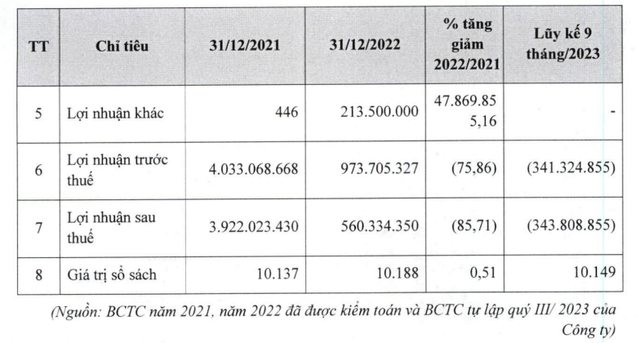

At the end of the trading session on February 7th, D17 stock of Dong Tan Co. plummeted on the UPCoM exchange to 91,700 VND/share. However, prior to that, the stock had increased from 22,000 VND/share to 107,800 VND/share in January, a 390% increase in the second half of the month.

D17 stock started trading on UPCoM on January 22nd at 22,000 VND/share. Therefore, its current price is still 4.2 times higher than its listing price. However, the liquidity of D17 stock only reached a few hundred units per session.

According to research, Dong Tan (formerly known as Dong Tan Co., Ltd.) was established on August 11th, 1993, according to Decision No. 556/QD-QP of the Minister of National Defense. Initially, the company’s main business was in industrial tree planting, livestock breeding, and services.

Since 1995, the company has switched to mining production and business activities. It has been granted land and mining licenses, sand mining, civil and industrial construction, road and bridge construction, landfill construction, and housing business.

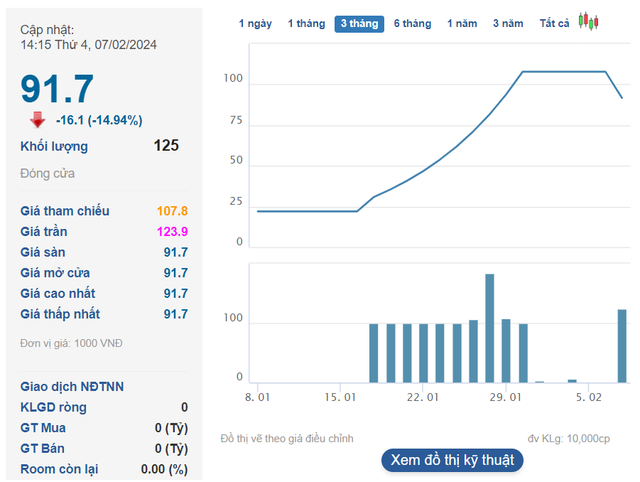

On July 23rd, 2017, the Ministry of National Defense issued Decision No. 2908/QD-BQP approving the plan to transform Dong Tan Co., Ltd. under Dong Hai Co., Ltd./Military Zone 7 into a joint stock company.

The company’s charter capital is 52.7 billion VND. Currently, Dong Hai Co., Ltd. – a subsidiary of the Ministry of National Defense – is the largest shareholder of Dong Tan with a 45% stake. Tan Phong Oil and Gas Co., Ltd., and Ngoc Hanh Construction Co., Ltd. – two companies with the same legal representative – Ms. Pham Thi Minh Ngoc, also own a 22.1% stake.

According to the company’s introduction, Dong Tan supplies nearly 5 million tons of materials including stone, sand, and fertile soil to the domestic market each year. In addition, since 2009, the company has also implemented a border patrol road project as the investor under the Ministry of National Defense. By 2016, the company had completed nearly 30 km of border patrol roads.

In the construction sector, Dong Tan has completed construction projects such as Lam Son Primary School, medical examination department – hospital 4, and internal projects, as well as dozens of charity houses.

