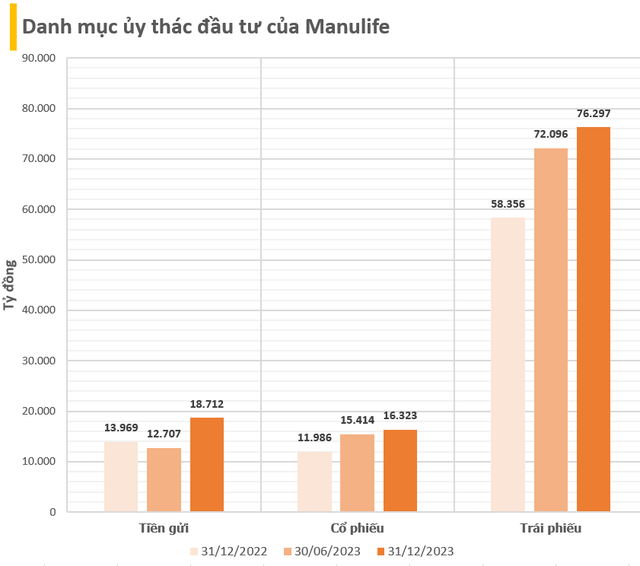

According to the 2023 financial statements of Manulife Investment (Vietnam) Co., Ltd., the company currently has a portfolio of entrusted investments valued at VND 112,208 billion (equivalent to approximately USD 4.7 billion), an increase of nearly 32% compared to the beginning of the year. This figure has also increased by over VND 12,000 billion compared to the mid-year portfolio in 2023. The majority of Manulife Investment’s investment portfolio is entrusted by Manulife (over VND 111,000 billion).

The total amount of entrusted investments by Manulife at Manulife Investment has increased in 2023, resulting in an increase in all portfolio items. First and foremost, more than 68% of the money invested by the fund is allocated to bonds. This figure has increased by VND 17,941 billion compared to the beginning of the year and by over VND 4,000 billion compared to June 30, 2023.

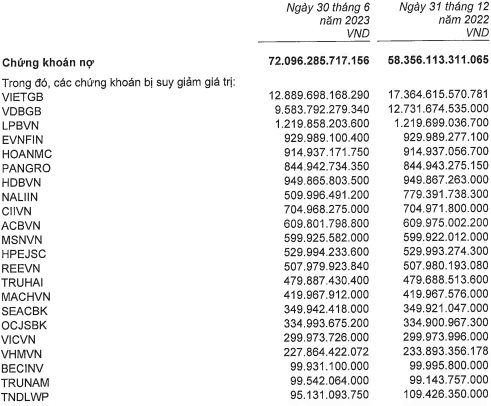

According to the semi-annual financial statements of Manulife Investment, this company has purchased bonds from many well-known companies with significant debts and issued large-scale bonds, such as Trung Nam Group, Vingroup, Masan Group, and various bank bonds.

After bonds, the second largest item in Manulife Investment’s investment portfolio is bank deposits. At the end of 2023, this fund had VND 18,712 billion deposited in banks, an increase of VND 4,743 billion. However, the amount of bank deposits by the company had decreased in the first half of 2023.

Finally, the entrusted investment portfolio in stocks by Manulife has increased by over VND 4,300 billion to VND 16,323 billion. In the semi-annual financial statements of 2023, the stocks that this fund invested in included many blue-chip codes such as GAS, VHM, VIC, HPG, VRE, VPB, VNM, etc.

The annual financial statements of Manulife Vietnam show that the company actively participates in the Vietnamese stock market.

In 2015-2016, the company only held two blue-chip stocks, VNM of Vinamilk and GAS of PV Gas, with a value of only a few tens of billion VND (while the total value of money and equivalent money held was in the thousands of billion VND). However, starting from 2017, Manulife Vietnam has increased its investment in stocks with a portfolio value exceeding VND 1,100 billion.

The growth rate of the stock investment portfolio value increased on average by 70% per year in the period 2015-2022, especially increased several times during the two years of the market boom in 2020-2021. The company also changed its investment appetite and accepted higher risks, allowing for a yearly provision reduction of hundreds of billion VND.

According to the semi-annual financial statements of Manulife in 2023, the insurance company had to set aside a VND 392 billion provision for stock investments and a temporary loss of VND 240 billion.

Regarding Manulife Investment Vietnam Co., Ltd., this entity is the branch of the Manulife Asset Management Group in Vietnam, established in 2005. It is an independent fund management enterprise and operates under the supervision of the State Securities Commission. The authorized capital of this entity is approximately VND 83 billion.

In 2023, the company brought in revenue of VND 336 billion, an increase of over 20% compared to the same period last year. Of this, the majority of Manulife Investment’s revenue comes from managing the investment portfolio for its parent company, Manulife (VND 320 billion). As a result, this enterprise reported a profit of VND 230 billion, an increase of nearly 37%.

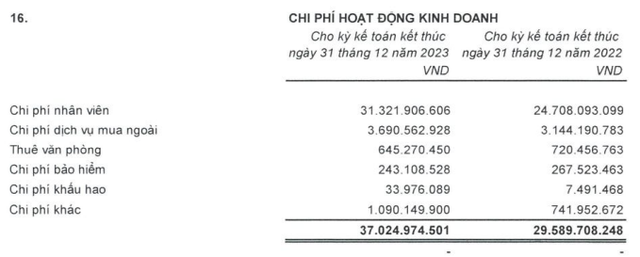

Notably, Manulife Investment currently has 33 employees but is willing to allocate over VND 31 billion for employee expenses in the past year. Therefore, the company has paid nearly VND 1 billion per employee in the past year.