Illustrative photo.

Oil prices rise

Oil prices are rising due to concerns of tension in the Middle East and ongoing conflicts between Russia and Ukraine that could restrict global oil supply.

At the close of February 5, Brent crude oil rose $0.66 or 0.9% to $77.99 per barrel, WTI crude oil rose $0.50 or 0.7% to $72.78 per barrel.

Traders are closely monitoring the situation in the Middle East, where ceasefire negotiations between Israel and Hamas seem unlikely to be implemented, indicating that tension in the oil-producing region will persist.

The US is also continuing its campaign against the Houthis in Yemen, with forces attacking a cargo ship, disrupting global oil trade routes, albeit with little impact on the supply.

In Russia, two Ukrainian drones attacked the country’s largest oil refinery in the southern part of the country on February 3.

Oil prices rose in this session after falling 7% the previous week due to concerns about China’s weakening economic activity and expectations of a gradual reduction in US interest rates.

The limiting factor in the oil price increase is the recovery of US service sector growth in January, reducing hopes for further interest rate cuts and pushing the USD to its highest level in nearly 3 months against other major currencies.

Gold at its lowest in over a week

Gold prices fell to their lowest level in over a week due to a stronger USD and bond yields rebounding after a strong US employment report and comments from Federal Reserve officials dispelled expectations of an early rate cut.

Spot gold fell 0.6% to $2,027.09 per ounce after hitting its lowest level since January 25 in early trading. April gold futures closed down 0.5% at $2,042.9 per ounce.

However, gold remains above $2,000 as geopolitical tensions in this market can quickly boost safe haven demand.

The USD index rose 0.5% to trade near its highest level in 3 months, making gold more expensive for holders of other currencies, while the 10-year Treasury bond yield rose to its highest level in a week.

Copper falls

Copper prices fell to their lowest level in 2 weeks as the USD strengthened and negative sentiment about China’s demand was reinforced by its struggling real estate sector.

Copper three-month futures on the London Metal Exchange (LME) fell 1.3% to $8,374 per tonne, having earlier fallen to their lowest level since January 23 at $8,357 per tonne.

Copper dropped sharply as the New York market opened as strong services data from the US diminished expectations of a strong interest rate cut by the Federal Reserve, boosting the USD. The strength of the USD makes this silver-colored metal more expensive for buyers in other currencies, reducing demand.

China has implemented a series of policies over the past year to support the real estate sector, which accounts for 1/4 of its GDP, but these policies have little effect in boosting the market.

The copper inventory at the Shanghai Futures Exchange has doubled to 68,777 tonnes since the beginning of January, a seasonal occurrence.

Dalian iron ore falls due to high inventory

Dalian iron ore prices fell amid record-high inventory at Chinese ports and long-lasting concerns about China’s real estate market, while Singapore iron ore rebounded slightly.

The May iron ore contract on the Dalian Commodity Exchange in China closed down 0.63% at 943 CNY ($131.02) per tonne.

The March iron ore contract in Singapore rose 0.33% to $126.7 per tonne, erasing some of the earlier gains.

The conflicting market signals have blurred prospects for demand, with Beijing’s various stimulus efforts and expectations of increased demand after the Lunar New Year holiday supporting prices.

However, pessimism in the context of struggling real estate and stock markets in the world’s second largest economy has limited price increases.

Increased inventories have put pressure on sentiment. Iron ore inventories at 35 ports tracked by the Shanghai Metals Market (SMM) rose 1.32% from the previous week to a total of 126.26 million tonnes by February 2.

Most Chinese steel mills are not interested in buying spot cargoes from the market, as they have already completed most of their supplementary activities in previous weeks.

Steel rebar changed little, hot-rolled coil steel fell 0.1%, wire rod steel changed little, and stainless steel fell 0.37%.

Japanese rubber rises to 3-year high on strong US data

Japanese rubber prices rebounded for the second consecutive day to a three-year high, amid positive US employment data and rising oil prices, while the JPY weakened.

