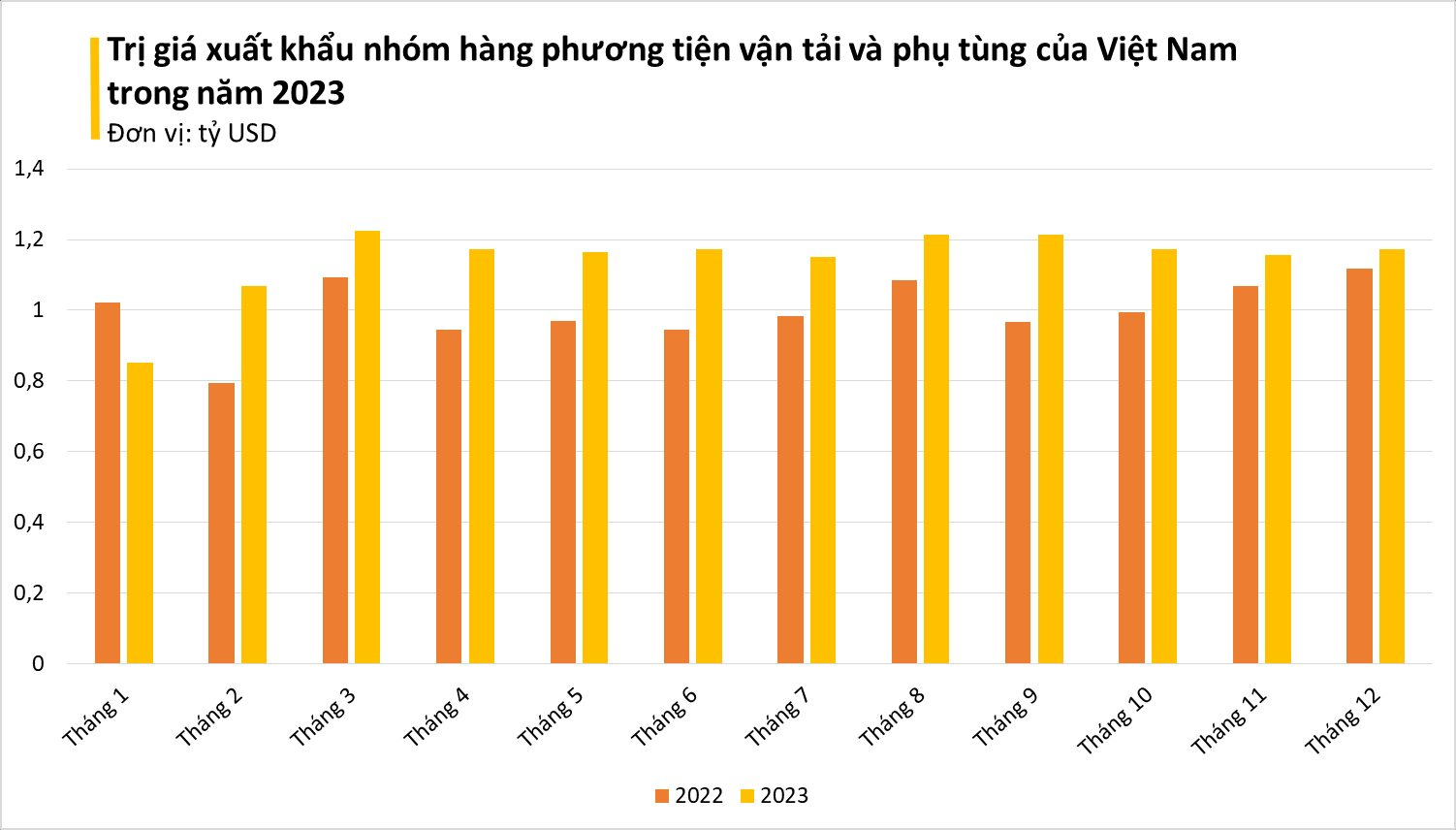

According to the latest updated statistics from the General Department of Customs, Vietnam’s exports of transport vehicles and spare parts in December reached 1.17 billion USD, an increase of 1.5% compared to November 2023. In the 12 months of 2023, Vietnam earned 14.2 billion USD from this group of goods, an increase of 18.1% compared to the same period in 2022.

It is worth noting that among the top 10 largest export groups of Vietnam in 2023, transport vehicles and spare parts are in two rare groups with double-digit growth, with an increase of 2.2 billion USD.

