After a remarkable gain in the previous session, VN-Index continued to maintain its positive performance on February 6, with strong momentum from the banking stocks. At the end of the trading session, VN-Index increased by 2.42 points (+0.2%) and closed at 1,188.48 points. The total trading value on HOSE and HNX exchanges reached over 16,400 billion VND, a decrease compared to the previous session.

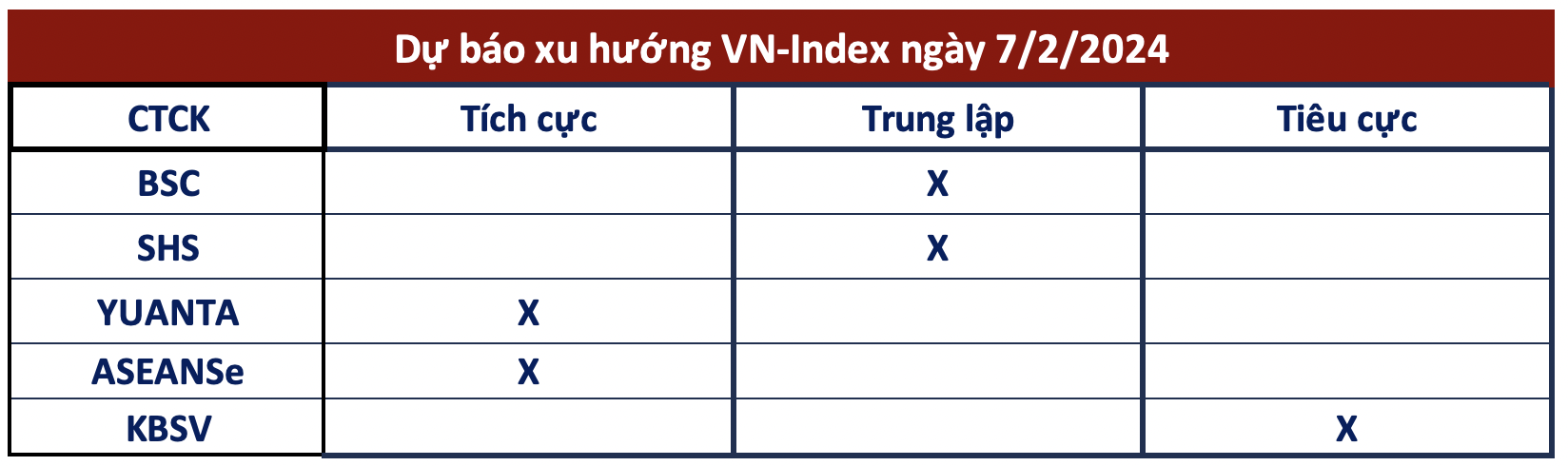

Following two consecutive days of gains during the Lunar New Year period, some securities companies believe that the market will face stronger volatility pressure around the 1,200-point resistance level, even the risk of forming a short-term peak which needs to be noted. However, there is still optimism about the VN-Index’s performance and investors are advised to continue holding high-weighted stocks in their portfolios.

BSC Securities evaluates the market’s performance as quite positive after nearly 2 weeks of fluctuations in the range of 1,163 – 1,186 points, accompanied by the leadership of stocks with large capitalization and improved liquidity. Volatile trading sessions still occur during the VN-Index’s consolidation process, pushing towards new high points in 2024.

SHS Securities believes that the VN-Index’s momentum has stalled as the index approaches the short-term psychological resistance of 1,200 points. Liquidity decreased significantly compared to the previous session, but in the context that there is only 1 trading session left before the long Lunar New Year holiday, this development is normal.

According to SHS, in the short term, the VN-Index is expected to continue its upward trend, but there may be fluctuations when approaching the psychological resistance level around 1,200 points. Short-term investors have actively taken profits in recent sessions and should not chase buying due to the possibility of market volatility around the strong resistance level.

With a more positive view, Yuanta Securities suggests that the market may continue to rise in the next session, but the amount of money could remain low due to limited trading sentiment ahead of the extended Lunar New Year holiday. At the same time, the forecasted money flow may focus on trading large and mid-cap stocks as these two groups are experiencing strong positive volatility. In addition, a slightly increased short-term psychological indicator indicates that investors are becoming less pessimistic.

Yuanta expects the VN-Index to soon approach the 1,200-point level. Short-term investors can continue to hold high-weighted stocks in their portfolios and take advantage of corrections to increase their positions in stocks or make new purchases.

Asean Securities (AseanSe) also believes that this correction is not significant, and partly due to today’s session being the final selling session for investors to transfer money to their accounts right before the Lunar New Year. Therefore, the short-term development is consolidated by the return of the score at the end and after the ATC session.

AseanSe maintains the view that the market will continue to move towards the 1,190-1,211 point resistance zone and recommends investors to continue holding stocks and maintaining a percentage of 60-70% in their portfolios.