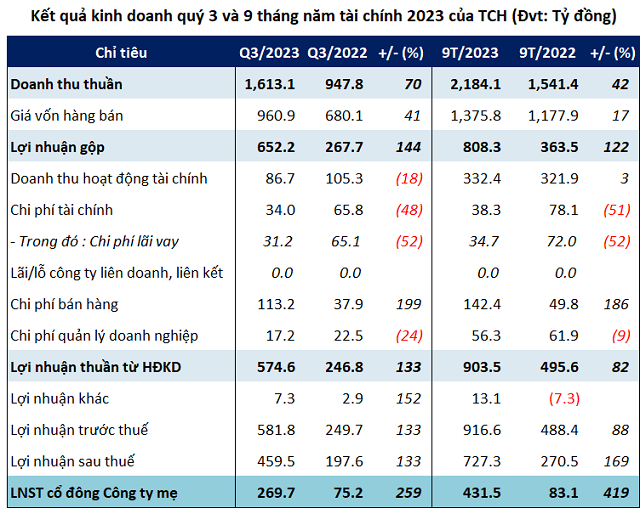

Hoang Huy Financial Services Investment Joint Stock Company (HOSE: TCH) has announced its consolidated financial statements for the third quarter of 2023 for the financial year from April 01, 2023 to March 31, 2024, with a net revenue of VND 1,613 billion, an increase of 70%.

After deducting the cost of goods sold, the gross profit of the company was over VND 652 billion, an increase of 144%; as a result, the gross profit margin also increased from 28% to 40%.

In this period, TCH’s total expenses reached VND 164 billion, an increase of 30%; with a significant focus on sales expenses, totaling over VND 113 billion, triple the amount in the same period.

Finally, TCH reported a net profit of nearly VND 270 billion, which is 3.6 times higher than the same period last year. This is also the highest recorded quarterly profit for Hoang Huy since the second quarter of 2020.

| TCH’s net profit from Q1/2020 to Q3/2023 |

Regarding the above results, the company stated that the main contribution to the revenue came from its automobile and real estate businesses, which maintained stable and growing operations in delivering products to customers. At the same time, the company also reduced expenses, leading to an increase in profitability.

For the accumulated 9-month period (from April 01 to December 31, 2023), TCH achieved a net revenue of VND 2,184 billion, an increase of 42%; while the net profit reached nearly VND 432 billion, 5.2 times higher than the same period.

Source: VietstockFinance

|

Compared to the set targets for this financial year, TCH has achieved 99% of the net revenue target and exceeded the after-tax profit target by 32% after 9 months.

Financial borrowings increased nearly 47 times compared to the beginning of the year.

As of December 31, 2023, TCH’s total assets reached nearly VND 16,776 billion, an increase of 18% compared to the beginning of the year, with a concentration in short-term assets of VND 14,500 billion, accounting for 86%.

TCH’s inventory was at VND 10,658 billion, an increase of 111% and accounting for 64% of total assets. Of which, the notable occurrence in the cost of unfinished business production was the Do Muoi project with nearly VND 4,919 billion. This is a new urban area project along Do Muoi road and the surrounding area in Tan Duong and Duong Quan communes, Thuy Nguyen district, Hai Phong City, with a total area of approximately 49.4 hectares. The investor of this urban area is CRV Real Estate Group Joint Stock Company (CRV) – a subsidiary of TCH with a total investment of nearly VND 10,158 billion.

Regarding the completed real estate inventory, there is the Hoang Huy Commerce project – building H1 with a value of VND 2,505 billion in the last quarter of 2023. According to Hoang Huy, this building (consisting of 3 apartment blocks) is undergoing project settlement.

At the same Hoang Huy Commerce project, the remaining building – H2 (consisting of 1 apartment block) is in the investment preparation process. As of December 31, 2023, the production and business costs at building H2 amounted to nearly VND 305 billion.

TCH’s total bank deposits at the end of 2023 also decreased significantly by 47% compared to the beginning of the year, reaching over VND 3,365 billion, accounting for 20% of total assets.

On the other side of the balance sheet, TCH’s total liabilities were nearly VND 16,776 billion, an 18% increase compared to the beginning of the year. Notably, the total borrowings increased sharply to VND 2,040 billion, 46.5 times higher than the beginning of the year, accounting for 42% of the total borrowings and 12% of the company’s capital sources.