Illustrative Image. Source: Momentum Works.

In August 2023, Mr. Niklas Ostberg, co-founder and CEO of Delivery Hero – the parent company of Baemin – had positive outlooks for the prospects in the Asian market, except Vietnam. He believed that food delivery business “never makes money” in Vietnam.

This seemed to be an early warning for the fate of Baemin in Vietnam. Three months later, the famous South Korean food delivery app announced that it will officially cease operations in Vietnam from December 8, 2023. The reason given was “the difficult global economic situation, as well as the fierce competition in the domestic market”.

A bitter pill to swallow

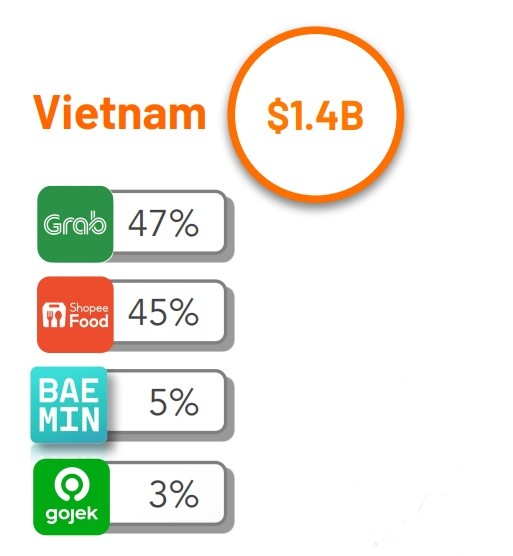

According to a recent report by Momentum Works, the Gross Merchandise Value (GMV) of food delivery platforms in Vietnam reached $1.4 billion in 2023, the highest growth rate in Southeast Asia at 27%, while other markets only grew by single digits. The data was aggregated from 4 platforms: Grab, ShopeeFood, Baemin, and Gojek.

Although the figures prove that the food delivery market in Vietnam is a “big pie”, along with the fact that ordering food online has become part of the life of many people in big cities, the departure of Baemin seems to be a reminder to the remaining competitors that this “pie” is not easy to swallow.

The data from Momentum Works showed that in 2023, Baemin accounted for 5% of the total GMV in the food delivery market in Vietnam. Even when Baemin significantly scaled back its operations before completely exiting, this figure was still higher than the 3% of Gojek – the platform from Indonesia that provides the food delivery feature GoFood.

According to Momentum Works CEO Jianggan Li, Goto – the parent company of Gojek – should divest from the Vietnamese market because competition is not feasible in the short and medium term, as Goto’s overall business situation is becoming increasingly unprofitable. In 2022, Goto recorded a net loss of $2.7 billion, more than 3 times its revenue.

Proportion of GMV across food delivery platforms in Vietnam. Source: Momentum Works.

Similarly to Niklas Ostberg’s perspective, Mr. Pham Chinh, a retail market researcher, stated that no company in the food delivery sector in Vietnam has made a profit.

“They call for investments and use that money to sustain their operations. Costs are always higher than revenues, so no one knows when they will make a profit. Those who can endure and survive in the end will be the winners,” he shared his viewpoint with Nguoi Lao Dong newspaper.

Grab and ShopeeFood dominate the market, can beFood make a difference?

According to Momentum Works data, the food delivery market in Vietnam is currently a “two-horse race” between Grab and ShopeeFood, with respective shares of GMV at 47% and 45%.

Looking at the entire Southeast Asia region, Grab – the Singaporean tech unicorn – also maintained its leading position in 2023. Meanwhile, ShopeeFood recorded a 67% GMV growth in the region, despite Shopee’s focus on e-commerce, making it the most formidable competitor of Grab in Vietnam.

Considering the leading platforms in the market, Ms. Vion Yau – Head of Analysis at Momentum Works – pointed out that these are the names that have been present in the market for many years and understand the characteristics of the Vietnamese market.

“Besides, they provide various complementary services such as ride-hailing or e-commerce, creating many advantages compared to platforms that only focus on food delivery,” this expert analyzed, and also highlighted a “death knell” that made Baemin have to stop in Vietnam.

Taking these factors into account, there is one name not included in the Momentum Works report but seems quite promising: the Be app owned by Be Group – a Vietnamese company.

As of December 2023, Be had about 300,000 online drivers working on its platform, serving more than 9 million customers in 40 provinces and cities with over 15 different services. Each month, Be processes more than 20 million transactions, with over 50% of users using more than 2 services.

According to data released by Be Group, they hold a 35% market share in ride-hailing in Vietnam. However, the food delivery segment is a different story. In 2019, Be Group had to postpone the launch of beFood after 6 months of research and preparation, in order to focus on the “ride-hailing war”. Finally, the beFood feature was only deployed in April 2022.

This was considered a wise move by Be Group, as the food delivery market had already seen names that “bloomed early but withered soon” like Lala or Vietnammm (which later sold itself to Baemin). Besides building a larger customer base than in 2019, Be Group has also strengthened its financial strength by receiving an investment of VND 739 billion from VPBank Securities in early 2024.

Nevertheless, like other food delivery platforms, Be will have to face the challenge of consumers continuing to tighten their spending due to the difficult economic situation, only ordering when there are promotions – pushing businesses into a “money-burning” competition to attract customers.

“Now, the ability to make enough profit for reinvestment and compensate for past losses is no longer a big story, so apps cannot continue to pursue the “money-burning” policy of technology startups,” Mr. Pham Chinh raised the issue for food delivery platforms.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)