|

The Importance of Remittances and Unexpected Downsides

Remittances in recent decades have increased rapidly and have played an important role in low- and middle-income countries (such as Vietnam, which is classified as a low-middle-income country according to the World Bank). According to World Bank data, remittances (as a percentage of GDP) received in low- and middle-income countries account for more than 1.5% of GDP, which is higher than the net foreign direct investment (1.4% of GDP).

Economic studies have identified both positive and negative impacts of remittances.

Remittances are seen as a source of external finance for recipient countries (especially low-income and developing countries), which helps to reduce barriers to capital for the economy, stimulating investment and consumption.

However, remittances also have some negative impacts. Particularly, the “Dutch disease” phenomenon can occur, where remittances may lead to a decrease in the labor supply in the market (as recipients of remittances may reduce their demand for employment), while domestic consumption for non-exported goods increases. Consequently, labor markets experience a shift in labor from export production to non-export production, resulting in reduced competitiveness of export goods due to increased labor costs. In addition, remittances (considered as capital inflows) can appreciate the currency (real exchange rate), thereby reducing the competitiveness of export goods.

However, previous studies have not reached a definitive conclusion on the positive or negative impact of remittances on the economy. The impact of remittances seems to vary depending on the specific characteristics of each country’s economy, the direction of remittance flows, and the absorptive capacity of the economy.

|

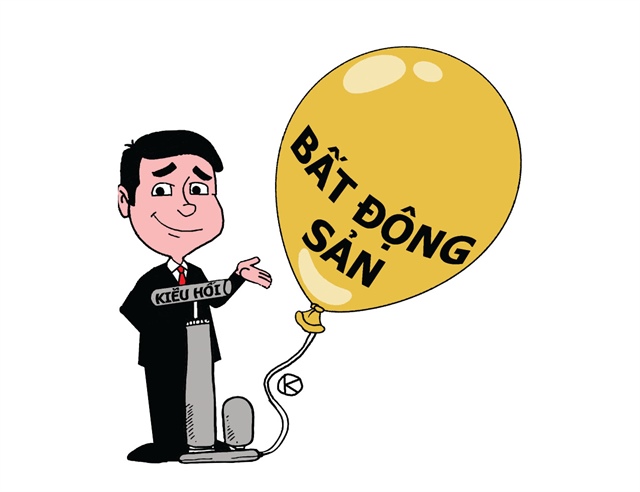

One concerning issue in the case of Vietnam is that remittances do not seem to go into production but are mainly used for real estate investment, debt repayment, saving, and durable goods consumption. If this trend continues for a long time, it may not only pose the existing negative impacts of the “Dutch disease” but also other issues such as overheating of the real estate market. |

In the case of Vietnam, some studies have found certain positive impacts of remittances, such as increasing household assets and economic growth, while others have found more negative results. One of the key findings is how remittances flow into the economy. One concerning issue in the case of Vietnam is that remittances do not seem to go into production but are mainly used for real estate investment, debt repayment, saving, and durable goods consumption. If this trend continues for a long time, it may not only pose the existing negative impacts of the “Dutch disease” but also other issues such as overheating of the real estate market. Therefore, this is a research result that policymakers need to pay attention to and develop appropriate policies.

Some suggestions

In terms of macroeconomic policy, studies have shown that there cannot be a one-size-fits-all policy to address all issues. The writer would like to propose some open ideas for consideration.

First, policymakers, especially the State Bank of Vietnam, need to closely monitor the fluctuations of remittances and their relationship with the real exchange rate of the US dollar/Vietnamese dong. The impact of remittances on the real exchange rate is a possibility and can reduce the competitiveness of Vietnamese exports. Therefore, the State Bank of Vietnam needs to maintain a flexible monetary policy to prevent unexpected or prolonged changes in the US dollar/Vietnamese dong exchange rate.

In terms of government and local authorities, organizations such as the International Monetary Fund (IMF) encourage countries receiving a large amount of remittances to consider investing in public infrastructure and institutions.

In terms of public infrastructure, investments should focus on critical infrastructure to facilitate economic activities, especially new economic activities through startups. Reducing costs such as transportation costs is essential to direct remittances towards production rather than consumption.

In terms of institutions, it is necessary to recognize that remittances should not be taxed because they can help reduce poverty and support low-income households. However, institutional improvements, especially business conditions, are needed to enable remittance recipients to use this money for productive business activities.

Education investment should also be considered to not only target the domestic workforce but also help recipients of remittances or labor migrants returning. Providing appropriate knowledge and skills for them to optimize the use of this capital for productive business activities is necessary. In addition, improving the knowledge and skills of the domestic workforce can indirectly increase the competitiveness of export goods in case they are negatively affected by remittances.

Finally, a policy perspective needs to recognize that remittances can be seen as an important resource for economic development but not as a long-term resource. This can lead to a cycle of relying on remittances for additional income. People will increasingly depend on income from remittances and seek ways to migrate/export labor, resulting in increased dependence.

TS. Nguyen Phuc Canh (Ho Chi Minh City University of Economics)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)