The July rubber contract on the Osaka Exchange closed up 6.4 JPY or 2.26% to 289.1 JPY ($1.95) per kilogram, closing at its highest level since February 26, 2021.

In Shanghai, rubber for delivery in May rose 125 CNY to 13,385 CNY ($1,859.85) per tonne.

US employment growth increased in January and wages increased at their fastest pace in nearly two years.

Coffee falls

March robusta coffee futures closed down $49 or 1.5% at $3,188 per tonne.

Traders said the market continues to be supported by tight supply in Europe, partly due to disruptions in the transportation of coffee from major producers in Asia through the Red Sea.

Vietnamese farmers are refusing to deliver the robusta coffee they have sold, except for renegotiated contracts, after global prices hit their highest level in 28 years.

March Arabica coffee fell 1.3% to $1.895 per pound.

Sugar falls

Raw sugar May futures closed down 0.36 US cent or 1.5% at 23.53 US cents per pound.

Traders said the market is weak as prices do not exceed 24 US cents and the price trend is unclear.

Speculators shifted to long raw sugar positions on the ICE US exchange during the week ending January 30.

White sugar March contract fell 2.1% to $646.7 per tonne.

Soybeans rise

Soybeans on the Chicago Board of Trade rose due to technical trading ahead of a series of key reports on the government’s crop season, after this contract hit its lowest level since December 2020. Soybean prices also rose after the US Department of Agriculture announced that weekly export inspections showed the closest soybean volume reached 1,426,472 tonnes, much higher than analysts’ expectations but lower than the same period last year’s volume.

Corn closed unchanged. Wheat fell for a second consecutive session due to a strong USD.

The most-traded soybean contract on the Chicago Board of Trade closed up 7-3/4 US cents at $11.96-1/4 per bushel. Corn fell 9-1/2 US cents to $5.90-1/4 per bushel while wheat closed unchanged at $4.42-3/4 per bushel.

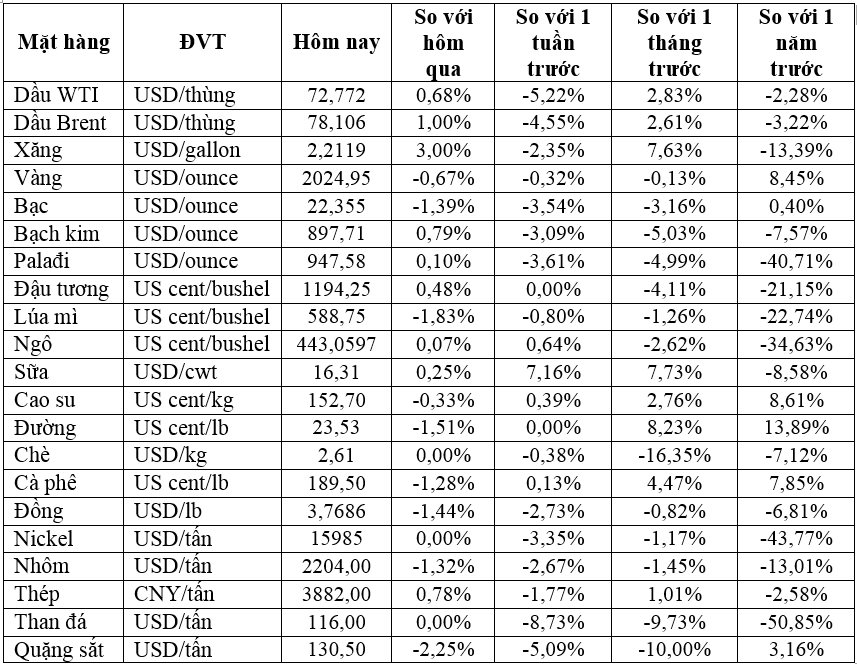

Key commodity prices as of the morning of February 6