The 15% growth target is set in the context of a weak domestic and international economy, as countries around the world pursue tight monetary policies to combat inflation. Data on commodity consumption and industrial production in the first month of the year indicate that the economy will continue to face numerous challenges. With this growth rate, the State Bank of Vietnam (SBV) and the Government expect to boost the domestic economy “against the current” compared to the world, as the National Assembly continues to set a relatively high GDP growth target, ranging from 6-6.5%. To achieve this economic growth rate, the promotion of credit disbursement plays a significant role.

However, the current weak demand from households and businesses may require even more loosening of policies to achieve these targets. The following analysis will present the tools that the SBV can use to achieve the goals for this year and the long-term implications if the economy does or does not achieve these targets.

Assessment of interest rate tool

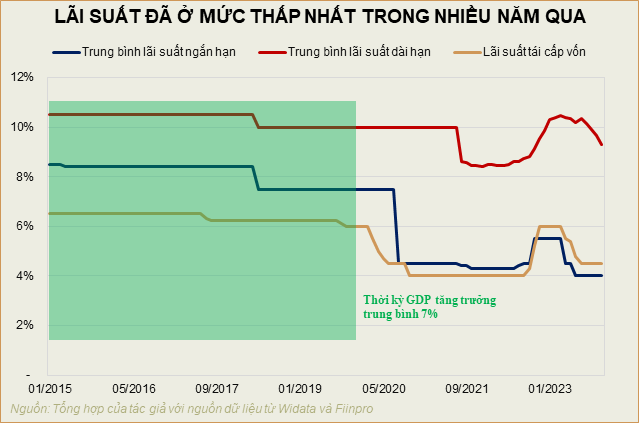

Interest rates are the most commonly used tool that any central bank in the world can use to adjust national monetary policies. In Vietnam, this tool has been used quite frequently in the past 3 years to manage monetary policies. Although in reality, this interest rate only serves to guide the market and does not directly affect the interbank market like the models in China or the US, with four banks holding nearly 50% of total credit in the country, the guidance from SBV can be effectively transmitted to the market.

However, this tool is gradually losing its effectiveness in stimulating credit as the economies of other countries weaken due to tight monetary policies to curb inflation. This directly affects the domestic export sector. Meanwhile, the domestic real estate market is facing a real estate bubble similar to what is happening in China currently. Decreased income, along with the burden of debt from household real estate investment, has eroded market demand. Therefore, even if deposit and lending interest rates of banks are low, it may not necessarily stimulate economic sectors. This is not to mention that Vietnamese households who have invested in real estate are still in a period of loss, with expectations of an increase in real estate gradually declining in the coming quarters, further affecting market demand.

It can be said that the current interest rate reduction is no longer able to stimulate credit demand as in the 2015 – 2019 period when the macroeconomic context has changed significantly. Lessons from China’s current low inflation risk to weak domestic market demand are things we need to keep in mind.

Assessment of legal tool

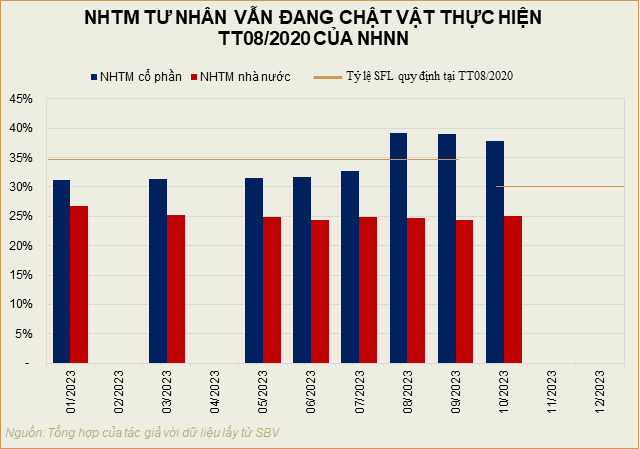

Because Vietnam’s economic structure still depends heavily on capital from banks, meaning that investment capital in fixed assets still has to rely on capital from banks, SBV’s Circular No. 08/2020 on the short-term capital to medium and long-term loan (SFL) ratio is a policy that restricts the supply of capital to the economy when private banks are still struggling to meet this ratio. Some commercial banks have had to restructure their sources of capital in order to maintain the required ratio from SBV. However, in the long run, they will also need to restructure their sources of capital to have a more stable fundraising structure.

