47,400 VND/share, an increase of nearly 11% compared to the beginning of 2024.

| MWG stock price movement since the beginning of 2024 |