Truong Ngoc Phuong reports the change of ownership of the group of individual shareholders of Hoa Sen Group (HSG-HOSE).

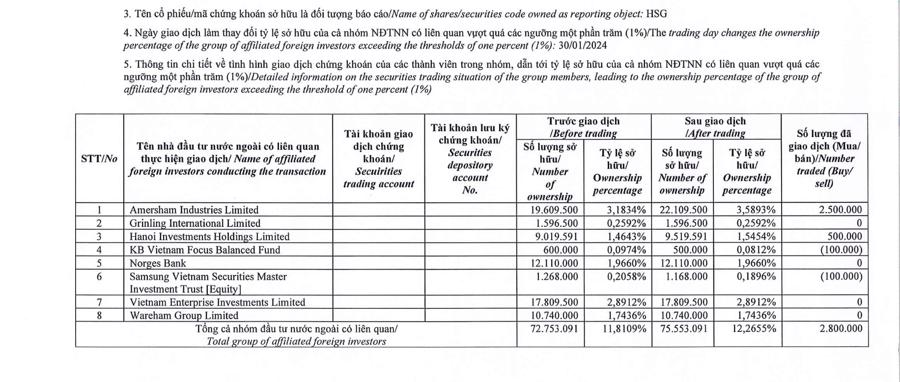

Accordingly, the fund group under Dragon Capital reported buying an additional 2.8 million HSG shares. After this transaction, the foreign fund’s ownership increased from 11.81% to 12.27% of the charter capital at HSG, equivalent to 75.55 million shares. The transaction was conducted on January 30.

Among them, the member funds carried out the transactions as follows: Amersham Industries Limited Fund purchased 2.5 million shares; Hanoi Investments Holdings Limited Fund purchased 500,000 shares; KB Vietnam Focus Balanced Fund sold 100,000 shares; and Samsung Vietnam Securities Master Investment Trust (Equity) Fund sold 100,000 HSG shares.

Recently on January 26, a member fund of the Dragon Capital group, Amersham Industries Limited, bought 3 million HSG shares.

Previously, in March 2023, this group officially became a major shareholder at HSG after the two member funds purchased 1.1 million shares.

In the opposite direction, Mr. Tran Ngoc Chu, Deputy Chairman of the Standing Board of Directors – Permanent Registrar, registered to sell 1.5 million HSG shares to reduce ownership from 1,781,147 shares, accounting for 0.29% of the charter capital, to 281,147 shares, accounting for 0.046% of the charter capital. The transaction is expected to be carried out from February 1 to March 1, 2024.

Previously, Mr. Vu Van Thanh, Deputy General Director – Permanent Duty, registered to sell 800,000 HSG shares to reduce ownership from 806,202 shares, accounting for 0.13% of the charter capital, to 6,202 shares, accounting for 0.001% of the charter capital. The transaction is expected to be carried out from January 29 to February 27.

Regarding HSG’s recent business results, the consolidated financial report for the first quarter of the fiscal year (FY) 2023-2024 (from October 1, 2023, to December 31, 2023) has also been announced.

Accordingly, in the first quarter of FY 2023-2024, the consolidated revenue reached VND 9,073 billion, and the consolidated after-tax profit reached VND 103 billion, which is more positive compared to the loss of VND 680 billion in the same period of the previous fiscal year.

According to the explanation from HSG, the consolidated profit reached VND 103 billion, an increase of VND 784 billion compared to the same period last year, due to the increase in the company’s gross profit and the decrease in financial expenses, with interest expenses decreasing by VND 23 billion and exchange rate differences decreasing by VND 41 billion compared to the same period last year.

In the market, at the end of the trading session on February 5, the HSG stock price slightly increased to VND 23,100/share, an increase of over 64% in the past year.