Illustrative image

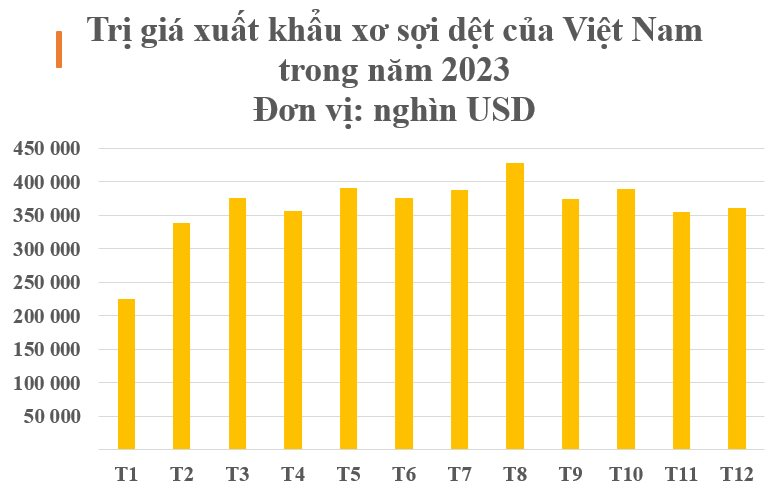

According to preliminary statistics from the General Department of Customs, Vietnam’s exports of textile fibers in December reached 155,658 tons with a value of over 361 million USD, an increase of 4.1% in volume and 2% in value compared to November. Overall, in 2023, our country earned over 4.3 billion USD from the export of various textile fibers, equivalent to over 1.7 million tons, an increase of 13.4% in volume but a decrease of 7.6% in value compared to 2022.

In terms of market, textile fibers are always the “fat gold mine” that China continues to seek because this is an extremely important input material for the textile and garment industry, a sector in which China leads the world. In 2022, China earned over 176 billion USD from textile and garment exports, ranking first globally. China reopened its economy entirely in the second quarter of 2023, supporting exports to China such as fibers and textile fibers’ recovery from the second half of 2023.

At the end of 2023, according to the General Department of Customs, Vietnam’s exports of textile fibers to China reached 882,715 tons with a value of over 2.3 billion USD, an increase of 24% in volume and 9.5% in value compared to 2022.

Not to be left behind in the race with China, the United States and South Korea have also increased their imports of this product from Vietnam. By the end of 2023, Vietnam’s exports of textile fibers to South Korea earned over 384 million USD, a 20% decrease from 2022. The U.S. has risen from the fourth to the third largest export market for Vietnam’s textile fibers with over 147 million USD, a 20.5% decrease compared to 2022.

As of the end of 2022, Vietnam has surpassed South Korea to become the 6th largest fiber-exporting country in the world.

Speaking of China’s textile and garment industry, this country plays the role of the “kingpin” of the world. China is the first country to discover how to raise silkworms to produce silk, hence it has a long tradition of fabric production, especially silk, which has been a premium fabric since ancient times.

China’s advantages in the textile and garment industry are low production costs, high-quality raw materials, modern industrial infrastructure, and available high-tech machinery, which have made this market a top priority for other countries to import.

Not only dominating the world in terms of fabric and garment production, many textile and garment companies in China are actively shifting towards automation in production lines to increase productivity and avoid labor shortages.

At a textile company in Suzhou, Jiangsu province, eastern China, a range of automated devices are being used, such as automated weaving machines, high-angle cameras, and other high-tech equipment. There are 96 main spindles operating simultaneously to spin fibers, and when the green light is on, robots perform automated screening, twisting, or weaving operations.

It is forecasted that in the coming time, the world’s largest textile-importing regions, the U.S. and Europe, tend to reduce imports of textile raw materials from China while increasing imports from other countries. Therefore, Vietnam will have opportunities to expand its market share in the export of fibers and textiles in the future.

Furthermore, currently, synthetic fibers made from petroleum, coal, and natural gas account for over 60% of the global fiber market share. Meanwhile, the Russia-Ukraine conflict has directly impacted and is expected to raise the production cost of fibers this year, creating opportunities for Vietnamese fiber products in the near future.