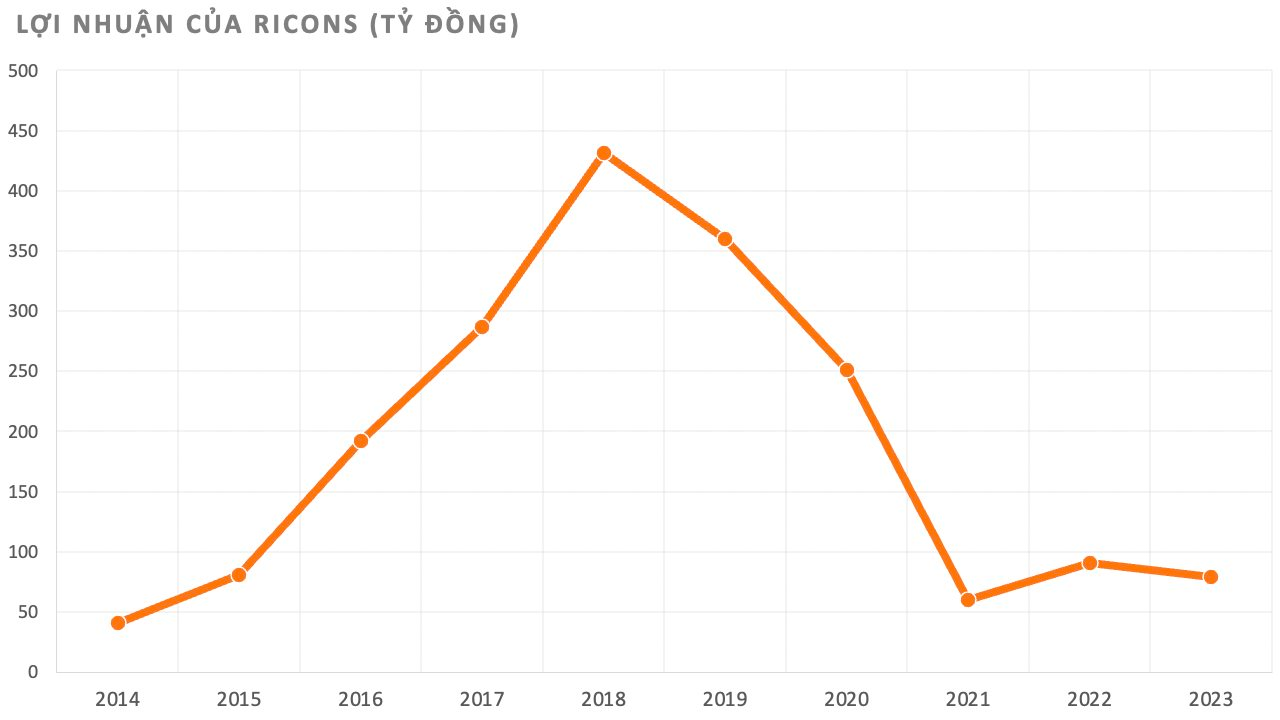

Ricons JSC (Ricons) has just announced its consolidated financial statements for the fourth quarter of 2023, with net revenue reaching VND 2,270 billion – a 25% decrease compared to the same period. Excluding cost of goods sold, the company earned gross profit of VND 97 billion – three times higher than the same period last year, and gross margin also increased from 1% to 4%.

