The Ho Chi Minh City Stock Exchange (HoSE) has just announced the market information for January 2024. Accordingly, at the end of the last trading session of January 2024, the VNIndex reached 1,164.31 points, the VNAllshare reached 1,182.55 points, and the VN30 reached 1,166.33 points; an increase of 3.04%, 2.34%, and 3.08% respectively compared to December 2023.

The top 3 sectors with the highest point increase in the first month of 2024 are the financial sector (VNFIN) with a 6.47% increase, the consumer goods sector (VNCOND) with a 5.49% increase, and the utility services sector (VNUTI) with a 1.84% increase. On the other hand, the sectors with the highest point decrease are the real estate sector (VNREAL) with a 3.25% decrease, the energy sector (VNENE) with a 2.03% decrease, and the essential consumer goods sector (VNCONS) with a 1.75% decrease.

The stock market liquidity in January 2024 continued to show growth, reflected in the average trading volume of 726.2 million shares per day, with an average trading value of over 16,531 billion dong per day; an increase of 4.60% in volume and 3.58% in value compared to December 2023.

Similarly, the trading of covered warrants (CW) in the first month of the Year of Giap Thin 2024 also followed the upward trend of the stock market, recording positive growth with an average trading volume of over 56.8 million CW per day, corresponding to an average trading value of over 42.7 billion dong per day; an increase of 20.40% in volume and 42.30% in value compared to December 2023.

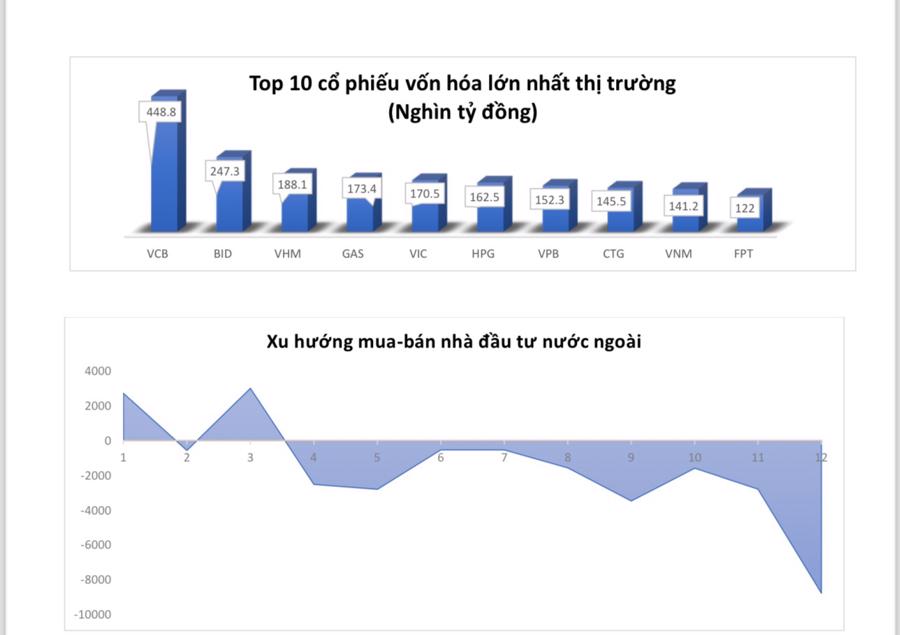

The total value of transactions by foreign investors in January reached over 52,551 billion dong, accounting for over 7.22% of the total value of transactions in the market. Foreign investors made net purchases in the month with a value of over 1,304 billion dong.

As of January 31, 2024, there were 628 listed securities traded on HoSE, including 396 stocks, 04 closed-end funds, 14 ETFs, and 214 covered warrants. The total listed stock volume reached over 152.9 billion shares. The market capitalization of stocks on HoSE reached over 4.7 million billion dong, an increase of 3.34% compared to the end of 2023, accounting for nearly 94% of the total market capitalization of listed stocks and equivalent to 46.06% of the 2023 GDP (current prices).

In terms of listing activities, in January 2024, HoSE listed 03 stocks (HNA of Hua Na Hydroelectric Joint Stock Company; QNP of Quy Nhon Port Joint Stock Company; TCI of Thanh Cong Securities Joint Stock Company) and 05 new CWs for official trading.

By the end of January 2024, HoSE had 41 companies with a market capitalization of more than 1 billion USD, of which 02 companies had a market capitalization of over 10 billion USD: Joint Stock Commercial Bank for Foreign Trade of Vietnam (VCB) and Joint Stock Commercial Bank for Investment and Development of Vietnam (BID).

