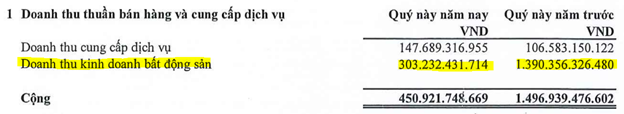

CTCP Tập đoàn C.E.O (HNX: CEO) has announced its consolidated financial statements for the fourth quarter of 2023 with a net revenue of nearly 451 billion VND, a 70% decrease compared to the same period last year. The majority of the revenue decline in this quarter is attributed to a significant decrease of 78% in real estate business income, amounting to just over 303 billion VND.

|

The revenue structure of CEO in the fourth quarter of 2023

Source: CEO

|

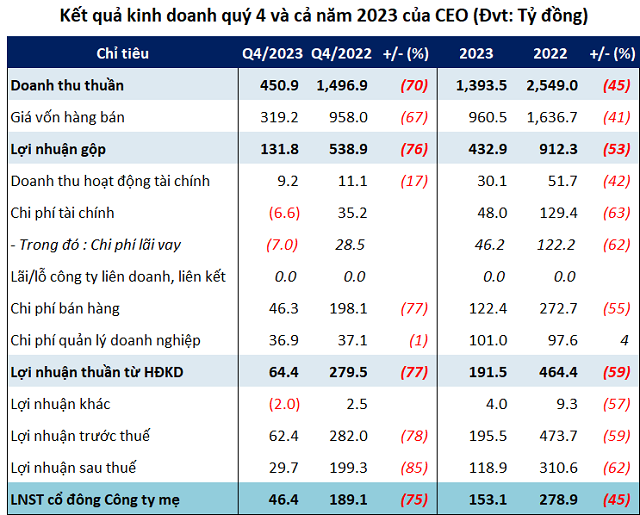

Although almost all expenses during the period of the Company have decreased, it is not significant enough for CEO to create a miracle. As a result, CEO reported a net profit of over 46 billion VND, a 75% decrease compared to the same period last year.

Source: VietstockFinance

|

For the whole year of 2023, CEO recorded a net revenue of over 1,393 billion VND and a net profit of 153 billion VND, both decreasing by 45% compared to 2022.

Compared to the plan, the Company achieved 48% of the total revenue target and 38% of the net profit after tax target for the whole year.

CEO stated that the year 2023 witnessed a difficult economic situation both domestically and globally. The overall business community and businesses in the real estate and tourism sectors in particular suffered negative impacts due to low market confidence, poor product liquidity, legal and administrative obstacles, slow recovery of tourism, low number of international tourists, high input costs, etc. These are the main reasons why the business performance of CEO did not meet the approved plan at the Shareholders’ General Meeting.

Total assets increased by 33%

The total assets of CEO as of December 31, 2023 reached over 9,421 billion VND, a 33% increase compared to the beginning of the year. It is worth noting that cash and cash equivalents nearly tripled to over 1,163 billion VND, mostly in bank deposits (1,148 billion VND).

Other major items include short-term financial investment of over 1,532 billion VND, 4 times higher than the beginning of the year, and short-term receivables of 1,520 billion VND, a 22% increase. Meanwhile, inventory amounted to 1,272 billion VND, a 13% decrease, mostly consisting of unfinished production costs at projects.

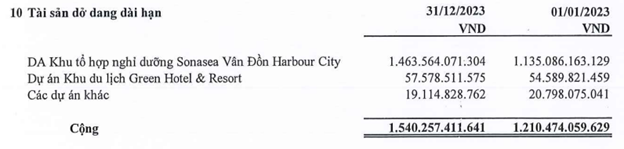

Long-term unfinished construction costs amounted to 1,540 billion VND, a 27% increase, mainly at Sonasea Van Don Harbour City resort complex project (over 1,463 billion VND) and Green Hotel & Resort tourism area (over 57 billion VND).

Source: CEO

|

On the other side of the balance sheet, CEO still has debts totaling over 3,186 billion VND, a 5% decrease compared to the beginning of the year. The total financial borrowings, both short-term and long-term, amount to only 822 billion VND, a 29% decrease compared to the beginning of the year, accounting for 26% of the total borrowings and 9% of the Company’s capital sources.