In the context of the economic situation in 2023, many businesses are facing difficulties in achieving their business plans. Therefore, many businesses are forced to divest from affiliated companies to restructure their capital and focus resources on potential areas.

Real estate companies withdraw from project companies

The divestment of Taseco Investment Corporation (Taseco Land, stock code TAL) from TAH Investment Corporation, the project owner of the office and commercial complex on B2CC4 Ho Tay land, is perhaps the highest-value deal of the past year.

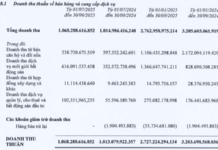

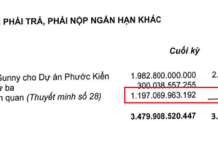

According to Taseco Land’s Q3/2023 financial statements, the value of the share purchase deposit related to this subsidiary was approximately 710 billion VND as of September 30, 2023.

Taseco Land withdraws from the Tay Ho Tay urban area project

Prior to this, TAH Investment Corporation had only become the project owner of the B2CC4 project in Tay Ho Tay urban area less than a year ago, after receiving the transfer from THT Development Corporation.

Another company that has withdrawn from that real estate project is Ninh Van Bay Tourism Real Estate Corporation (stock code NVT). They completed the transfer of the entire capital of Tan Phu Tourism Corporation (more than 12%) at the end of September 2023.

This is the unit that develops the Emerald Ninh Binh Resort. The withdrawal of investment capital from the Emerald Ninh Binh Resort project after more than a decade was explained by NVT as a means to restructure and enhance financial capacity.

Divestment deals related to securities companies

Last year, the securities sector also witnessed numerous divestment deals. One of them was the largest shareholder of Everest Securities Corporation (stock code EVS) – Fusion Suites Saigon Hotel divesting all of its 32 million shares (equivalent to 19.42%) from December 6 to December 26, 2023.

After the transaction, Fusion Suites Saigon Hotel is no longer a shareholder of EVS. The unit stated that the purpose of the divestment was to increase the company’s working capital.

From December 6 to December 26, EVS shares recorded negotiated transactions with a total volume of 32 million shares. The total transaction value was over 269 billion VND, equivalent to the average selling price of 8,420 VND per share.

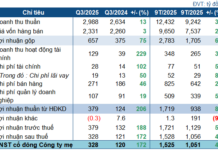

Next, we cannot overlook the divestment of VNDirect Securities Corporation (stock code VND) from its only subsidiary – Investment Securities Management LLC (IPAAM), completed on December 13, 2023.

The transferee was IPA Group Investment Corporation (stock code IPA). After the completion of the deal, IPA replaced VND as the parent company owning 100% of IPAAM’s capital.

IPAAM was established in 2008 with a charter capital of 100 billion VND and primarily operates in the field of securities investment fund management and portfolio management.

These three companies have a close relationship with each other. IPA is currently the largest shareholder of VND with a ownership ratio of 25.84%. In addition, Mr. Vu Hien, Chairman of IPAAM’s Board of Directors, is also the Chairman of IPA’s Board of Directors and a member of VND’s Board of Directors. His wife, Ms. Pham Minh Huong, is currently the Chairman of VND’s Board of Directors and a member of IPAAM’s Board of Directors.

Another securities company with major shareholders divesting all of its capital is Petro Securities Incorporation (stock code PSI) and SaigonBank Berjaya Securities Corporation (SBBS). In particular, SMBC Nikko Securities Inc. (Japan) sold nearly 9 million PSI shares (14.9%) on October 6, marking their official withdrawal from the list of PSI shareholders.

In the opposite direction, securities companies also divest from their major investee companies. For example, SSI Securities Corporation (stock code SSI) divested all of its 3.4 million shares of Saigon Ground Services Joint Stock Company (stock code SGN), equivalent to a 10.18% stake on October 13, 2023, with an estimated value of nearly 241 billion VND. SSI officially bid farewell to SGN after 8 years of investment since SGN’s IPO at the end of 2014.