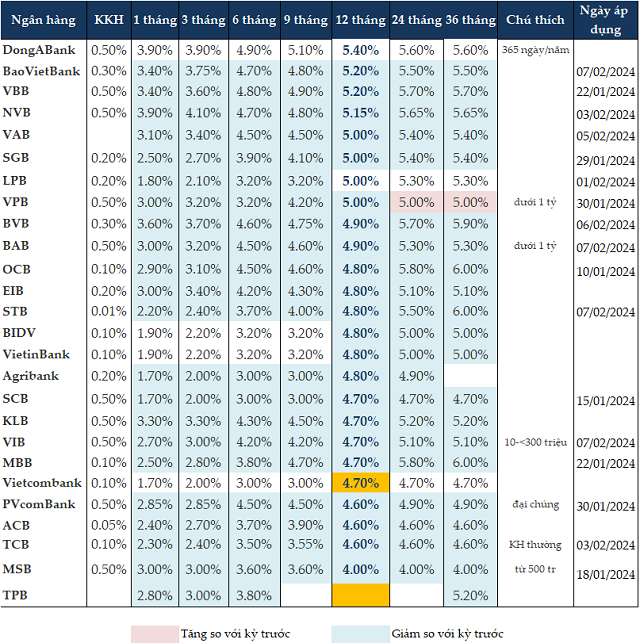

Most banks have reduced their deposit interest rates by 0.1-0.4 percentage points across all terms, in the adjustment period in early February 2024, such as: VBB, NVB, BAB, SGB, LPB, MBB, TCB, MSB…

Vietbank (VBB) has reduced its interest rates for all terms by 0.3-0.4 percentage points since January 22, 2024. The bank has lowered the 1-month term interest rate to 3.4% per year, the 3-month term rate to 3.6% per year, the 9-month term rate to 4.9% per year, and the 12-month term rate to only 5.2% per year.

Starting from February 3, 2024, NVB has reduced its interest rates by 0.2-0.5 percentage points for all terms. The bank has decreased the 1-month term rate to 3.9% per year, the 6-month term rate to 4.7% per year, and the 12-month term rate to only 5.12% per year.

Although LPB’s deposit interest rates for the 1st of February 2024 have only been reduced by 0.2-0.3 percentage points compared to the previous period, the 1-month term rate is now only 1.8% per year, and the 3-month term rate is reduced to 2.1% per year.

BAB has implemented new interest rates since February 7, 2024, lowering all terms by 0.2-0.5 percentage points compared to the most recent adjustment period. Specifically, for deposits under 1 billion VND, BAB applies an interest rate of 3% per year for the 1-month term, 3.2% per year for the 3-month term, 4.5% per year for the 6-month term, and only 4.9% per year for the 12-month term.

On the other hand, VPBank has reduced deposit interest rates for terms of 12 months and below, but increased rates for terms over 12 months. The change, effective from January 30, 2024, has lowered the 1-month term rate to 3% per year, the 3-6 month term rates to 3.2% per year, and applied a rate of 5% per year for terms over 12 months.

In the group of state-owned banks, VietinBank and BIDV have similar interest rates. These two banks continue to reduce interest rates for terms of 12 months and above, applying a rate of 4.8% per year for the 12-month term and 5% per year for terms over 12 months.

For over-the-counter deposits, interest rates for the 1-2 month term are at 2.2% per year, declining to 2.5% per year for the 3-5 month term, 3.5% per year for the 6-9 month term, 5% per year for the 12-18 month term, and 5.3% per year for terms over 24 months.

Agribank, after further adjustments, has aligned its deposit interest rates to a similar level as Vietcombank. The 1-2 month term rate is now reduced to 1.7% per year, the 3-5 month term rate is 2% per year, and the 6-9 month term rate is 3% per year. The 12-month term rate at Agribank is 4.8% per year, while it is 4.7% per year at Vietcombank.

Therefore, as of February 7, 2024, the interest rates for savings deposits are 1.7-4.1% per year for the 1-3 month term, 3.0-4.9% per year for the 6-9 month term, and 4.0-5.4% per year for the 12-month term. These deposit interest rates are at the lowest levels ever recorded in history.

For the 12-month term, the interest rate of 5.5% per year has disappeared. DongABank offers the highest deposit interest rate at 5.4% per year, followed by VBB and BaoVietBank at 5.2% per year.

For the 6-month term, DongABank still offers the highest interest rate at 4.9% per year, followed by VBB at 4.8% per year.

Meanwhile, there is no longer a 4% per year interest rate for the 3-month term. Instead, DongABank has the highest rate of 3.9% per year.

|

Deposit interest rates for individual savings at banks as of February 7, 2024

|

Prior to that, at a press conference on implementing the banking sector’s tasks in 2024, Deputy Governor of the State Bank of Vietnam (SBV), Dao Minh Tu, stated that interest rates are now at their lowest level in the past 20 years. Many commercial banks believe that interest rates cannot go any lower. The SBV’s directive is for banks to actively save costs to reduce interest rates and support the economy. If interest rates can be reduced, they should be. The SBV does not raise the possibility of increasing interest rates in 2024. Therefore, one of the solutions is for the SBV to encourage credit institutions to strive to reduce interest rate levels. In addition, the management of interest rates must also be based on global economic developments and large macroeconomic balances.

In its report released on January 29, 2024, UOB assessed that with the pace of economic recovery and better prospects in 2024, the potential for further interest rate cuts has diminished. Therefore, UOB believes that the SBV will maintain the refinancing rate at the current level of 4.5%. Instead of continuing to lower interest rates, which will be constrained by the lower limit, the government has shifted the focus to non-interest rate measures to support the economy.

At a meeting with investors on February 1, 2024, Pham Quoc Thanh, CEO of HDBank, shared that this year, fiscal and monetary policies will continue to support the recovery trend of various sectors of the economy. Exchange rate and interest rate policies will ensure healthy liquidity for economic growth. Thanh believes that the current low interest rate trend will continue in the first quarter and may slightly increase from the third quarter of 2024 onwards. This also supports sectors that have shown positive signs of recovery in the past period.

Meanwhile, Nguyen Huu Huan, Associate Professor at Ho Chi Minh City University of Economics (UEH), predicts that interest rates in Vietnam will depend heavily on interest rate policy actions from the U.S. Federal Reserve (Fed). If at its meeting in March 2024, the Fed lowers its interest rates, it will have a ripple effect on the interest rate policies of central banks worldwide, leading to rate cuts. Vietnam will benefit from this.

Cat Lam