Ms. Linh (34 years old) receives “a million whys” from Trang (13 years old) about the “red envelope savings plan” every Lunar New Year. The upcoming Lunar New Year of the Goat is no exception. Many parents will also need to “face” questions from their children about finances – money, during the Lunar New Year and throughout their growing up process.

With the desire to accompany parents and children on the journey of financial management, TPBank introduces a product called “Dear Kids Account” on the TPBank App. This is a meaningful gift that TPBank provides to parents and children on the threshold of the Lunar New Year of the Goat.

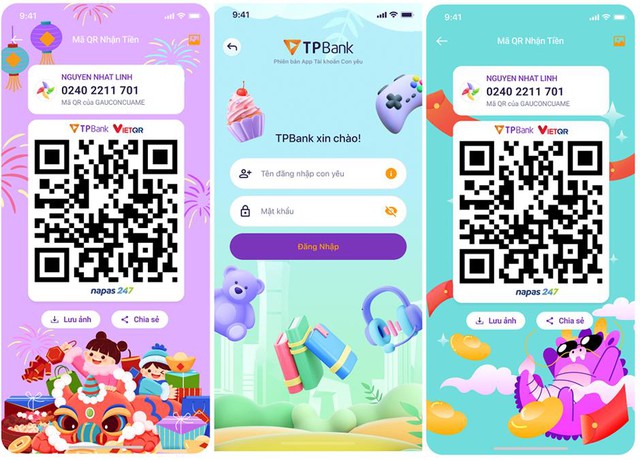

With just a few steps on the TPBank App, parents can open a Dear Kids account with their child’s nickname. After successfully opening the account, parents can quickly view the account balance information directly on the app’s home screen. Parents can also access a separate management area on the app to experience features designed specifically for their children, such as savings, managing the username and password of the “Dear Kids Account”.

The great thing about the Dear Kids Account is that it provides a “quick view” version with a vibrant interface for parents and children to conveniently track their money anytime, anywhere, on a different mobile device. Parents and children can receive balance notifications, and manage the account anytime with just a phone with the TPBank App installed. In the future, the Dear Kids Account will have more attractive features for parents to set up for their children.

To double the joy for children, TPBank also provides a QR code feature for instant transfers to the “red envelope wallet” during the Lunar New Year. Now, children’s own little piggy bank has been digitized on the digital banking app.

Children will be thrilled to receive money in their accounts like adults. Both parents and children will receive “ting ting” notifications when there are balance changes and can “check” the red envelope money at the same time as their parents.

For adults, giving red envelopes via QR codes is also a “lifesaver” whenever they don’t have new money ready or forget to bring red envelopes. Relatives from afar can also give “spirit red envelopes” to children by transferring money to the Dear Kids Account, along with warm wishes.

Along with countless lucky and well-wishing words, if parents guide their children to use and help them learn more about financial management, Lunar New Year red envelopes will not only be a material gift from adults, but they will also become more meaningful.

After the Lunar New Year, instead of worrying about how the red envelope money their parents “keep for them” will be, children can plan to save right on the TPBank App, and the savings accounts can be named clearly for easier management. Parents and children can save additional amounts into their savings accounts on the TPBank App. Children will have a visual view of their own money and learn how to plan their personal finances scientifically.

As society develops, the awareness of financial management for parents and children is also changing. Children will gradually have a sooner awareness of their own money and will also be exposed to new payment technology applications other than cash. Parents with a modern 4.0 mindset often seek ways to help their children learn how to manage their finances from an early age, spend money properly, and save for themselves. Financial management is a skill that is essential for everyone, so helping children get used to it early will equip them with a proactive, independent, and flexible mindset.

With a continuous orientation, putting customers at the center and developing feature services based on the specific needs of each customer segment, TPBank demonstrates its understanding of customers – parents through the “Dear Kids Account” product. TPBank will accompany parents with their children on the journey of learning how to manage their finances.

The “Dear Kids Account” product also embodies TPBank’s philosophy of technology for the human soul, with the desire to bring customers and society a better and more convenient life, contributing to creating a modern, sustainable digital society and continuing with future generations.

From now until February 29, 2024, TPBank offers its customers the opportunity to pick the biggest fortune to welcome the new year 2024, starting with the program “Soaring Dragon”, having the “Look Luck” game on the TPBank App & Prosperous red envelopes at Branches/Transactional Offices. Customers who open a Dear Kids Account on the TPBank App will receive loyalty points in their accounts as well as have a chance to win 9999 gold and lucky red envelopes worth up to 8,888,888 VND.

For more details, visit: https://tpb.vn/website-game-tet-2024

In addition to red envelopes via QR codes and the Dear Kids Account, TPBank offers many interesting and diverse red envelope methods on the TPBank App. Customers can simultaneously send warm Tet wishes through beautiful virtual cards on ChatPay along with red envelope money as a special New Year gift to their relatives, friends, and partners.

An extraordinary thing is that customers can send red envelopes to up to 50 people in their contact list at once with just one simple transaction on ChatPay.

Now, TPBank customers will have a different and convenient New Year red envelope experience for the Lunar New Year 2024.