Services

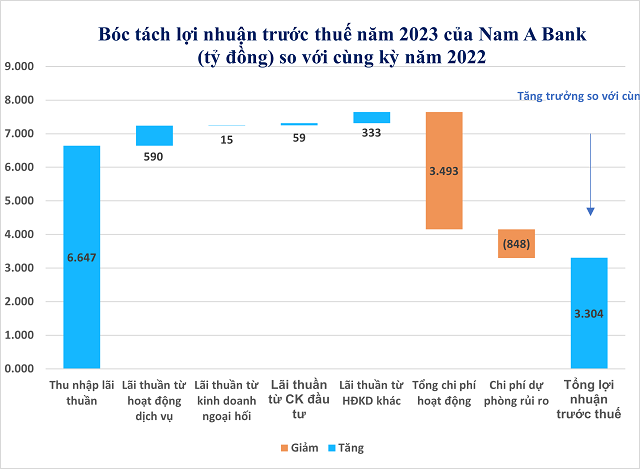

Non-interest income is a highlight in NAB’s profit growth structure for 2023.

(Source: NAB)

|

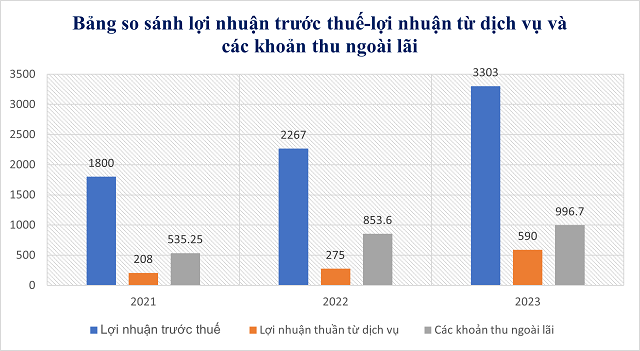

In 2023, NAB’s non-interest income increased nearly 1,000 billion VND, accounting for nearly 32% of pre-tax profit. Good control of operating costs and the effectiveness of non-interest income areas are notable points in Nam A Bank’s business performance report in 2023.

Customers transacting at Nam A Bank.

|

Specifically, the income from service activities in the bank’s period reached 590 billion VND (an increase of 114.6%). Non-interest income reached 996.7 billion VND, contributing significantly to the strong growth rate of the bank in 2023. For the first time, Nam A Bank achieved a profit of over 1,000 billion VND in a quarter, and the annual profit exceeded 3,000 billion VND.

This positive growth result comes from Nam A Bank’s continuous expansion of its operations, expanding its customer base in terms of both quality and quantity through a strong digital banking platform to diversify and meet customer needs for products and services.

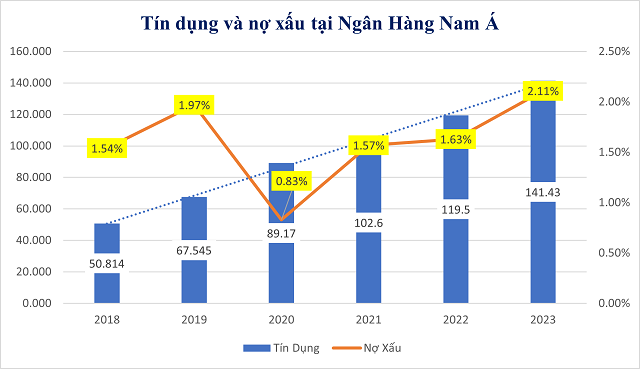

By the end of 2023, the bank’s total assets reached over 210,000 billion VND, an increase of 18.2% compared to the same period. Customer loans grew by 18.3%, reaching a balance of over 141,400 billion VND. Customer deposits increased by 16.3%, reaching over 145,400 billion VND, mainly focused on term deposits.

(Source: NAB)

