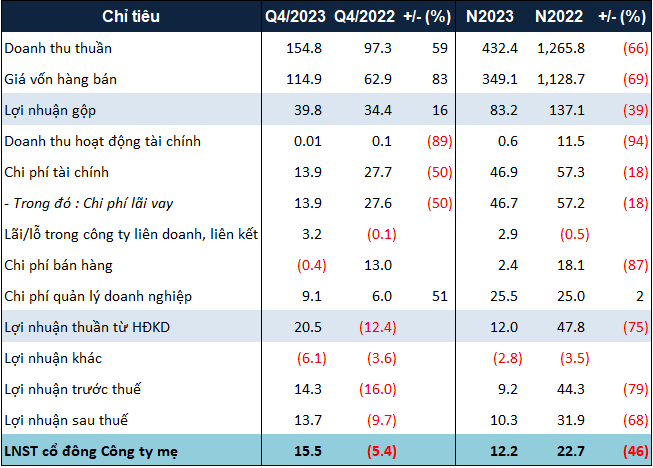

Specifically, despite a significant increase in real estate revenue in the fourth quarter, QCG’s net revenue for the whole year of 2023 only recorded over 432 billion VND, a 66% decrease compared to the previous year. In addition, revenue from financial operations (interest on deposits) also decreased by 94%, amounting to just over 600 million VND.

Although borrowing costs and selling expenses were significantly reduced, QCG only achieved a net profit of over 12 billion VND, a 46% decrease.

On the other hand, compared to the pre-tax profit target of 50 billion VND for 2023, QCG has only achieved more than 18% of the set figure.

The fourth quarter was the most optimistic quarter for QCG in 2023, with net revenue increasing by 59% compared to the same period, reaching nearly 155 billion VND, thanks to real estate revenue (71 billion VND), nearly four times higher than the fourth quarter of 2022. As a result, the company achieved a net profit of nearly 16 billion VND (compared to a loss of over 5 billion VND in the same period), the highest in 4 quarters.

On the balance sheet, QCG’s total assets as of December 31, 2023 were nearly 9.6 trillion VND, a 4% decrease compared to the beginning of the year. Among them, the largest item was inventory, which decreased slightly by 2% to about 7 trillion VND. On the other hand, the company’s cash holdings decreased by 63%, leaving only about 29 billion VND.

As for liabilities, QCG’s total payable debt decreased by 7%, to over 5.2 trillion VND. Borrowings decreased by 2%, to approximately 582 billion VND, with all long-term loans from Gia Lai Commercial Joint Stock Bank, with a balance of over 268 billion VND, and payment due of over 39 billion VND.

Disputes between QCG and Sunny Island continue to be unresolved due to their connection with Van Thinh Phat.