| Earnings performance of FIT Corporation since 2010 |

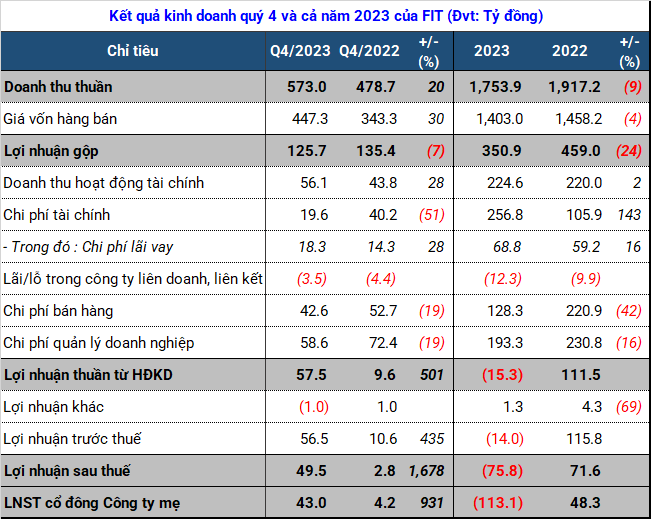

For FIT Corporation (HOSE: FIT), positive net earnings in the fourth quarter come from a number of factors. Firstly, revenue has recorded a good increase of 20%, reaching 573 billion VND. Secondly, financial activities, one of FIT’s important sources of income, have also increased significantly by 28%, reaching 56 billion VND.

Lastly, both selling expenses and management expenses have been reduced by 19% compared to the same period last year. Although interest expenses have also increased by 28%, it does not have much impact on FIT’s performance in the quarter.

Source: VietstockFinance

|

The company earned a net profit of 43 billion VND in the fourth quarter of 2023, ten times the figure in the same period of 2022. This is also the best fourth quarter for FIT since 2019, but it is still not enough to help the company report a profit for the whole year due to the large loss recorded from the sale of investments in the previous third quarter.

This is also the reason why FIT’s full-year finance cost in 2023 increased by more than 143%, leading to a net loss of 113 billion VND, the lowest level since 2010, despite significant reductions in selling expenses by 42% and management expenses by 16%.

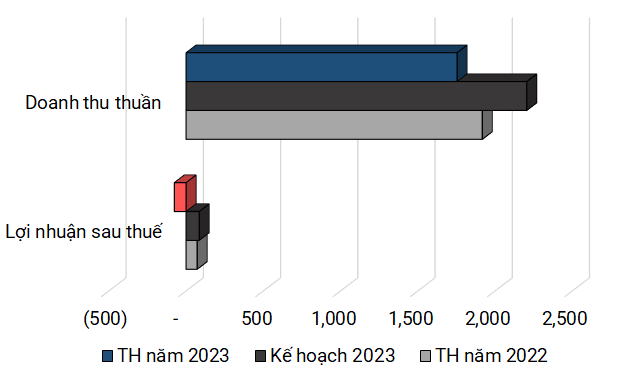

As a result, FIT achieved 80% of its revenue target, but naturally failed to achieve the after-tax profit goal of 85 billion VND set at the beginning of the year.

|

Performance results compared to FIT’s 2023 plan (Unit: billion VND)

Source: VietstockFinance

|

By the end of 2023, FIT’s time deposit has increased significantly, from 409 billion VND to 1.3 trillion VND. The company has also completely divested its capital in Cap Padaran Mui Dinh JSC in the third quarter of 2023, thereby no longer accounting for this investment.

The basic construction costs also experienced a significant increase of 96% compared to the beginning of the year, amounting to 428 billion VND. In which, FIT has invested 133 billion VND in the Capsule factory, an additional 20 billion VND in the GMP-EU Long An factory, and an additional 43 billion VND in the Vikimko factory.

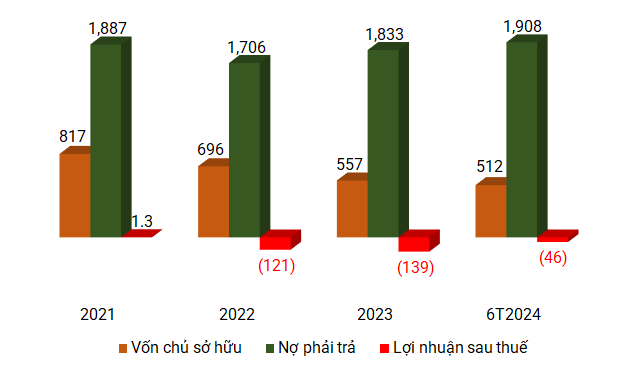

On the other hand, FIT’s bank loans have doubled since the beginning of the year, with an additional 640 billion VND from Vietnam Joint Stock Commercial Bank for Industry and Trade (Vietinbank, HOSE: CTG).

| Performance of total assets and debts of FIT since 2010 |