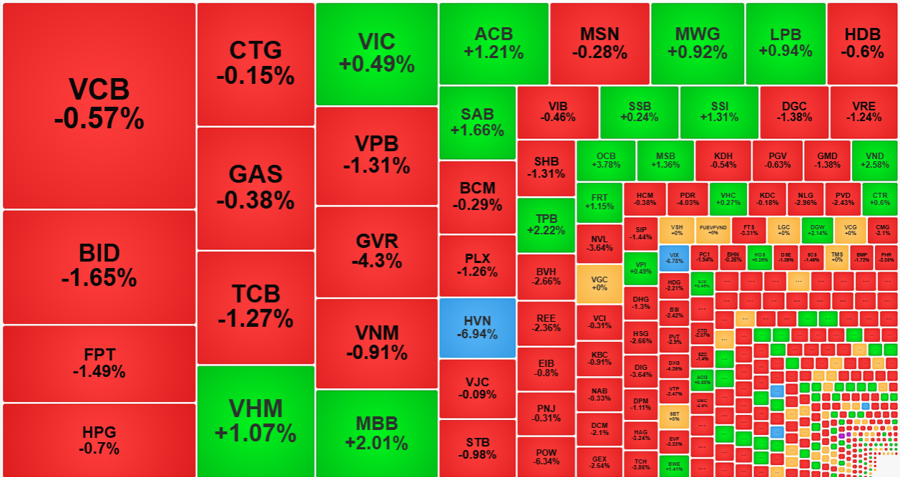

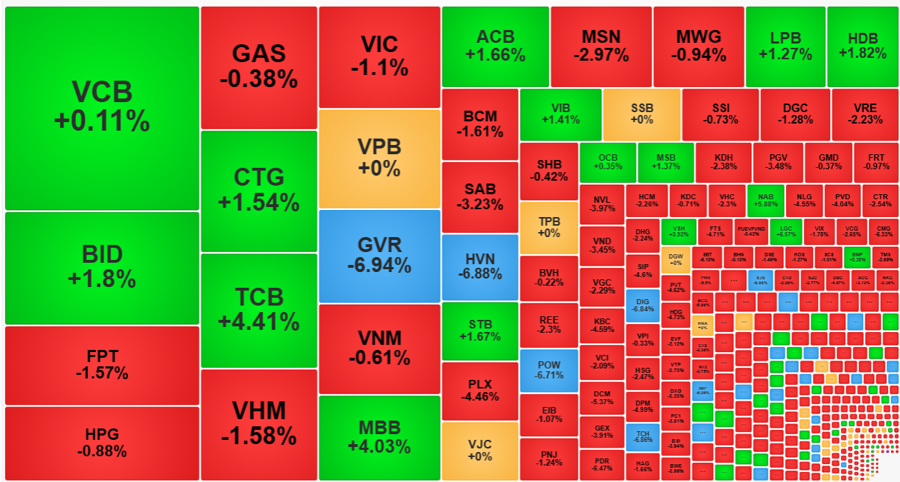

4 out of 5 large cap stocks weakened, causing the VN-Index this morning to not be able to maintain the best gain, but trading remains relatively positive in the days leading up to Tet. Liquidity decreased slightly mainly due to banking stocks, and this group also saw a significant decrease in prices.

The VN-Index ended the morning session with an increase of 2.79 points or +0.24%, while the peak at the beginning of the session was about +4.9 points or +0.41%. Many pillar stocks were not able to hold their high prices, especially the banking group, which is the reason why the market is in a prolonged state of stagnation.

In the morning session, only 15 out of 27 banking stocks on the exchanges were still in the green, with 7 stocks increasing by more than 1%. Weaker blue-chips stocks include VIB, which increased by 1.65%, 1.32% for CTG, and a 1.18% increase for TCB. Even these stocks have somewhat retreated from their morning highs, for example, VIB had to give back nearly 1.6% of its gains, while TCB retreated by 0.83%. VCB and BID also saw significant declines: VCB, at its highest point, increased by 0.67% compared to the reference price, but later fell by 1.32% from its peak and closed below the reference price by 0.67%. BID also declined by about 0.62% from its peak and closed down 0.31%.

VCB and BID, along with VHM decreasing by 0.12% and VIC decreasing by 0.47%, are 4 out of the top 5 stocks in terms of market capitalization. Expanding to the top 10 market caps, VNM also decreased by 0.59%. Among the gainers, GAS, HPG, VPB, and FPT have also seen significant weakening over time. The considerable decline in the pillar group is the reason why the VN-Index is relatively weak. The banking sector on the HoSE exchange this morning was not able to maintain its impressive liquidity, with the total trading value of this group decreasing by 32% compared to yesterday morning.

However, the market is not necessarily bad, as the morning session still saw a dominant breadth on the upside. Even around 10:30 am when the VN-Index was at its weakest, up less than 1 point from the reference price, the breadth still remained at 228 advancing stocks/159 declining stocks. By the end of the morning session, HoSE had 240 advancing stocks/175 declining stocks, with 67 stocks increasing by more than 1% and accounting for 37.7% of the total trading value on HoSE.

Banking stocks are no longer leading in terms of both price increases and liquidity. Today, NVL led the group with an increase of more than 1% and the highest trading value of VND 281.5 billion, with a 1.47% increase in price. Next is VIX with VND 264.8 billion trading value and a 1.97% increase in price, DGC with VND 176.5 billion trading value and a 2.97% increase in price, DBC with VND 163.7 billion trading value and a 1.33% increase in price, VCI with VND 154.1 billion trading value and a 2.16% increase in price. The lower liquidity group also saw a very good price increase, for example, FRT increased by 3.68%, SZC increased by 2.87%, ORS increased by 2.84%, HTV increased by 2.11%, HCM increased by 2.04%…

The large-cap stocks with the highest market capitalization are currently not strong enough after the banking stocks cooled down, naturally causing the VN-Index to return to a stagnant state like before yesterday’s session. Basically, the current strong momentum is still only activated by the banking group, without a broad spread in the pillar group. Not to mention that VIC and VHM are still in the red, and stocks like HPG, GAS, VNM have no surprises. The possibility of changing the pillar stocks has not yet been resolved.

However, this is still a favorable context for small and medium-sized stocks to increase in price. The breadth confirms that there are still profit opportunities if investors hold onto stocks. In fact, stocks with trading value below VND 100 billion are still increasing strongly, as well as fund flows are still mainly focused on the advancing group. According to statistics from HoSE, nearly 70% of the total trading value is still in the advancing group, with only about 21% concentrated in the declining group.