CTCP B.C.H (UPCoM: BCA) has announced to the State Securities Commission and the Hanoi Stock Exchange (HNX) about the stock price of BCA increasing to the ceiling price for 5 consecutive sessions from 31/01 – 06/02/2024.

According to the company, the increase in the stock price of BCA in the recent period “completely depends on the market supply and demand and investor sentiment. The company does not have any direct impact on the trading price in the market.”

The stock price of BCA started to heat up on 31/01 at the price of 5,900 VND/share, and after 5 consecutive limit-up sessions, the BCA price closed on 06/02 at 11,500 VND/share, equivalent to a 95% increase during that period.

As of the noon session on 07/02, the BCA stock continued to increase by 7% compared to the reference price, reaching 12,300 VND/share, a 109% increase during 6 trading sessions. The liquidity also increased significantly in the 5 consecutive limit-up sessions, with an average of over 311 thousand shares/session.

| BCA stock price movement since the beginning of 2024 |

The BCA stock price increased after the company’s leaders continuously had the “stock accumulation” strategy, but they could not successfully execute it as desired. Specifically, Mr. Pham Ba Phu – Chairman of the Board of Directors registered to buy 3 million shares, but could only successfully trade 750,000 shares from 04/12/2023 – 03/01/2024, increasing his ownership percentage of BCA to 9.08%, equivalent to over 1.7 million shares.

Following the Chairman, Mr. Dang Ngoc Hung – CEO cum Board Member also registered to buy 1.2 million shares during the period from 13/12/2023 – 05/01/2024 but could not complete any share transactions. Mr. Hung said that his personal financial plan had changed. After the unsuccessful transaction, he still owns 1.13 million shares of BCA (5.93% ownership percentage).

Record net profit in Q4, where did it come from?

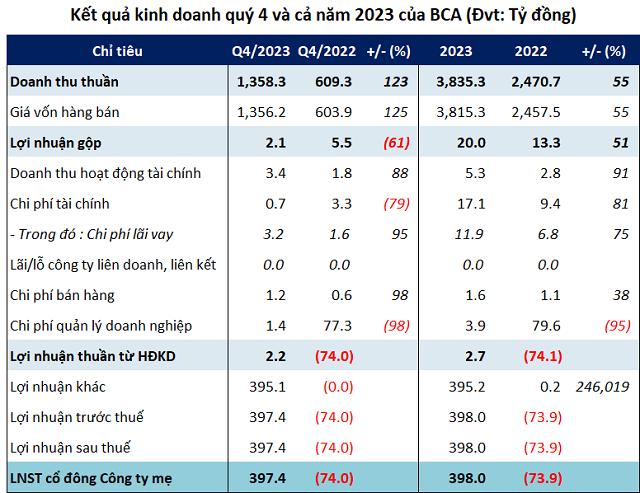

Recently, BCA announced the consolidated financial statements for Q4/2023 with revenue of over 1,358 billion VND, an increase of 123% compared to the same period last year. Due to the high cost price, after deduction, gross profit was only over 2 billion VND, a decrease of 61%. The gross profit margin also decreased from 1% in the same period to 0.2%.

However, BCA still achieved a net profit of over 397 billion VND, compared to a loss of 74 billion VND in the same period. This is also the highest-profit quarter since its listing on UPCoM in 2021 and also the quarter that contributed to the company’s profit for the whole year.

Source: VietstockFinance

|

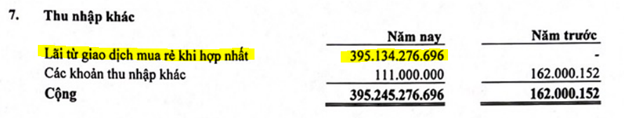

According to BCA‘s explanation, during the period, the company implemented the acquisition of shares to own subsidiaries. Therefore, the consolidated financial statements for Q4/2023 recorded other income from the gain from a bargain purchase when combining an amount of 395 billion VND.

Source: BCA

|

By the end of 2023, the company recorded revenue of over 3,853 billion VND, an increase of 55%; while net profit reached 398 billion VND, compared to a loss of 74 billion VND in the same period; Q4 alone contributed to 99% of the yearly profit.

This is also the year with the record profit of the company since its listing and the first year of consolidated financial statements for the business. Accordingly, the merged entity is Tuyen Quang Iron and Steel Co., Ltd.

Source: BCA

|

It is worth mentioning that despite the large revenue and profit in the period, BCA only has a total of 12 employees, an increase of 1 employee compared to the beginning of the year.

|

Tuyen Quang Iron and Steel Co., Ltd. was formerly Hang Hung Minerals Co., Ltd. established on January 28, 2005, headquartered in Tuyen Quang City with Mr. Ke Liang Feng (Chinese nationality) as the legal representative cum Chairman of the company. In August 2016, the company changed to Tuyen Quang Iron and Steel Co., Ltd. as today, and at the same time increased the charter capital to over 556 billion VND, all of which is foreign capital. After several changes and updates until December 2023, Tuyen Quang Iron and Steel has a charter capital of over 2,167 billion VND with BCA as the company’s owner, and Mr. Nguyen Duy Luan holds the position of CEO cum legal representative of the company. As of June 30, 2023, Mr. Luan owns over 1.68 million shares, equivalent to 8.78% ownership percentage of BCA. |

Total assets increased by 6.6 times since the beginning of the year

With the first year of consolidated financial statements, almost all of BCA‘s capital has expanded on the balance sheet. By the end of 2023, the total assets of BCA reached 4,013 billion VND, an increase of 6.6 times compared to the beginning of the year. The cash amount also increased significantly to 1,038 billion VND, up 924 times, with the majority being non-term deposits (over 1,034 billion VND).

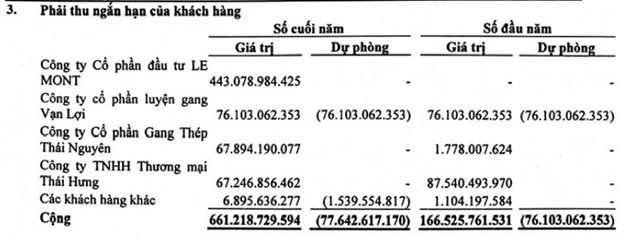

Short-term accounts receivable from customers increased to nearly 831 billion VND, up 8.4 times compared to the beginning of the year, due to the emergence of short-term accounts receivable after the merger with Tuyen Quang Iron and Steel. Inventory was at the level of 521 billion VND, up 2.6 times from the beginning of the period.

Source: BCA

|

On the other side of the balance sheet, BCA‘s total liabilities also increased to nearly 3,478 billion VND, up 7.5 times compared to the beginning of the year. In which, financial borrowings both short-term and long-term reached over 1,895 billion VND, up 12.7 times, accounting for 55% of the total borrowings and 47% of the company’s capital.

| BCA’s capital sources from 2019 – 2023 |