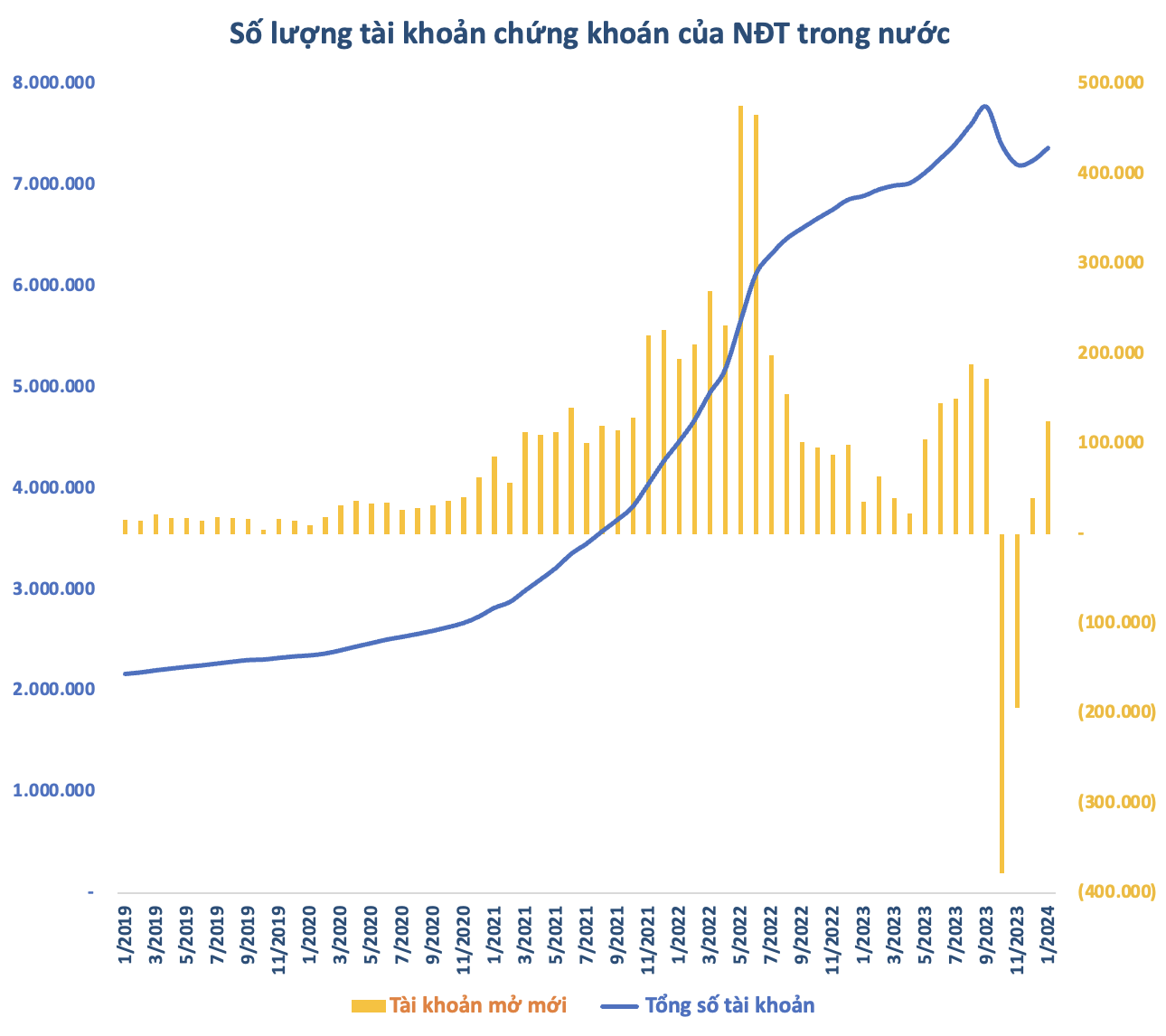

According to data from the Vietnam Securities Depository Center (VSD), the number of domestic investor accounts increased by 125,169 accounts in January 2024, more than three times the number in the previous month. This is the highest number of new securities accounts opened in the past four months.

In terms of structure, the increase in the number of securities accounts in the first month of 2024 mainly came from individual investors with 125,048 accounts. Meanwhile, the accounts of institutional investors only increased by 121 accounts.

After a period of decline due to review and purification activities of regulatory agencies on securities market participants’ data, the number of domestic investor securities accounts has increased for the past two consecutive months. As of the end of January 2024, Vietnam has more than 7.35 million individual securities accounts, equivalent to about 7% of the population.