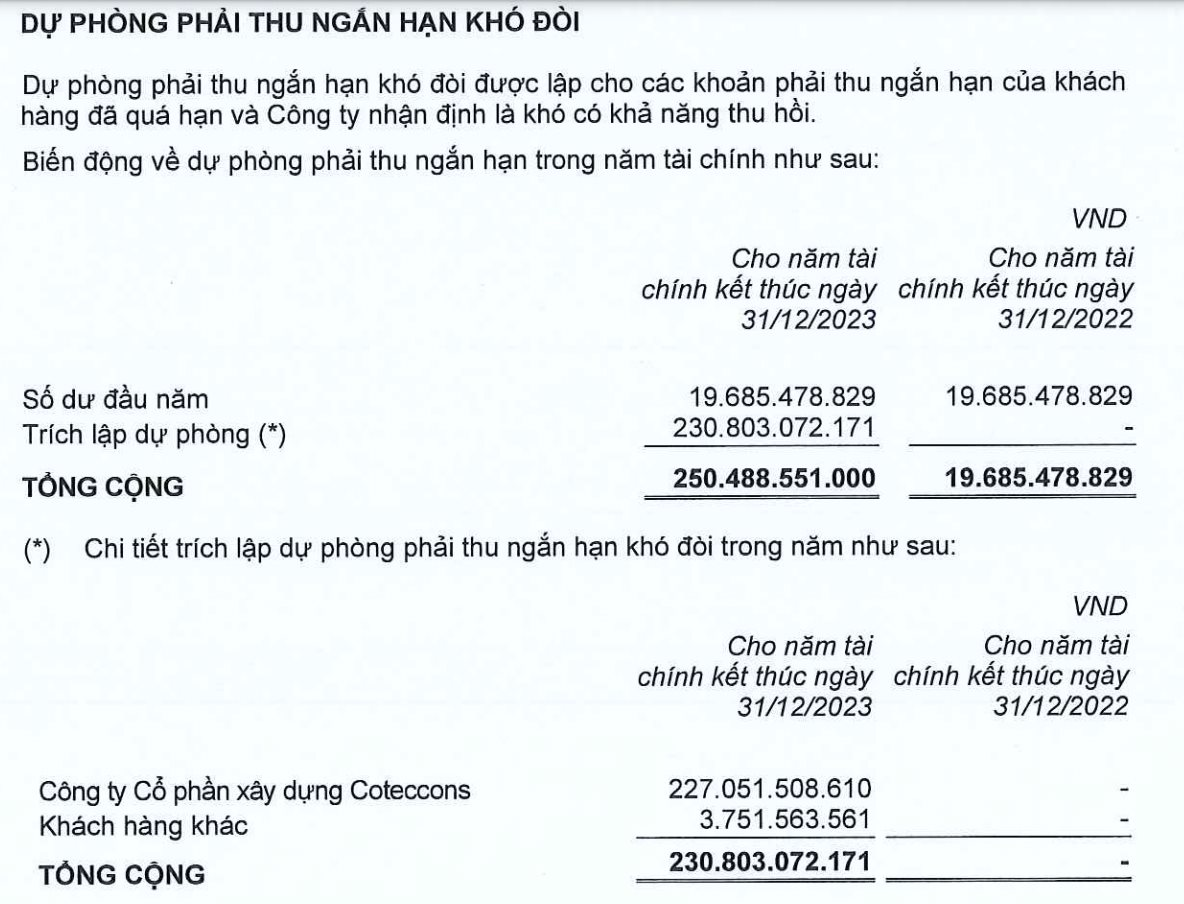

During the period, due to the recognition of provision for difficult-to-collect receivables amounting to VND 213 billion, along with losses in associated companies of over VND 44 billion, Ricons incurred a net loss of VND 8 billion (compared to a profit of VND 4 billion in the fourth quarter of 2022).

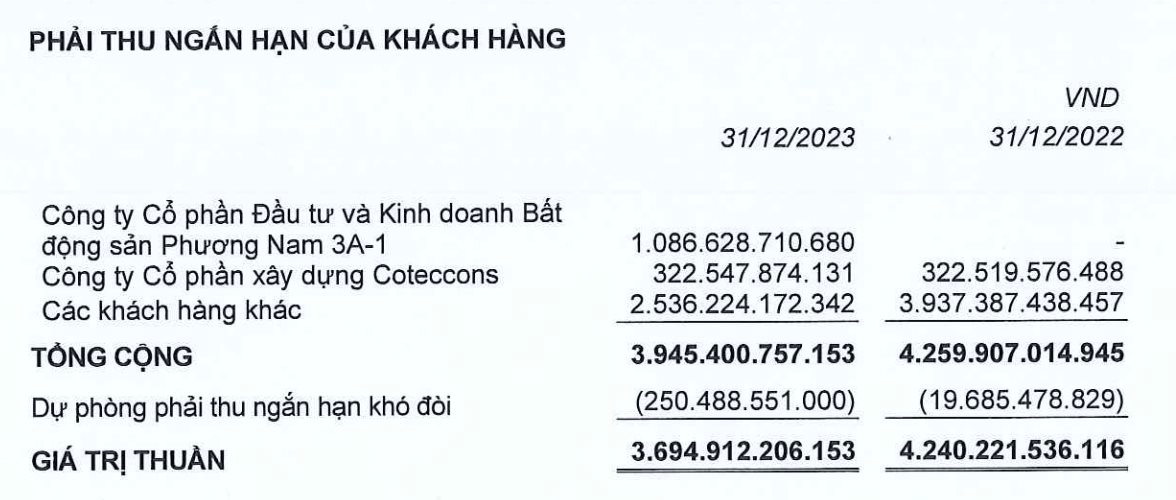

The main provision is made for Coteccons Construction Joint Stock Company (CTD) with VND 227 billion, equivalent to more than 70% of Coteccons’ total debt.

Previously, on July 24, 2023, Ricons submitted a petition to the court requesting the initiation of bankruptcy proceedings against Coteccons, as it believed that Coteccons did not have the ability to pay overdue debts to Ricons. Currently, Coteccons’ outstanding debt to Ricons is recorded at over VND 322 billion.

In contrast, Ricons also reversed construction warranty provision costs, recognizing other profit of VND 23 billion. This also helped Ricons still achieve net profit of nearly VND 6 billion, although it decreased by 44% compared to the same period.

For the whole year of 2023, Ricons achieved net revenue of nearly VND 7,575 billion and net profit of VND 79 billion, decreasing 33% and 13% respectively compared to 2022. Compared to the annual plan, Ricons still exceeded 26% of the revenue target and 58% of the after-tax profit target.

As of December 31, 2023, Ricons’ total assets reached over VND 7,866 billion. Of which, short-term receivables amounted to over VND 4,137 billion, accounting for 53% of total assets. The provision for difficult-to-collect short-term receivables also increased by 13 times year-on-year, to over VND 250 billion.