On February 5th, Pomina Steel Joint Stock Company (code POM – HOSE exchange) issued a press release in response to the notification from the Ho Chi Minh City Stock Exchange (HoSE) regarding the possibility of delisting POM shares.

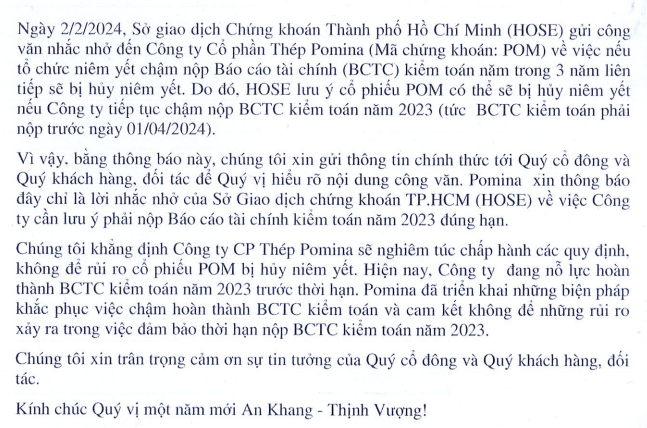

Specifically, on February 2nd, HoSE sent a reminder letter to Pomina Steel regarding the potential delisting of POM shares if the company fails to submit the audited financial statements for 2023 on time.

It should be noted that POM had already missed the deadline for submitting the financial statements for two consecutive years, 2021 and 2022. If the company fails to submit the audited financial statements for three consecutive years, there is a possibility of delisting.

In response to this issue, Pomina Steel stated that this is just a reminder from HoSE to submit the audited financial statements for 2023 on time (before April 1st).

Source: POM Press Release

The company stated that it will strictly comply with the regulations and prevent the delisting of POM shares. Currently, the company is making efforts to complete the audited financial statements for 2023 before the deadline. Pomina Steel has implemented measures to address the delay in submitting the audited financial statements and is committed to ensuring the timely submission of the financial statements for 2023.

Immediately after receiving the warning from HoSE about the risk of compulsory delisting, POM shares declined by 6.94% in the trading session on February 5th, to 4,830 VND per share. In the opening session on February 6th, POM shares continued to decline by 6.83%, to 4,500 VND per share, with over 200,000 shares being sold.

Pomina Steel continues to face a crisis in its business performance in 2023. In the fourth quarter of 2023, Pomina Steel recorded a revenue of 333 billion VND, a decrease of 81% compared to the same period last year. The after-tax profit of the parent company recorded a loss of 313 billion VND, compared to a loss of 459.4 billion VND in the same period last year.

In the fourth quarter of 2023, the gross profit was only 22 billion VND, while the financial costs amounted to over 180 billion VND. Additionally, other operating activities resulted in a loss of over 148 billion VND, which are the two main reasons for the loss in the fourth quarter.

Pomina Steel stated that Pomina 3 Steel Plant is still inactive but has to bear many costs, including interest expenses. The company is currently restructuring and has found new investors. All procedures are awaiting approval at the Shareholders’ General Meeting scheduled to be held on March 15th, 2024. After the Shareholders’ General Meeting, the company will put Pomina 3 Steel Plant back into operation, expected in the second quarter of 2024.

In addition, Pomina Steel also mentioned that the real estate market is still frozen, steel consumption and revenue have declined significantly, while fixed costs and high interest expenses have resulted in large losses.

Accumulated from the beginning of 2023, Pomina Steel recorded a revenue of 3,281 billion VND, a decrease of 75% compared to the same period last year, and the after-tax profit of its parent company recorded an additional loss of 960 billion VND, compared to a loss of 1,166.9 billion VND in the same period last year.

It is known that in 2023, Pomina Steel set a revenue target of 9,000 billion VND and an after-tax profit target of a 150 billion VND loss. Thus, the loss in 2023 has exceeded the planned loss of 150 billion VND.

As of December 31st, 2023, Pomina Steel’s accumulated loss was 1,271 billion VND, accounting for 45% of the equity.

The total assets of Pomina Steel decreased by 5.7% compared to the beginning of the year, reaching 10,404.3 billion VND. Among them, the main assets were long-term unfinished assets, totaling 5,808 billion VND, accounting for 56% of the total assets; short-term receivables were recorded at 1,603 billion VND.

Regarding the source of capital, the total short-term and long-term borrowings increased by 1.5% compared to the beginning of the year, reaching 6,312 billion VND and equal to 396% of the equity.

It is worth noting that as of December 31st, 2023, the total short-term debt was 7,963.6 billion VND and the short-term assets were recorded at 3,099 billion VND. Thus, the short-term debt exceeds the short-term assets by 4,864.3 billion VND.