When achieving this ratio, banks will have to increase the interest rates on deposits to attract more long-term savings deposits to continue to serve the investment needs of individuals and businesses. If they want to maintain their profits, they will have to increase long-term interest rates, which may reduce the demand of businesses, especially in the current global economic context.

Circular No. 22/2023 is also a signal that SBV wants to orient 4 state-owned banks to provide long-term capital for the economy, especially in two areas: social housing and industrial parks, which are essential and truly necessary needs of households and the economy. However, the development of social housing still faces many issues that need to be addressed in order to create a breakthrough in the implementation process. If the Government can be more aggressive in adjusting policies for social housing, there may be a large credit flow into this area, especially in the context of a series of real estate projects being stuck and becoming bad debts in the banks due to no market demand.

Assessment of fiscal tool

The Law on Credit Institutions does not mention that SBV is allowed to directly purchase Government bonds as in the US. However, SBV can indirectly influence this activity through the ownership of 4 state-owned banks to provide capital for the Government to implement strong and synchronized fiscal policies in key economic areas nationwide.

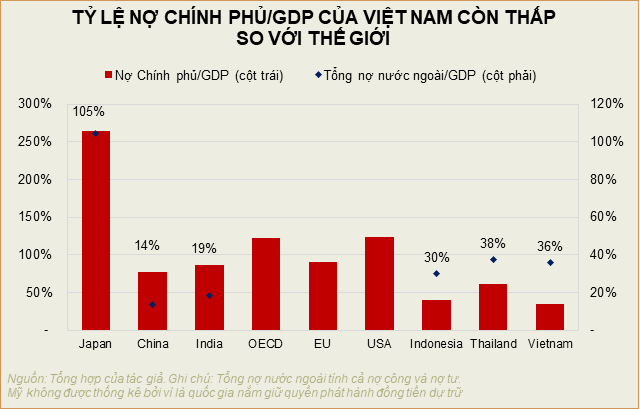

The Government has made efforts to keep the public debt/GDP ratio below 40% for over 10 years. Compared to other countries in the region and major countries, Vietnam has a relatively low ratio. The Government can raise this ratio in the short term to help the economy achieve the goals set by the National Assembly, as long as this is debt denominated in dong. Meanwhile, Vietnam’s foreign debt/GDP ratio is at the same level as the region. For a country increasingly dependent on imports for export growth, this ratio should not be too high, as it will make it difficult for SBV to manage exchange rates and inflation, as it cannot print money to repay these foreign debts but can only borrow more. It will create a snowball effect that makes the VND increasingly dependent on and affected by foreign monetary policies, negatively affecting macroeconomic stability domestically.

Proposed policies

In the current economic situation, policies on interest rates, legal policies, and through the Government may be difficult to stimulate credit growth to achieve the targets. If they insist on achieving these goals through more aggressive policies (reducing lending standards, loosening Circular No. 08/2020, etc.), the most obvious result will be that Vietnam’s economy will develop against the trend compared to other countries. However, the banking system will then face potential bad debts due to the lowered lending standards, and if not managed well, it may result in a crisis similar to the 2010 – 2014 period. A real estate bubble may reappear in the real estate market or the stock market, and when tightened, it will create a sharp decline as we have seen in 2021 – 2022.

Credit policies have truly been loosened too much in 2023, considering the weak absorption capacity of the economy. Therefore, if credit is not selectively pumped with caution, these credit pumps may spark large-scale crises in subsequent periods when accumulated credit is not only in non-production sectors but also generates accumulated debt in weak business sectors that are difficult to recover.

Among the chosen solutions, in addition to promoting synchronized and long-term infrastructure investment, the authors still expect improvements in legal corridors for credit segments that have real needs in society, such as social housing or industrial real estate. These credit needs can create a bigger driving force for Vietnam’s sustainable development in the long term rather than simply achieving annual targets.

Lê Hoài Ân, CFA – Đặng Phú, VDSC