OVERVIEW OF ACTIVITIES AND TRANSACTIONS ON HoSE IN 2023

In 2023, despite being affected by factors in the region and the world such as escalating geopolitical tensions, low economic growth, high inflation, and reduced consumer demand…, the Vietnamese stock market still achieved double-digit growth thanks to economic management policies and timely support from the Government.

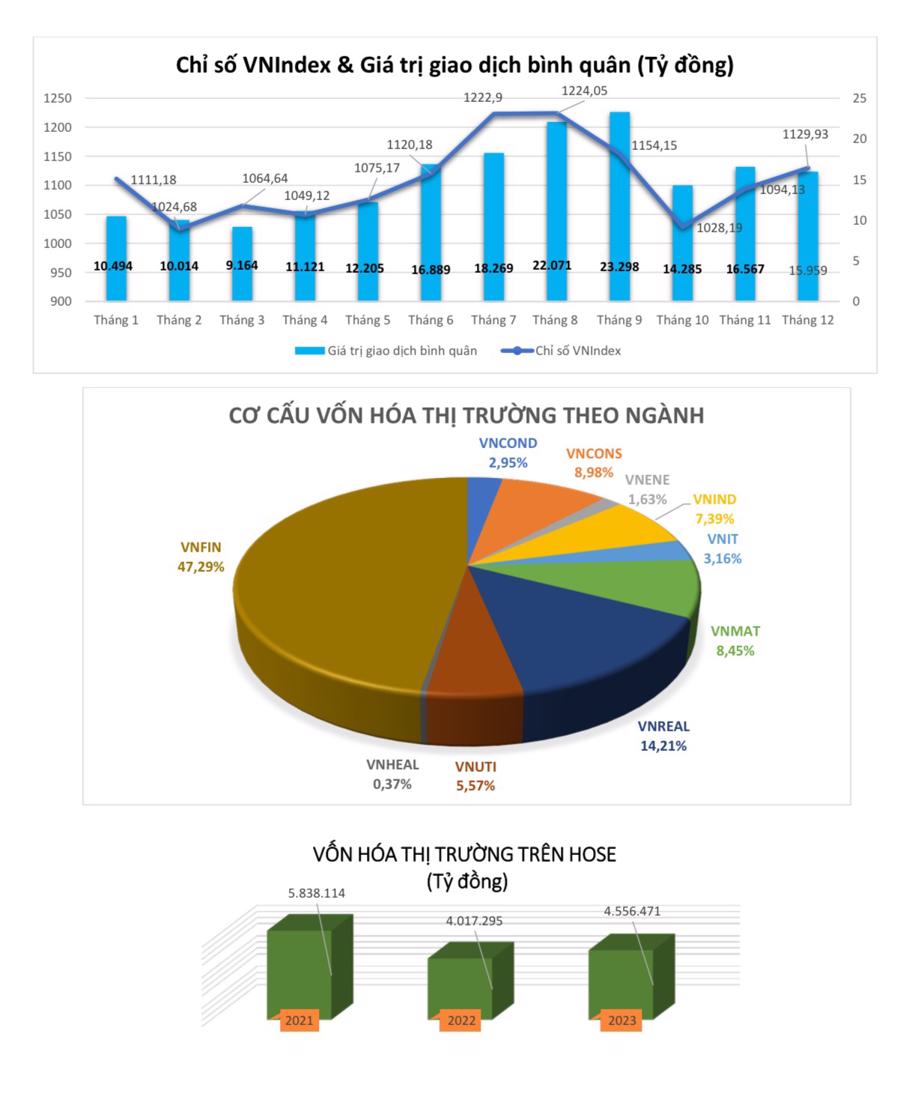

Specifically, at the end of the trading session on December 29, 2023, the VN-Index reached 1,129.93 points, an increase of 12.19% compared to 2022. The market capitalization of listed stocks on HoSE as of December 29, 2023 reached over 4.55 million billion dong, an increase of about 13.4% compared to the end of 2022 and equivalent to 47.9% of the 2022 GDP.

The total trading volume of stocks in 2023 reached over 193 billion shares, with a total trading value of nearly 3.8 million billion dong, equivalent to an average trading volume of nearly 775.3 million shares per day (up 11.8% compared to 2022) and an average trading value of 15,265 billion dong per day (down 11.1% compared to 2022).

By the end of 2023, there were 42 companies with a market capitalization of over 1 billion USD on HoSE, an increase of 5 companies compared to the end of 2022. Among them, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (VCB) was the only company with a market capitalization of 19 billion USD.

As of December 29, 2023, there were 394 listed stocks, 14 ETFs, 4 closed-end funds, and 229 CWs listed and officially traded on HoSE. The total volume and value of listed stocks reached 154.9 billion shares and over 1.53 million billion dong, an increase of about 7.7% in volume and 7.0% in value compared to the end of 2022.