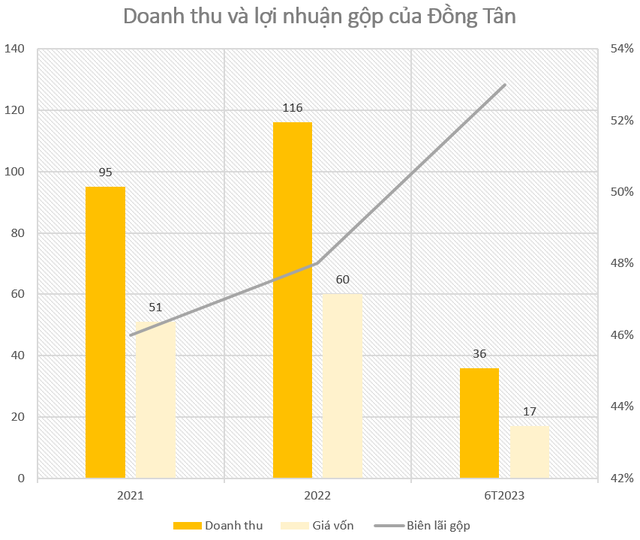

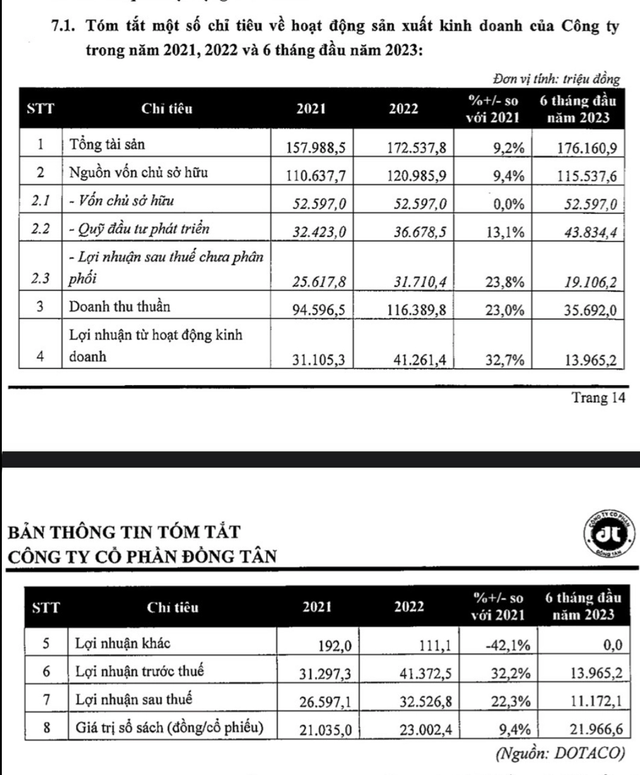

In terms of business results, the company consistently generates hundreds of billion VND in revenue and tens of billions VND in profit each year. In particular, Dong Tan’s gross profit margin is quite high, about 40%-50%.

For example, in the first half of 2023, Dong Tan achieved 35.7 billion VND in revenue, 11.2 billion VND in after-tax profit, and an EPS of nearly 22,000 VND/share. The company’s total assets as of June 30th amounted to 176 billion VND. Moreover, Dong Tan has no financial debt.

In terms of leadership, Mr. Le Ba Tong (born in 1979) is currently the Chairman of the Board of Directors of Dong Tan. Besides working at Dong Tan, Mr. Ba Tong also serves as the Deputy General Director of Dong Hai, the largest shareholder of Dong Tan.

NEM stock increased by 526% in one month

Not only D17, another newcomer to the UPCoM market in January was NEM stock of Northern Electrical Equipment Corporation, which had an even more impressive breakthrough. Specifically, at the end of the trading session on February 7th, NEM stock was priced at 63,900 VND/share, a 526% increase compared to the opening price of 10,200 VND/share in the first trading session on January 5th. However, like D17, the liquidity of NEM stock is also low, only a few thousand units.

According to research, Northern Electrical Equipment Corporation (NEEM) is headquartered in Que Vo Industrial Zone (Bac Ninh) and currently has a charter capital of 88.48 billion VND. It was established in 2004 and transformed into a joint stock company in 2016. By June 2023, it became a public company.

