After a strong recovery, bank stocks, which were expected to decline in favor of mid-cap growth sectors according to the continuous movement of capital, have shown strong growth as the Lunar New Year holiday approaches.

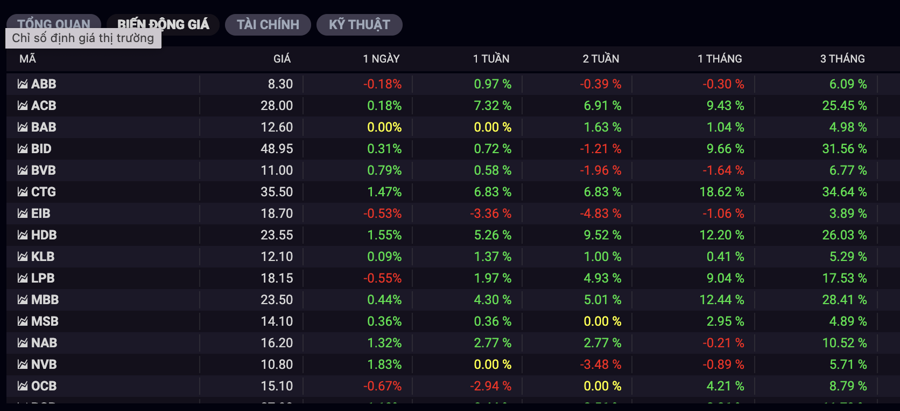

Within the past month, CTG increased by 18.62%; HDB increased by 12%; MBB increased by 12.44%; BID increased by 9.66%; ACB increased by 9.43%. Over the past 3 months, CTG increased by 34.64%; BID increased by 31%; MBB increased by 28%; HDB increased by 26%… The growth of the banking sector has brought the Vn-Index straight to the closing mark of 1,198 points at the end of the 7-day Lunar New Year holiday, corresponding to a 10-point increase.

Explaining the movement of the banking sector, Mr. Nguyen The Minh, Director of Personal Customer Analysis at Yuanta Securities, believes that the valuation of the banking sector is not really attractive, but investors are looking at the expectations for this sector in 2024.

Positive points include the recent extension of bad debt handling by the State Bank of Vietnam, which provides banks with additional room to reduce interest rates and stimulate credit growth in 2024, with the target set at 15% for the whole year. Commercial banks are more proactive than usual in boosting credit growth.

The Casa ratio of this group is also gradually increasing, which has a significant impact on the banking sector’s profitability in 2024, providing room for this group to have a better NIM in 2024. “In the short term, bank valuations may be high, but in 2024, when business results are more positive, the valuation of banks will be re-evaluated,” emphasized Mr. Minh.

In 2024, despite the existence of pressure on asset quality, FiinRatings analysts also believe that the profitability of banks will improve to some extent due to the expected economic recovery, along with solutions and credit policies implemented by the Government and the State Bank of Vietnam to achieve the goal of promoting economic growth, thereby somewhat addressing the difficulties in credit growth.

In addition, a trend in 2024 for the banking industry that may affect credit growth and the credit rating of banks is the promotion of Tier 2 capital to supplement capital sources and support growth targets. With the current lower capital adequacy ratio of domestic banks compared to banks in the same region, FiinRatings expects this trend to help improve the capital buffer and maintain a relatively stable capital source with appropriate costs, thereby enhancing the credit rating of banks.

Meanwhile, BSC believes that the current valuation of the industry is still suitable for accumulation, especially for the private sector, while the state-owned sector still has a basis for raising valuations through private placements. The basis comes from a reconsideration of the industry’s valuation in past cycles, without considering the period from 2014 to 2016, which was a period of restructuring the sector after the real estate crisis with a series of new regulations (such as Circular 36/2014 and Circular 41/2016 of the State Bank of Vietnam).

Tighter risk management regulations and improved balance sheet health are the main differences in the current cycle compared to the past. The amended Credit Institution Law towards minimizing systemic risks has also just been approved.

BSC continues to maintain a positive recommendation for the banking industry in 2024 based on the following key points: low interest rate environment and economic recovery prospects help improve credit growth and NIM gains due to the reset cost of capital, strengthened bad debt handling in 2023 creates room for profit recognition from debt recovery in 2024, thereby improving the prospects for profit growth in 2024, supported by a valuation that is still in a suitable range for accumulation.