According to the Securities Market Development Strategy (SMD) approved until 2030, Vietnam aims to achieve the milestone of 9 million securities trading accounts of investors in the stock market by 2025 and 11 million accounts by 2030. Specifically, the government requires a focus on developing institutional investors, professional investors, and attracting the participation of foreign investors.

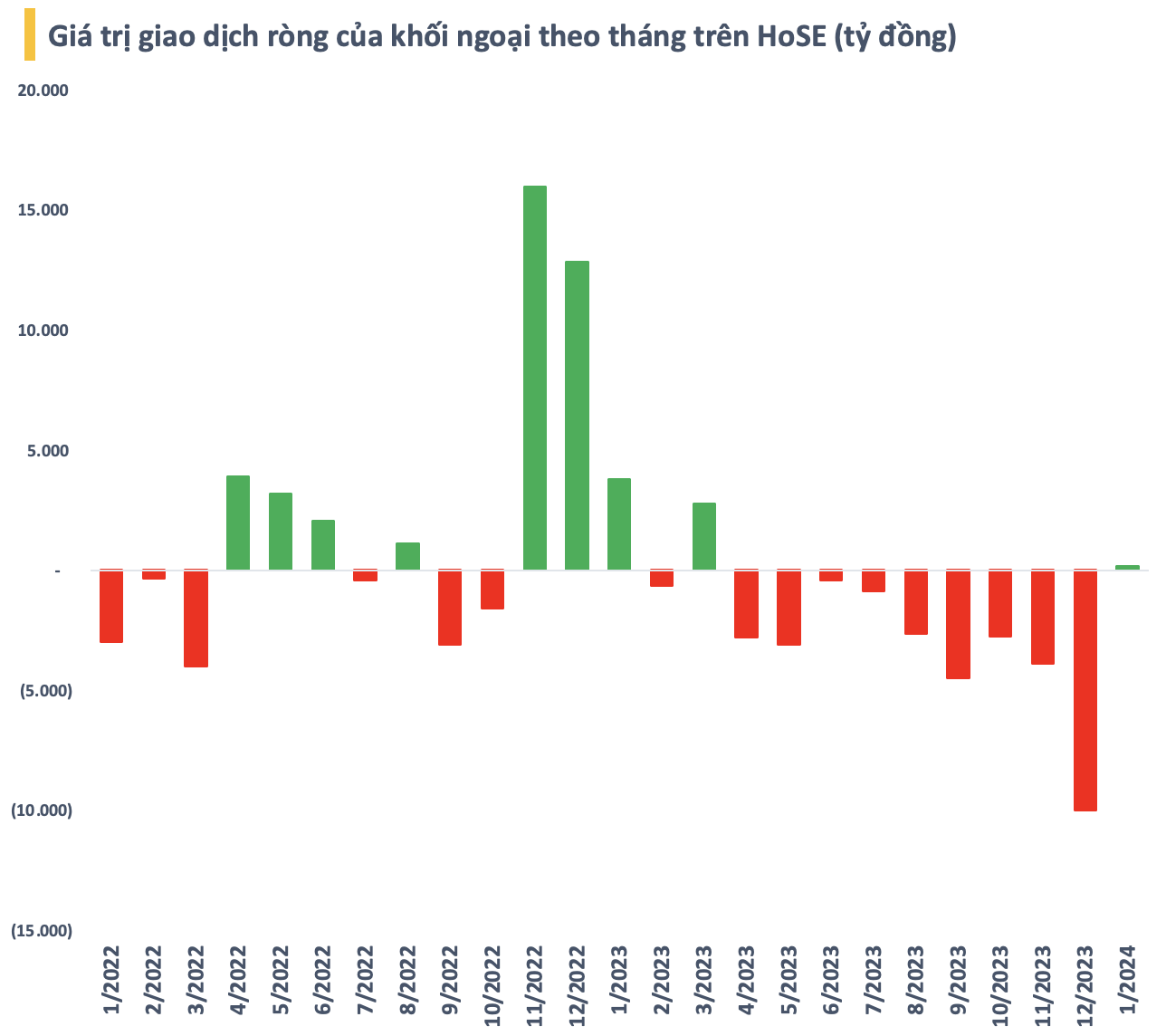

The increase in the number of securities accounts comes in the context of a relatively positive market situation recently. In January 2024, VN-Index increased by 3.04%, marking the third consecutive month of growth. The upward trend is mainly supported by domestic capital flow and the reversal of foreign capital. In January 2024, foreign investors net purchased more than VND 125 billion on HoSE.