NEEM’s main business areas include manufacturing and assembling high-voltage, medium-voltage, low-voltage electrical panels, and information-telecommunication cabinets, as well as other electrical materials and equipment. Since 2019, due to the impact of COVID-19, the company has suspended its manufacturing activities and focused only on business activities such as outdoor high and medium-voltage equipment, electrical panels, transformers and new energy power stations, energy quality management equipment, and circuit breaker panels for the city’s power grid. The company primarily serves the northern market.

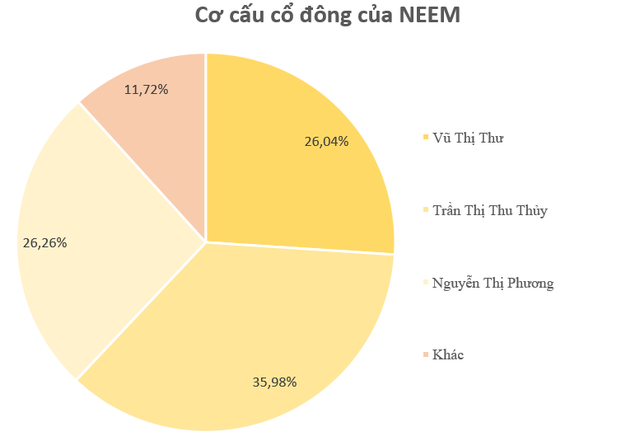

By mid-2023, the company had 105 shareholders, of which 3 major shareholders held a total of 88.5% of the capital, including Northern Power Corporation (26.26%), Ms. Tran Thi Thu Thuy (35.98%), and Ms. Nguyen Thi Phuong (26.26%). However, in December 2023, Northern Power Corporation divested its entire stake through public auction. Seven investors won the bidding, including Ms. Vu Thi Thu, who won the auction for over 2.3 million shares and became a major shareholder.

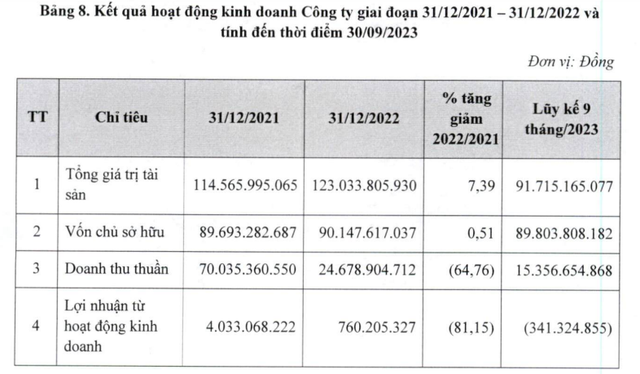

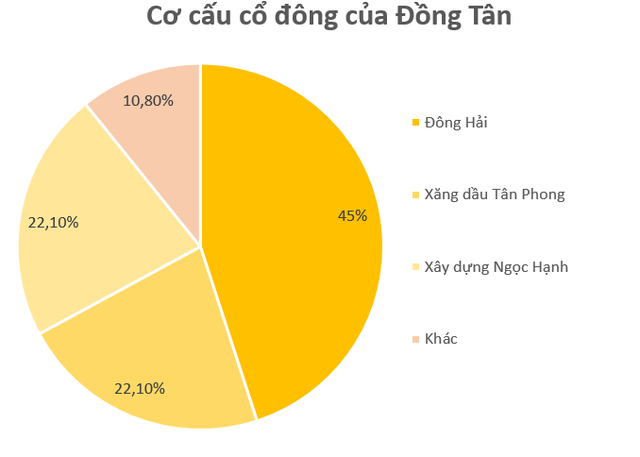

As of the third quarter of 2023, the company’s total assets reached 91.715 billion VND, with only 2 billion VND in debt. In terms of business operations, in the first nine months of 2023, the company recorded 15.35 billion VND in revenue from sales and services, an increase of 25.5 times compared to the same period last year, and a loss of over 300 million VND.