On February 6th, Hoang Anh Gia Lai Joint Stock Company (HAGL, stock code: HAG) announced information regarding the principal and interest payments of HAGLBOND16.26 bond series issued on December 30th, 2016.

Accordingly, on February 2nd, the company made a payment of VND 35.75 trillion as principal. The next payment is scheduled for the first quarter of 2024. Prior to that, on January 15th, HAGL also made a payment of VND 8.45 trillion as principal for this bond series.

Hoang Anh Gia Lai has just made a principal payment of VND 35.75 trillion for the HAGLBOND16.26 bond series.

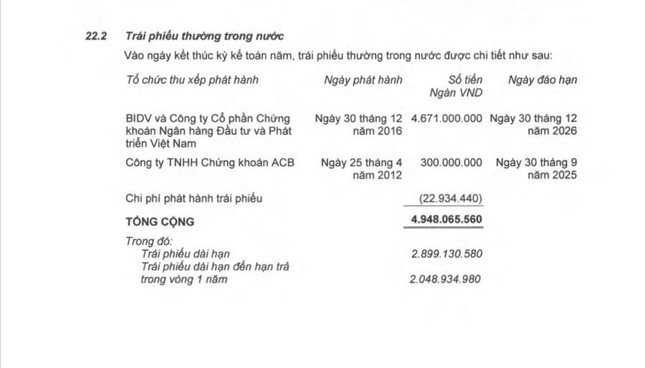

The HAGLBOND16.26 bond series has a total issuance value of VND 6,546 trillion with a maturity of 10 years, due on December 30th, 2026. The bondholders are BIDV.

HAGL issued this bond series to raise capital for investment projects and to restructure the company’s debts. The collateral for this bond series includes nearly 30,000 hectares of leased land in Laos, Cambodia, and nearly 45 million HAG shares owned by Mr. Doan Nguyen Duc (Chairman Duc) – Chairman of HAG’s Board of Directors.

Regarding this bond series, according to HAGL, the reason for the late payment is the lack of funds from the debt repayment of Hoang Anh Gia Lai International Agricultural Company (stock code: HNG) – which has agreed on a three-party debt repayment plan and has not yet liquidated certain non-profitable assets of the company.

The HAGLBOND16.26 bond series is shown on HAG’s financial report for the fourth quarter of 2023.

In the fourth quarter of 2023, HAG recorded net revenue of VND 1,898 trillion and net profit of VND 1,007 trillion, an increase of 16% and 323% respectively compared to the same period. The significant increase in net profit was mainly due to significant financial activities in the fourth quarter. In particular, financial revenue reached VND 295 billion – 3.6 times higher than the same period due to the company’s liquidation of certain investments.

In addition, the negative financial cost was VND 996 billion, mainly due to negative interest expense of VND 952 billion. According to HAG, this cost fluctuated significantly compared to the same period, as it was exempted from interest expenses by the Export-Import Commercial Joint Stock Bank (stock code: EIB).

As a result, HAG recorded a net profit of VND 1,709 trillion in 2023, more than 1.5 times higher than the previous year. As of December 31st, 2023, the company’s total assets increased by VND 1,729 billion compared to the beginning of the year, a 9% increase to VND 21,528 billion. It is worth noting that HAG increased its investment in fixed assets by VND 1,577 billion, reaching VND 5,399 billion.

In connection with the bond repayment plan, as part of the plan to use the expected VND 1,300 billion from the sale of 130 million shares at a price of VND 10,000 per share, HAG stated that it will allocate VND 346.7 billion to prepay the entire principal and interest of the HAG2012.300 bonds issued by the company on June 18th, 2012 at ACB Securities Company.