Bond security with reputable issuing advisory organizations

Any business looking to issue bonds must go through a licensed financial organization that performs the issuing advisory (IA) business.

For investors, a complex financial product like corporate bonds requires an objective assessment of the risk level from intermediaries, which in this case are the issuing advisory organizations. This is particularly important because Decree 08/2023 stipulates that investors must take responsibility for evaluating products, making investment decisions, as well as the risks arising from bond investments and transactions.

Therefore, smart investors nowadays prioritize choosing bonds offered through reputable intermediaries to minimize risks while ensuring the safety and effectiveness of cash flow. At the top of the credibility ranking list is Techcombank Securities Joint Stock Company (TCBS) – a subsidiary of Techcombank, currently the issuing advisory organization with more than 50% market share. TCBS always ensures a rigorous appraisal process to provide investors with high-quality, efficient, and safe bonds.

Box on the right: The bond issuing advisory process at TCBS goes through 9 rigorous steps: (i) Assessing the needs of the issuing business and the investors; (ii) Understanding the business and conducting in-depth assessment; (iii) Bond structure; (iv) Primary offering; (v) Establishing a bond issuance file; (vi) Approval of issuance; (vii) Closing the issuance; (viii) Listing; (ix) Post-issuance monitoring.

Only bonds within Techcombank’s risk appetite are offered to investors, and only issuing organizations on the list of IA organizations managed and maintained by Techcombank are used for retail.

Bonds at TCBS: Safety confirmed

Even during the difficult period when the corporate bond market faced challenges and many businesses could not redeem bonds for investors, 100% of the bonds distributed by TCBS were fully paid on time in 2022 and 2023. During the period from November 2022 to May 2023 (7 months) when the bond market was in crisis, TCBS’s iConnect bond agreement system still supported investor liquidity with 165,575 transactions and VND 17,785 billion trading volume for repurchases.

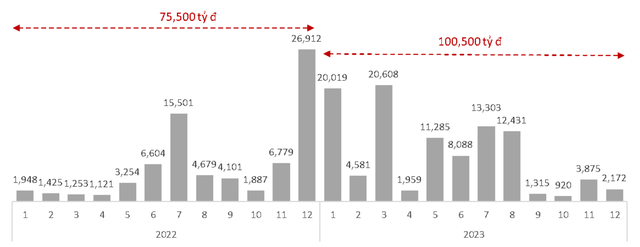

In 2022, more than VND 75,000 billion of principal and interest payments for bonds expired on time, corresponding to over 500 bond codes that TCBS was the issuing advisory. In 2023, TCBS made payments of more than VND 100,500 billion in principal and interest for bonds to investors.

At TCBS, customers can buy iBond corporate bonds entirely online on the TCInvest system and are provided with complete information about the bond and the issuing business, as well as a risk disclosure document to consider before participating.

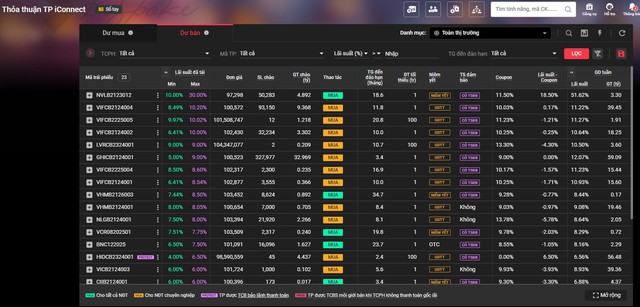

Not stopping at reputable advisory, TCBS also enhances the quality of post-issuance agency services. For example, the convenient bond liquidity solution on the iConnect bond agreement system solves the liquidity problem for investors, helping them manage and limit liquidity risks. Accordingly, investors can easily sell when they need to recover capital and interest at any time.

Box on the right: Mr. Phan Van Manh, an investor in Ho Chi Minh City, shared: “I invested in 3-year bonds with an interest rate of 9% per annum at TCBS. After holding the bond for 1 year, I decided to sell it on iConnect with an interest rate of 8.5% per annum. This way, my total profit is up to 10% per annum, including 9% for holding the bond in the first year and 1% (corresponding to the remaining 2 years) for selling it on iConnect.”

In 2023, nearly 29,000 customers sold bonds on iConnect with a profit rate higher than when they bought them. Among them, nearly 2,000 customers enjoyed a bond interest rate difference of over 3%.

Giao dịch trên Hệ thống thỏa thuận trái phiếu iConnect