|

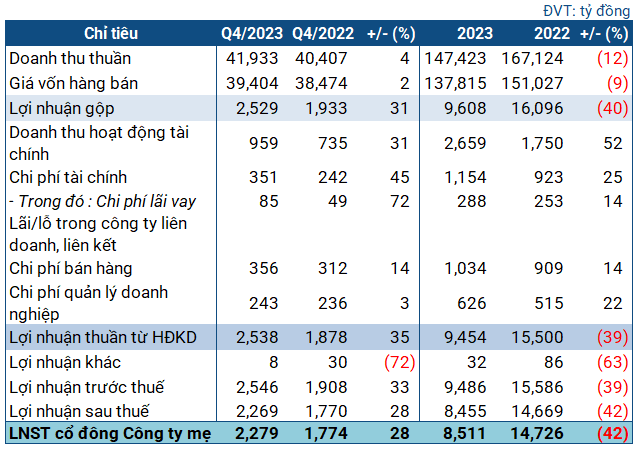

Business performance of BSR in the fourth quarter and the whole year of 2023

Source: VietstockFinance

|

In the fourth quarter, BSR reported net revenue of nearly 42 trillion VND, a 4% growth. The cost of goods sold only increased by 2%, reaching over 39.4 trillion VND. After deductions, gross profit reached 2.5 trillion VND, a 31% increase compared to the same period last year.

Both revenue and financial operating costs in the period increased significantly, mainly due to interest on deposits/loans and exchange rate differences. After deducting other expenses, BSR ended the third quarter with net profit of nearly 2.3 trillion VND, a 28% increase compared to the same period last year.

This is also the second consecutive quarter of profit growth for BSR, after two quarters of decline. The company stated that production and consumption in the fourth quarter increased compared to the same period last year, contributing to the growth in profit for this quarter.

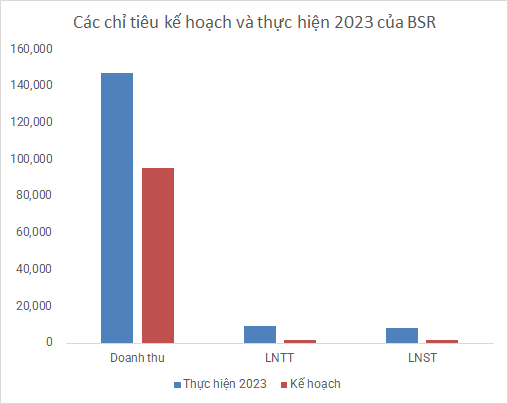

However, with a high base from the previous year (with a record profit of 14.7 trillion VND in 2022), BSR ended 2023 with many declining indicators. Specifically, revenue reached 147 trillion VND, a 12% decrease, and net profit reached 8.5 trillion VND, a decrease of 42%.

As it was forecasted in advance, the 2023 Shareholders’ Meeting set modest targets, combined with the postponement of the maintenance plan for the Dung Quat Refinery and Petrochemical Complex to the beginning of 2024. Thanks to this, BSR exceeded the revenue target by 54% and achieved more than 5 times the planned after-tax profit for the whole year.

Source: VietstockFinance

|

At the end of the third quarter, BSR’s total assets increased by over 10%, reaching over 86 trillion VND. The company held more than 38 trillion VND in cash and deposits, a 52% increase.

Short-term receivables at the end of the period reached nearly 15 trillion VND, a 9% decrease. Inventory stood at 15.4 trillion VND, an 8% decrease. Construction in progress costs decreased slightly to 1.2 trillion VND, mainly for the Dung Quat Refinery Expansion Project (DQRE).

In terms of sources of capital, most of BSR’s payable debts are short-term debts, recording over 28 trillion VND, a 9% increase compared to the beginning of the year. Short-term borrowings increased by 22%, reaching nearly 11 trillion VND, which are bank loans. At this time, the company has retained earnings of 16.2 trillion VND after tax, a 10% increase compared to the beginning of the year.

The 2024 plan continues to decline, with the listed target on HOSE

Recently, BSR’s Board of Directors announced the provisional business plan for 2024. One of the key plans this year is to register the listing of BSR shares on the Ho Chi Minh City Stock Exchange (HOSE).

This plan was already approved at the 2023 Shareholders’ Meeting. Accordingly, BSR wants to list all issued shares – equivalent to 3.1 billion shares (currently only nearly 244 million shares are registered for trading on UPCoM) – on HOSE. However, up to now, this plan has not been implemented.

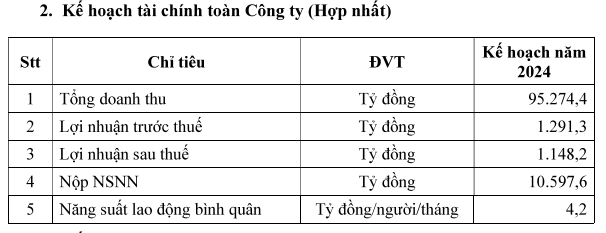

In terms of financial targets, despite going through a fairly good year of business, BSR aims to further reduce its targets compared to the previous year. Specifically, the revenue target for 2024 is over 95 trillion VND, a slight decrease compared to the 2023 plan, and 35% lower than the actual performance in the previous year. The target pre-tax and after-tax profits are over 1.3 trillion VND and over 1.1 trillion VND, respectively, representing a decrease of 29% and 32% compared to the plan, and only 1/7 of the 2023 achievement.

Source: BSR

|

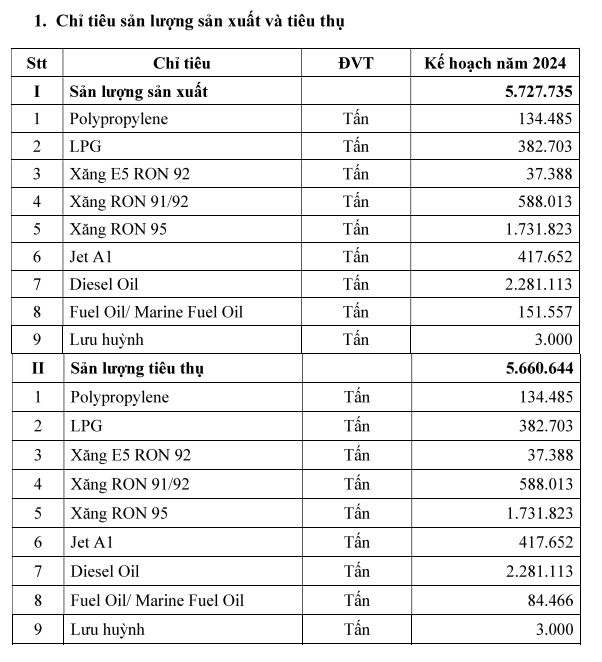

Regarding production targets, BSR aims for about 5.7 million tons in each production and consumption target.

Source: BSR

|