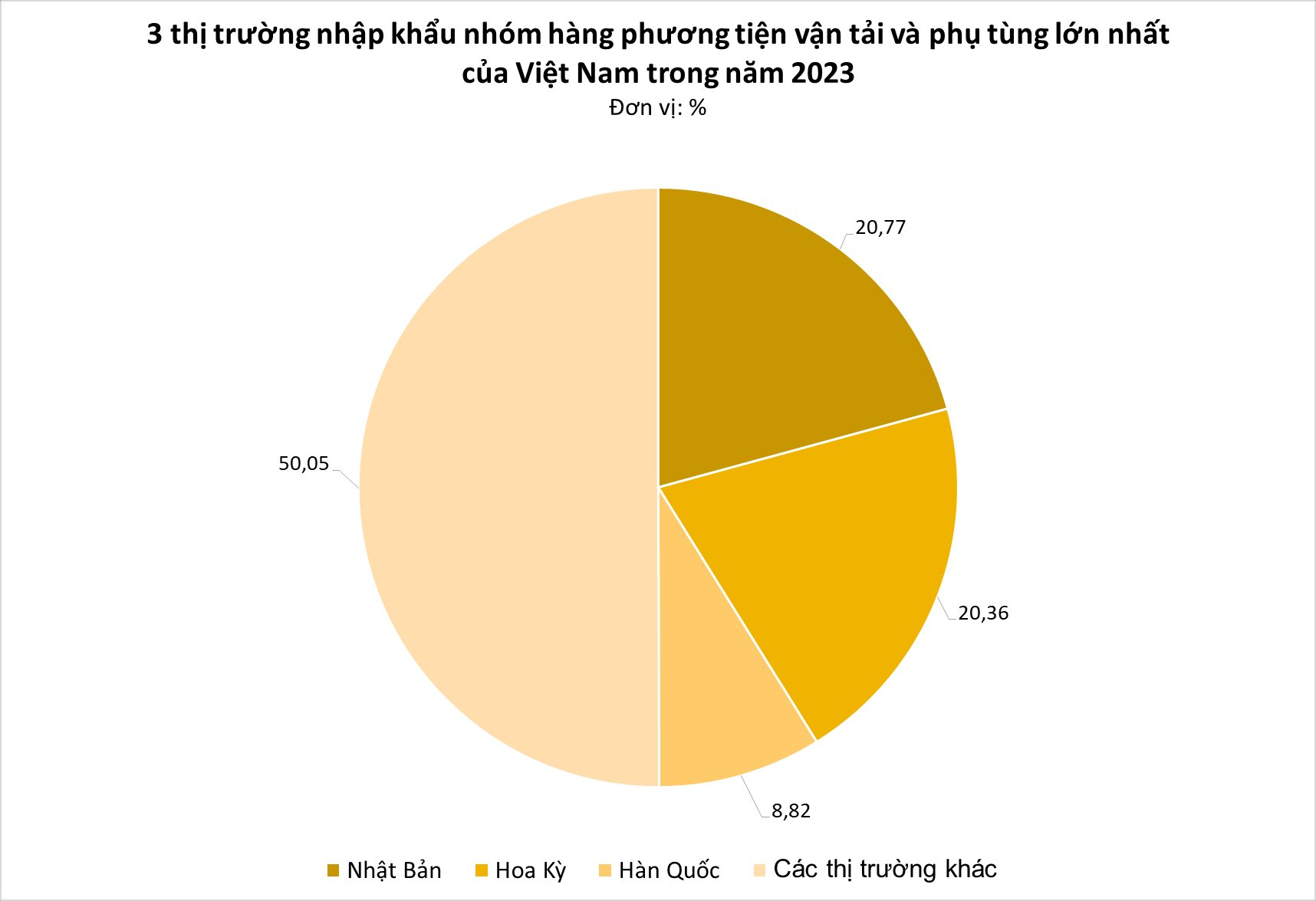

The major import markets for this group of goods from Vietnam are countries with leading automobile industries in the world such as the United States, Japan, South Korea, Thailand, and Germany.

Japan is the largest export market for Vietnam in 2023. Specifically, in December, our country exported nearly 254 million USD, an increase of 1% compared to December 2022. In total for the year, the land of cherry blossoms spent over 2.9 billion USD to import this group of goods, an increase of 16.1% compared to the same period in 2022. This market accounts for 20.77% of the total export volume of the transport vehicles and spare parts group in the 12 months of 2023.

The United States ranks second, importing 262 million USD in December, a 44% increase compared to December 2022. In total for the year, Vietnam exported over 2.88 billion USD to the United States, an increase of 11.5% compared to the same period last year. The US accounted for a proportion of 20.36%.

South Korea is the third largest export market for this group of goods. Vietnam earned nearly 100 million USD in December, a strong increase of 21.4% compared to December 2022. In total for the 12 months, Vietnam exported over 1.2 billion USD to this market, an increase of 53.5% compared to the same period last year, accounting for 8.82% of the total.

In addition to the three main markets, many other markets also recorded a remarkable growth rate in 2023, such as Nigeria (968%), Saudi Arabia (157%), South Africa (230%), UAE (221%),… Besides, most other markets experienced double-digit growth. This shows that technology and automotive companies around the world are strengthening their supply chains for components and spare parts in economies with nearly 100 million people.

According to many experts, this result is partly due to the impact of supply chain shifts, finding alternative component suppliers to reduce dependence on the world’s manufacturing “workshop” in China.

Over the past 20 years, China has risen from an anonymous position to become the world’s leading country in the auto parts industry.

This is seen as a great opportunity for countries in the Southeast Asian region, with Vietnam being the most focused on. From there, the orders for components and spare parts have shifted from China to Vietnam much more than the orders that domestic enterprises are producing, supplying, or exporting.

Vietnamese automotive spare parts exports in recent years have relatively high technology such as ignition cables, parts in gearboxes, airbags, electronic components in gearboxes, etc.

Many foreign-invested enterprises also choose Vietnam as a production base to export globally to countries like Japan, Taiwan,… At the same time, Vietnam has also attracted automobile component suppliers from other countries such as Germany, South Korea,…

Although the export turnover has increased, most of the companies in this field in Vietnam are foreign-invested enterprises, while pure Vietnamese enterprises mainly produce simple products and low-tech components with low value, facing difficulties in becoming original component manufacturers and suppliers.