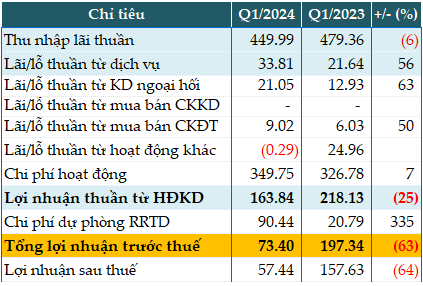

In the first quarter, Vietbank’s net interest income decreased by 6% year-over-year to nearly VND450 billion. The bank attributed the decline to lower interest rates in the interbank market, resulting in reduced interest income from market 2.

However, non-interest income sources grew compared to the same period last year. Service fees increased by 56% to nearly VND34 billion, primarily driven by international payment services and digital banking.

Foreign exchange trading activities generated a profit of over VND21 billion, up by 63%, as the bank capitalized on exchange rate fluctuations.

Trading in investment securities also yielded a profit of over VND9 billion, a 50% increase year-over-year, as the bank seized opportunities in the government bond market.

Operating expenses rose by 7% to nearly VND350 billion, primarily due to higher deposit insurance premiums and capital expenditures.

Furthermore, Vietbank set aside over VND90 billion for credit risk provisions in order to strengthen its buffer and improve future asset quality, an increase of 4.3 times compared to the same period last year. Consequently, the bank’s pre-tax profit fell by 63% to over VND73 billion.

In comparison to the “basic” target of VND950 billion and the “aspiration” target of VND1,050 billion pre-tax profit set for the full year, Vietbank has achieved only about 8% and 7%, respectively, after the first quarter.

|

VBB’s Q1/2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

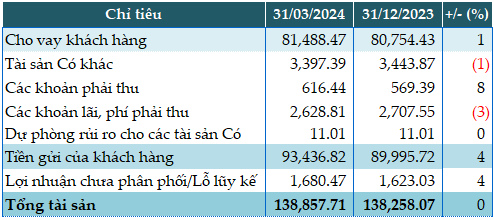

As of the end of Q1, the bank’s total assets remained relatively stable at VND138,858 billion. Loans to customers increased slightly by 1% to VND81,488 billion. Customer deposits grew by 4% to nearly VND93,437 billion.

|

Some of VBB’s Financial Indicators as of 31/03/2024. Unit: Billion VND

Source: VietstockFinance

|

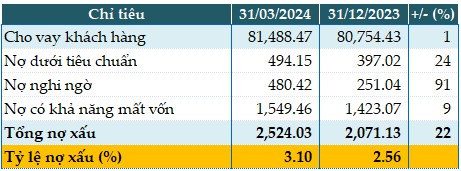

Total bad debts as of March 31, 2024, amounted to over VND2,524 billion, a 22% increase compared to the beginning of the year. Of this, doubtful debts increased the most. As a result, the ratio of bad debts to outstanding loans rose from 2.56% at the beginning of the year to 3.1%.

|

VBB’s Loan Quality as of 31/03/2024. Unit: Billion VND

Source: VietstockFinance

|