|

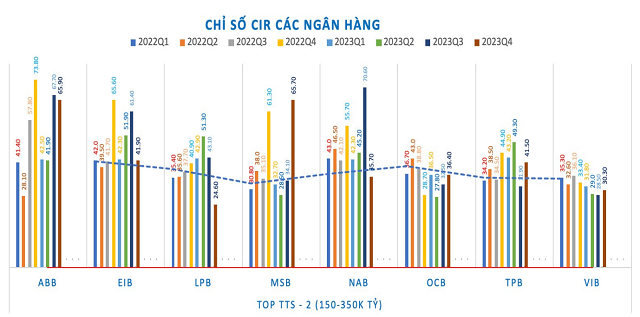

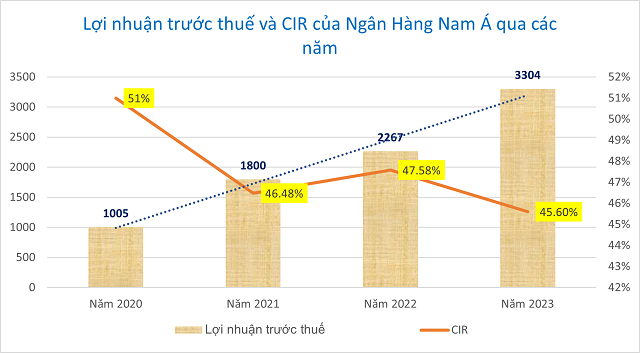

Significant improvement in CIR in 2023

The Cost to Income Ratio (CIR) reflects the percentage of a bank’s operating costs compared to its total revenue, thereby indicating the efficiency of the bank’s operations.

The Cost/Income Ratio (CIR) at NAB in Q4 2023 has shown significant improvement, with the Q4 CIR below 40%, lower than the average CIR of 7 banks of the same scale in terms of total assets (total assets of 150 – 350 trillion VND).

(Source: Financial Reports of Banks)

|

From 2020, Nam A Bank has strongly transformed and expanded its operations in various provinces and cities nationwide. The bank now has nearly 250 business points nationwide, including nearly 150 traditional business points (branches, transaction offices) and 100 ONEBANK points. Although operating costs have increased, the CIR has gradually improved over the years.

ONEBANK currently has 100 points nationwide.

|

The strong digital transformation in recent years has helped Nam A Bank operate more efficiently, streamline processes, and increase labor productivity. In fact, despite the challenging business environment, Nam A Bank has focused more on ensuring safety indicators, asset quality, and optimizing operations.

(Source: NAB)

|

Effective and secure risk management

(Source: NAB)

|

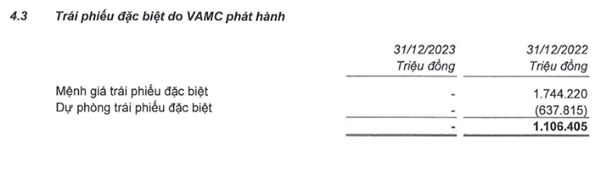

Along with the general difficulties of the economy, the Non-performing loans (NPL) of the bank in 2023 were at 2,989 billion VND, corresponding to a NPL ratio of 2.1%. However, compared to Q3, the NPL ratio and amount of Nam A Bank have both decreased significantly. The highlight of Q4 2023 is that the Bank has completely cleared the bad debts at VAMC.

By the end of Q4, Nam A Bank no longer held special bonds issued by VAMC. Previously, at the end of Q3, the bank still had 1,286 billion VND nominal value of special bonds issued by VAMC. The proactive early settlement of VAMC’s special bonds is expected to create a solid foundation for Nam A Bank’s business operations in the coming years.

(Source: Financial Statements of Nam A Bank)

|

Significant improvement in CAR in 2023

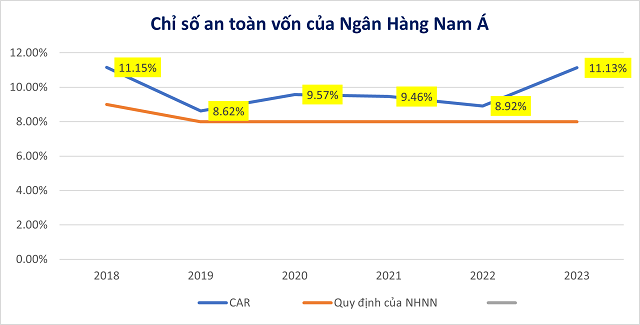

The Capital Adequacy Ratio (CAR) is one of the important indicators in evaluating the safety and risk management activities of banks. Therefore, the commercial banking system is increasingly moving towards international standards as a prerequisite for ensuring the minimization of systemic risks in banks.

(Source: NAB)

|

Nam A Bank’s CAR has significantly improved in 2023 as the bank gradually moves towards Basel III standards and builds a strong capital buffer for future credit growth. In 2023, the bank further consolidated the most advanced components of Basel as well as international financial reporting standards. Specifically, Nam A Bank announced the successful implementation of credit risk according to the Basel II – FIRB internal credit rating method and continued to complete the development of methodologies and tools according to Basel III – Reforms. Nam A Bank and Ernst & Young Vietnam have organized a handover ceremony for the IFRS international financial reporting standards project…

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)